GPO Plus, Inc. (OTCQB: GPOX) is in hyper-growth mode. And they provide plenty of non-speculative proof. Most recently, record-setting revenues in its first quarter for FY/2024. More than impressive, the $970,735 posted beat its bullish guidance by roughly 12% and, better still, crushed the prior quarter's revenues by 126%. And it was no one-off performance.

On the contrary, that score followed triple-digit-percentage growth precedent from FY/Q4, when revenues of $430,000 represented an over 320% increase compared to the three months ending April 30, 2023. Revenues aren't the only things getting larger. The company's store count is as well, evidenced by its over 570 in operation in several states, which, by the way, is expected to increase to over 1000 during its current fiscal year. That's not all fueling the bullish thesis.

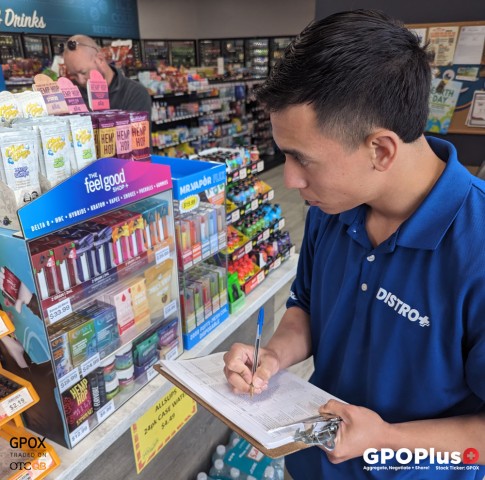

The average revenue contributions per store are also on the rise, driven through its Distro+ divisions' "White Glove Direct Store Delivery," which the company said resulted in an over 365% increase in monthly sales, surging from an average of $580 per location to $2,120 in the first 100 stores receiving the new service and enhanced product offering. And that trend is expected to continue. In its Q1 update, GPOX reiterated that it continues to maximize accretive benefits from its Direct to Store Delivery (DSD) model.

Expediting Its Growth Through Efficiency

That's leading to accelerating growth, which already has momentum behind it. GPOX got its start after acquiring the assets of Betterment Retail Solutions, which led to them establishing its first Regional Distribution hub in Lubbock, Texas, to serve 470 retail sales locations. In 2023, GPOX made its service model and infrastructure more efficient, creating what they referred to as a Mini-hub business model, a hub and spoke design that can leverage low-cost efficiencies to generate high store revenues. GPOX wasn't done yet.

Through its Distro+ division, GPOX launched its "White Glove DSD," a hands-on, full-service business model that GPOX notes has helped drive average sales per unit to record levels. Part of that growth comes from an enhanced product offering, including those from its in-store concept, "the Feel Good Shop+," which offers customers CBD-inspired health and wellness products. Additional contributions result from providing clients a service and benefit that others don't- primarily filling a product manufacturing and delivery gap for the 15% - 20% of items not typically provided by primary vendors. That mission also gets help. This time, it is in the form of technology-driven solutions.

GPOX announced live testing, implementation, and the rollout phase for MSRP+, its proprietary software empowering order management, logistics optimization, lead generation, sales analytics, accounting, inventory management, and e-commerce for DISTRO+. Those enable a strategy that maximizes intrinsic strengths, particularly those related to manufacturing and distributing consumer products, facilitating GPOX serving a growing list of convenience store and specialty retailer clients. The latter includes gas stations, smoke shops, vape shops, and other high-volume, high pedestrian-trafficked locations.

500+ New Store Openings Planned In FY/2024

This has led to GPOX currently servicing about 570 locations in 12 states, with expansion supported by the Mini-Hubs, the vital and easy-to-operate component in providing enhanced service to retail partners. Each Mini-Hub is designed to serve 50 to 100 stores, utilizing a small storage facility, 1-2 drivers, and a minivan for product delivery. These satellite locations are serviced by the regional hub, like the one in Lubbock, Texas, which was designed and intended to serve over 2,000 retail locations, including potential placements resulting from pilot programs with two national chains. Success there could lead to an additional 300 new store locations added.

The company already expects to onboard roughly 258 new locations in Texas, Iowa, and Kansas by the end of this year and another 123 locations throughout New Mexico in early 2024. With plans to serve the entire product line at each location, using a store-average sales estimate should add appreciably to near-term revenue streams. That could happen faster than many think and for excellent reasons.

According to GPOX, most retailers get about 80% - 85% of their products from just a few distributors, with the remaining products sometimes represented by dozens of separate vendors. As one might expect, that's a significant pain point for most corporate retailers, especially gas stations and convenience stores that sell potentially thousands of different products. For management, it's a tall order to handle. And it's where GPOX intends to shine. As mentioned, its focus is on providing clients with products not provided by the retailer's primary distributors, using its White Glove DSD service to mitigate specialty retailers' challenges of identifying and qualifying new products, ensuring quality, and managing delivery.

