VANCOUVER, BC / ACCESSWIRE / November 28, 2022 / SILVER X MINING CORP. (TSXV:AGX)(OTCQB:AGXPF)(FRA:WPZ) ("Silver X" or the "Company") is pleased to report its interim financial results for the three and nine months ended September 30, 2022. The full version of the condensed consolidated interim financial statements and accompanying management discussion and analysis can be viewed on the Company's website at www.silverxmining.com and on SEDAR at www.sedar.com. All financial information is prepared in accordance with International Financial Reporting Standards ("IFRS") and all dollar amounts are expressed in US dollars unless otherwise stated.

Mr. Jose M. Garcia, CEO of Silver X stated, "Month over month production improvements were the hallmarks of the positive financial results during this quarter that we hope to see continue through the remainder of the year as we continue ramping up to commercial production" Mr. Garcia continued, "During the quarter we continued our track record of consistent execution while laying the building blocks for long-term growth and tightening our operations further to continue improving our operating margins. As we are transiting through the last stage of the ramp up of our operations, we will be providing the updates on operational results on quarterly basis as opposed to the monthly updates provided to date".

Q3 2022 Highlights

- Record quarterly operating revenues of $5.5 million, representing a 73% increase from previous quarter.

- Record quarterly operating earnings attained of $2.0 million.

- The Company achieved net gain in a quarter for the first time, with a net gain of $0.2 million.

- Cash costs(1) of $11.0 per silver equivalent ("AgEq") ounce produced(1)(2) and All-In-Sustaining Cost(1) ("AISC") of $15.8 per AgEq ounce produced(1)(2).

- Record monthly AgEq ounces processed in August of 195,039(2).

- Record quarterly AgEq ounces processed and produced(2) of 481,040 and 371,072, respectively.

Notes:

- Cash costs per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS financial ratios. These are based on non-IFRS financial measures that do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the "Non-IFRS Measures" section of this press release for further information.

- AgEq ounces produced were calculated using the average sales prices of each metal for each month, and revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

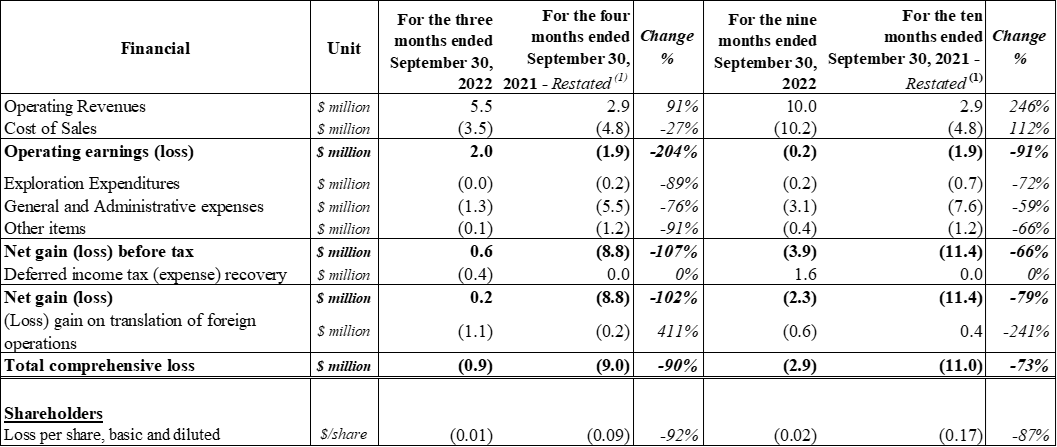

Summary of selected financial results

Note:

(1) Restatement due to adoption of amendments to IAS 16 effective for annual reporting period beginning on or after January 1, 2022. The Company changed its fiscal year-end from February 28 to December 31, resulting in a 10-month transition year from March 1, 2021, to December 31, 2021.

For the three months ended September 30, 2022, the Company recorded a net gain before tax of $0.2 million, compared to a net loss before tax of $8.8 million in the four months ended September 30, 2021 ("Q3 2021").

The reduction in loss in the current period was primarily due to increased operating revenues from the sale of pre-commercial mineral production of $5.5 million (vs. $2.9 million in Q3 2021) reflective of the continued ramp up of production, reduction in cost of sales of $3.5 million (vs. $4.8 million in Q3 2021) and decreased general and administrative expenses, primarily as a result of a $4.2 million reduction in office and administration costs (vs. $5.5 million in Q3 2021) due to reduced corporate activities, and reduction in share-based payments of $2.9 million (vs. $3.5 million in Q3 2021).

Loss or gain on translation of foreign operations fluctuates depending on the strength of the Peruvian sol and Canadian dollar against the US dollar. Loss on translation for the three months ended September 30, 2022, of $1.1 million (vs. $0.2 million in Q3 2021) more than offset the net gain of $0.2 million resulting in a comprehensive loss of $0.9 million (vs. $9.0 million comprehensive loss in Q3 2021).

