Churning around the $0.05 level, thinly traded Victory Battery Metals Corp (OTC Pink: VRCFF) stock presents not only an attractive investment proposition; it exposes a compelling one. In fact, using any fair-value calculation factoring in the totality of assets, it's fair to suggest that VRCFF's current share price doesn't provide valuation justice to the fact that this company is exploring significant assets on proven grounds, sitting atop potentially billions in battery metal reserves, and has completed recent capital raises to expedite its ambitious 2023 exploration agenda.

In other words, investors shouldn't be misled by Victory's microcap share price. Instead, they should recognize the opportunity by understanding how well-positioned Victory is to capitalize on exploration opportunities inherent to a broad, diversified project portfolio. They must also include this: VRCFF projects are not isolated, drill and hope locations. VRCFF is a more de-risked sector play, noting that it is developing existing projects in very mining-friendly jurisdictions. Several of its projects, not including potential additions, are adjacent to industry behemoths like Agnico Eagle (NYSE; AEM) and American Lithium (NASDAQ: AMLI). Said more directly, Victory Battery is in an excellent neighborhood, with a history of metals scores setting an optimistic precedent.

Those investing in the metals sector know that location indeed matters. But so does strategy, and Victory Battery has refined theirs, pivoting its focus away from uncovering precious metals and more fully monetizing assets by unearthing battery metals to serve the massive demand from the EV and green energy sectors. Putting that opportunity into play is its flagship project, Smokey Lithium, located close to North America's only lithium-producing silver mine. While the potential score from that project can be substantial, investors should recognize that VRCFF isn't a single shot on revenue-generating goal company.

Multiple Shots On Battery Metal Goals

Victory Battery Metals also maintains five other projects: Stingray Lithium Array in James Bay, Quebec; Georgia Lake Lithium property, Ontario; Tahlo Lake, in the Babine Copper-Gold Porphyry District, British Columbia; Saguenay Nickel Project, Quebec; and Black Diablo Copper and Manganese in Nevada. Each of these should be considered near-term value drivers, noting the historically proven locations in infrastructure-ready jurisdictions that can expedite Victory's mission to explore new sources of critical battery metals needed to fuel changing global energy initiatives.

Keep in mind that North America and its allies need what Victory intends to deliver: lithium. Currently, the lithium supply chain lacks balance, with estimates suggesting that China provides upwards of 70% of lithium production while only making about 13% of that supply available to demand outside its borders. In other words, with an unstoppable demand for lithium needed to power critical sectors, including planned changes to grids and energy infrastructures, China could hold a weapon more potent than conventional weaponry. In fact, the control over lithium markets could have catastrophic implications for those planning to develop sustainable and clean energy products and services.

But there is light at the end of the tunnel. The United States, Canada, and other European companies are starting to recognize the threat and, in response, are helping guide potentially billions of dollars in grants and incentives to stabilize supplies. In the right places with the right assets at the right time, Victory Battery Metals appears exceptionally well-positioned to seize opportunities inherent to that movement. Here's why and how:

Momentum at Victory Battery's Back in 2H/2023

Foremost, Victory has the capital to advance its ambitious exploration calendar. The company recently completed a successful private placement raising $2 million and a non-brokered Unit Private placement that raised $300,000 through the sale of 6,000,000 Units. Those deals were finalized in March and, all told, should position VRCFF well financially to execute its near-term initiatives. That's excellent news for VRCFF, the markets, and investors.

Remember, any company, regardless of whether it's trading at a nickel or one hundred dollars, will be an enormous financial beneficiary if it can deliver the lithium expected. That includes Victory, who intends to close the appreciable gap between supply and demand. The great news is that they may have some help expediting that mission. As noted, federal mandates around lithium and critical battery metals production in the United States and Canada provide ways for the so-called junior mining and exploration companies, like VRCFF, to participate, capitalize, and maximize individual opportunities. Of course, money alone doesn't generate lithium and other much-needed battery metals. The biggest hurdle to clear is being in the right locations, and VRCFF checks those boxes.