Beyond good, GPOX believes its White Glove DSD service can help to eliminate 100% of the challenges faced, a stat that is doing more than attracting new business; it's contributing enormously to the growth of serviced locations by simplifying and optimizing client operations. That results from GPOX consolidating multiple products into one distribution service, essentially becoming a one-stop shop for these specialty retailers to leverage.

Demand Is The Value Driver

GPOX highlighted that the service is leading many of its retail partners to ask what additional products can be provided through this uncomplicated and comprehensive GPOX service solution. That's helped support bullish internal expectations. GPOX expects its White Glove Service will contribute to opening at least 500 new locations in its current fiscal year. By utilizing proprietary technology, real-time data, and efficiencies from its hub and spoke business services model, revenues from new and existing sites are expected to fall faster toward the bottom line.

And there could be plenty more of it to drop. GPOX believes increased product offerings could increase average sales per convenience store location to over $3,000, about 40% higher than current. That's not based on the status quo. In an update, GPOX highlighted executing its plans to introduce proprietary new products, such as Yuenglings Ice Cream flavored gummies and High-Cloud gummies, expected to generate roughly 40% gross margins. The gross margins for general products are also impressive, typically between 20% - 35%. Strength in both should accelerate GPOX reaching cash-flow and/or bottom-line EPS, potentially by the end of this new fiscal year. That would not be surprising.

A Growth Mission In Progress

The GPOX mission has always included becoming its clients' best-in-class manufacturing and distribution company, filling a considerable need as a one-stop source to fill significant shelf space. And that's just a part of the GPOX value proposition to its clients.

The company does other heavy lifting, including price negotiation, meeting minimum order requirements from large manufacturers, and providing uncompromising, hands-on service, from order placement to shelf stocking to end-sales management. As the numbers show, that work is doing more than shifting GPOX's growth pace into a higher gear; it's exposing an investment opportunity from a disconnect between GPOX assets, revenue growth, a timely strategy, and its share price.

Still, often the case in investing, that's not necessarily bad news. Disconnects expose opportunities. And in this case, based on all the above, GPOX stock presents an attractive one. In fact, better positioned today compared to when GPOX stock scored its 52-week high of $0.29, about 65% higher than current; the opportunity may be more than just attractive- it's compelling.

IMPORTANT NOTICE AND DISCLAIMER: All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This paid advertisement includes a stock profile of GPO Plus, Inc. (Nasdaq: GPOX). Primetime Profiles Direct, a property of Shore Thing Media Group, Llc. is an investment newsletter being advertised herein. This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to sell or a solicitation of an offer to purchase any securities. In an effort to enhance public awareness, Shore Thing Media Group, Llc. was retained by Spyder Growth Strategies, Llc to create and distribute digital content for GPO Plus, Inc. Spyder Growth Strategies Llc compensated Shore Thing Media Group, Llc., and/or, its parent company, $5,000 to complete and distribute these services. This advertisement is being disseminated for a period of one month beginning on 12/4/23 and ending on 12/31/23. Shore Thing Media Group, Llc. owners, officers, principals, affiliates, contributors, and/or related parties do not own, intend to own, sell, or intend to sell GPO Plus, Inc. stock. However, it is prudent to expect that those hiring Shore Thing Media Group, Llc, including its owners, employees, and affiliates may sell some or even all of the GPO Plus, Inc. shares that they own, if any, during and/or after this engagement period. If successful, this advertisement will increase investor and market awareness of GPO Plus, Inc. and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement does not purport to provide a complete analysis of GPO Plus, Inc. or its financial position. The agency providing this content are not, and do not purport to be, broker-dealers or registered investment advisors. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a registered broker-dealer or registered investment advisor or, at a minimum, doing your own research if you do not utilize an investment professional to make decisions on what securities to buy and sell, and only after reviewing the financial statements and other pertinent publicly-available information about GPO Plus, Inc. Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in GPO Plus, Inc. SEC filings. Investing in microcap securities such as GPO Plus, Inc. is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, Shore Thing Media Group, Llc. cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions. This advertisement contains forward-looking statements, including statements regarding expected continual growth of GPO Plus, Inc. and/or its industry. Shore Thing Media Group, Llc. note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect GPO Plus, Inc. actual results of operations. Factors that could cause actual results to vary include the size and growth of the market for GPO Plus, Inc. products and/or services, the company's ability to fund its capital requirements in the near term and long term, federal and state regulatory issues, pricing pressures, etc. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. Shore Thing Media Group, Llc. are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks. Additional disclosures and disclosures can be found at https://primetimeprofiles.com/disclaimer/.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Country: United States

Website: https://primetimeprofiles.com/