That advantage could allow VRCFF to cash in on its opportunities through company-sponsored development or partnerships, including with its large-cap sector player neighbors. Keep in mind that assets proven in the ground accrue to the balance sheet, so VRCFF doesn't necessarily need to fund a $10 million dig program; it's likely plenty of suitors would line up to help financially for a stake. Remember, companies like Tesla (NASDAQ: TSLA), Ford (NYSE: F), and General Motors (NYSE: GM) are making no secret of their willingness to buy as much lithium and other battery metals as possible to file their product development programs. Tesla CEO Elon Musk has been more explicit, saying he would not rule out mining for lithium through his own company. Still, while an ambitious goal, the fastest way for him to secure the metals he needs would be to partner with a company on location. Victory Battery checks that box too.

And with Victory Battery Metal's active and diversified programs targeting exactly what the EV and clean energy sector needs, few, if any, investors, analysts, or industry insiders are ruling out that possibility.

A Time for Consolidation, Victory Battery Has Attractive Assets

Frankly, consolidation is to be expected. The move toward global electrification and net-zero emissions has made lithium more valuable than gold. It's also important to note that the EV sector alone needs it to power the 10 million vehicles sold last year. That sales trend is accelerating, with manufacturing trends and estimates leading analysts to forecast that over 40% of total passenger cars will be electric-powered by 2030. That expectation and the lithium demand inherently involved put VRCFF in a sweet spot of opportunity as it continues to develop its promising assets in friendly territories.

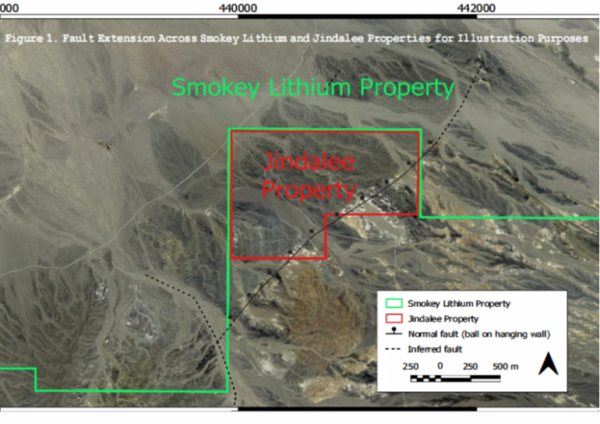

VRCFF’s flagship project is its Smokey Clay Lithium asset, located 20 miles north of Clayton Valley and 20 miles west of American Lithium's flagship exploration location. In addition to excellent precedent, it resides in Esmeralda County, one of North America's most prolific lithium regions that is home to multiple large-tonnage lithium clay deposits with acceptable grades of over 900 parts per million (ppm). A spring drilling program that concluded in May 2023 provided Victory with the evidence needed to increase estimates of the area and thickness of Smokey Lithium's targeted claystone sequences. This led to the milestone announcement of changing the project's status from early-stage to advanced.

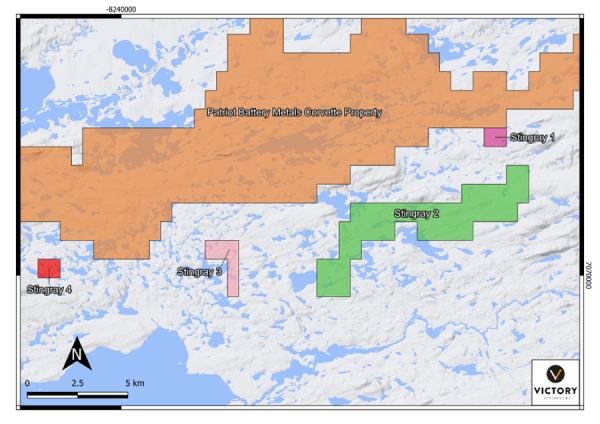

However, Smokey Clay Lithium is far from being the only value driver. VRCFF is exploring and developing other potentially asset-rich properties, including its Stingray Properties, which consist of 347 non-contiguous claims directly adjacent to Patriot Battery Metals' (TSXV: PMET) promising Corvette Property. What is interesting about this project is that the area is relatively under-explored, with some sections even remaining entirely unexplored. But that's not necessarily bad news. In fact, it can be quite the opposite if VRCFF shows data supporting its belief in underground treasure. And they are building that case, with favorable geology reports indicating that properties to the east and west of Victory's claims reportedly host pegmatite dikes and, better yet, show prospective bias for pegmatites similar to those found on Infinity Stone's Taiga and Camaro projects.

Another value driver inherent to Stingray is that by being located in Quebec's James Bay lithium district, which is expected to become the latest lithium hub, Victory can benefit from developing and existing infrastructure within the region. That advantage saves the company considerable capital and paves a more viable pathway toward closing strategic acquisitions and partnerships.

Additional Projects Worthy of Appraising

Other projects are also in play, and they, too, should not go underappreciated or under-valued. Its Georgia Lake Lithium Project is located two kilometers east of Rock Tech Lithium's (TSXV: RCK) advanced lithium project. With established infrastructure, this project benefits from both low exploration costs and a lithium-rich district. Historic mapping dates back to the 1950s, with data indicating the presence, and potential abundance, of S-type granites, which frequently host spodumene pegmatites. Completing its aerial assessment and survey, Victory updated investors that it plans to commence work to assess pegmatite content in June 2023.

Victory's Tahlo Lake Project, one of the newest additions to its pipeline, is also in play. Tahlo Lake is a 1,688 hectares property located in the prolific Babine Copper-Gold Porphyry District in British Columbia. Notably, it sits adjacent to the same north-northwest trending fault as the prolific Morrison Deposit. Also of potential value, VRCFF recently confirmed in a mag survey of the property that a historic copper anomaly in the region's soil overlies a linear mag high. Again, costs can be low to appraise and develop the opportunity, as infrastructure exists from American Eagle Gold's (TSX: AE) NAK Property, one of several major projects within the district.

Another project is its Saguenay Nickel Project, consisting of five claims over 286.4 hectares. An assessment in 1959 showed the property to contain respectable nickel content. Despite that bullish report, little to no modern exploration efforts have occurred in the region until Victory's acquisition. VRCFF is assessing the property's potential to determine the most efficient and profitable path forward for exploiting its value.

Although in its early stages of exploration and consideration, Victory's Black Diablo could also significantly contribute to long-term value. The company has 16 confirmed claims. Essential to its appraisal, this south of Winnemucca project is indicated to contain VMS copper deposits in the same belt of rocks as Nevada Sunrise Gold's Coronado VMS Project. A boost of production optimism is warranted, noting that the project is only 10 miles north of the Big Mike Copper Mine, which produced about 25 million pounds of copper in 100,000 tons of ore grading 10.5 percent copper.

An Impressive Asset Portfolio Targeting Unrelenting Demand

Interestingly, factoring in just parts of Victory Battery Metals' portfolio and current projects can justify a share price considerably higher than its current. While that's not a difficult calculation to support that premise, it's not an appropriate way to measure and award this microcap mining and exploration company. Instead, it should be granted an evaluation more in line with what's expected from its impressive project arsenal.

In fact, more than having excellent assets, they are in the right places and working to exploit value from project locations rich in historical success. Remember: VRCFF has an advanced-stage project that continues to make progress, meaning it could potentially generate enormous value before a hole is even dug. That's how valuable its projects can be to companies needing lithium and other battery metals. In other words, while a value investment window of opportunity is currently open, it could close quickly. Considering its assets, surveys supporting deposits, cash to develop, and an expert team guiding the mission, that bullish sentiment is warranted.

After all, in a sector where location and historical precedent matter, Victory Battery Metals is checking all the right boxes. And if just one project scores in 2023, the valuation for this company could surge. Should multiple achieve success, then expect growth to be exponential.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to five-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Victory Battery Metals, Inc. for a period of two weeks ending on June 19, 2023. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/