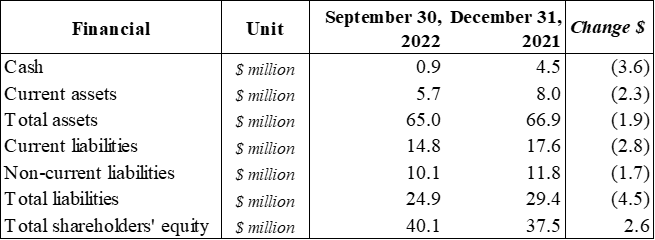

Financial position

The Company held cash of $0.9 million at September 30, 2022. The improved operating cash generation attained during the quarter contributed to the reduction in the Company's current and non-current liabilities balances.

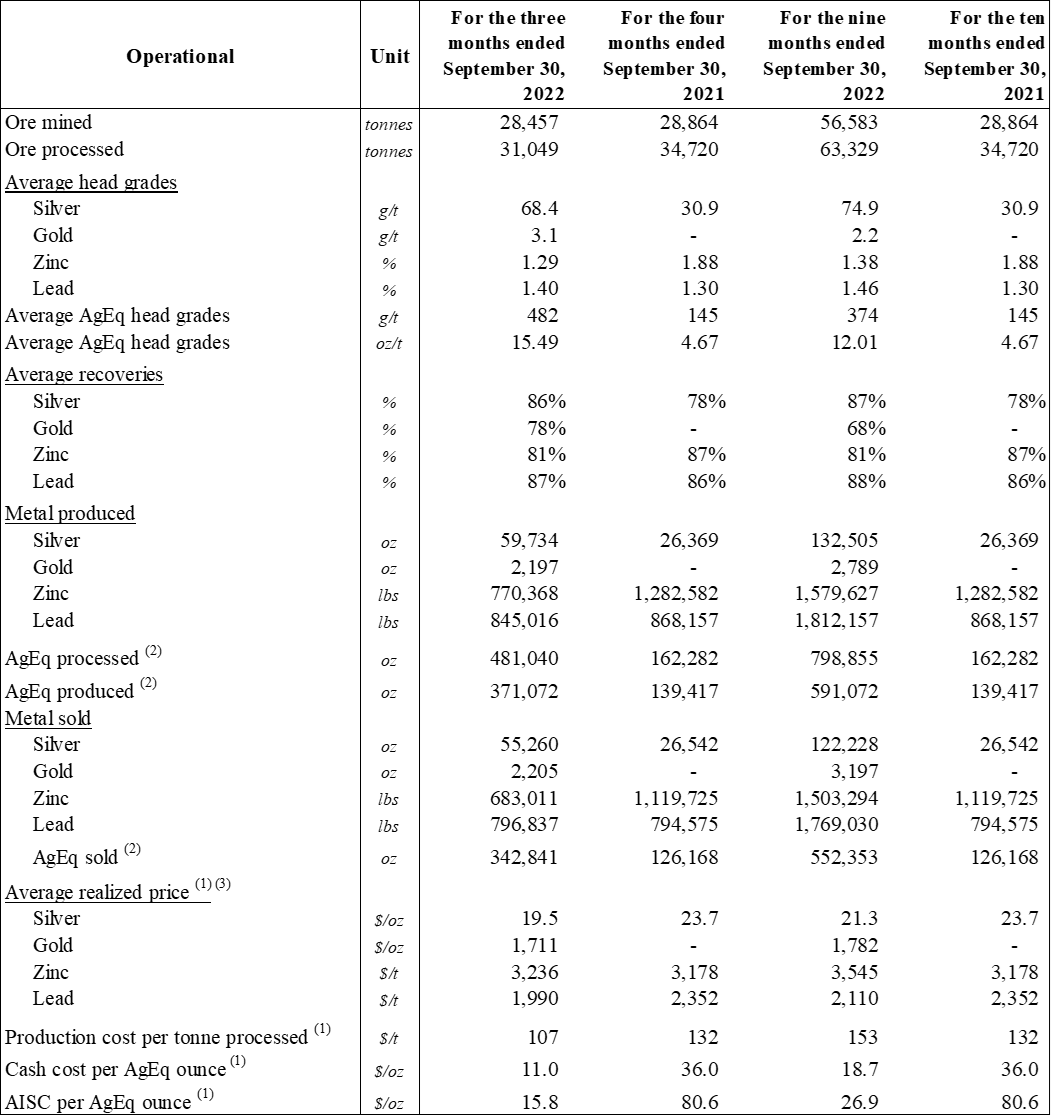

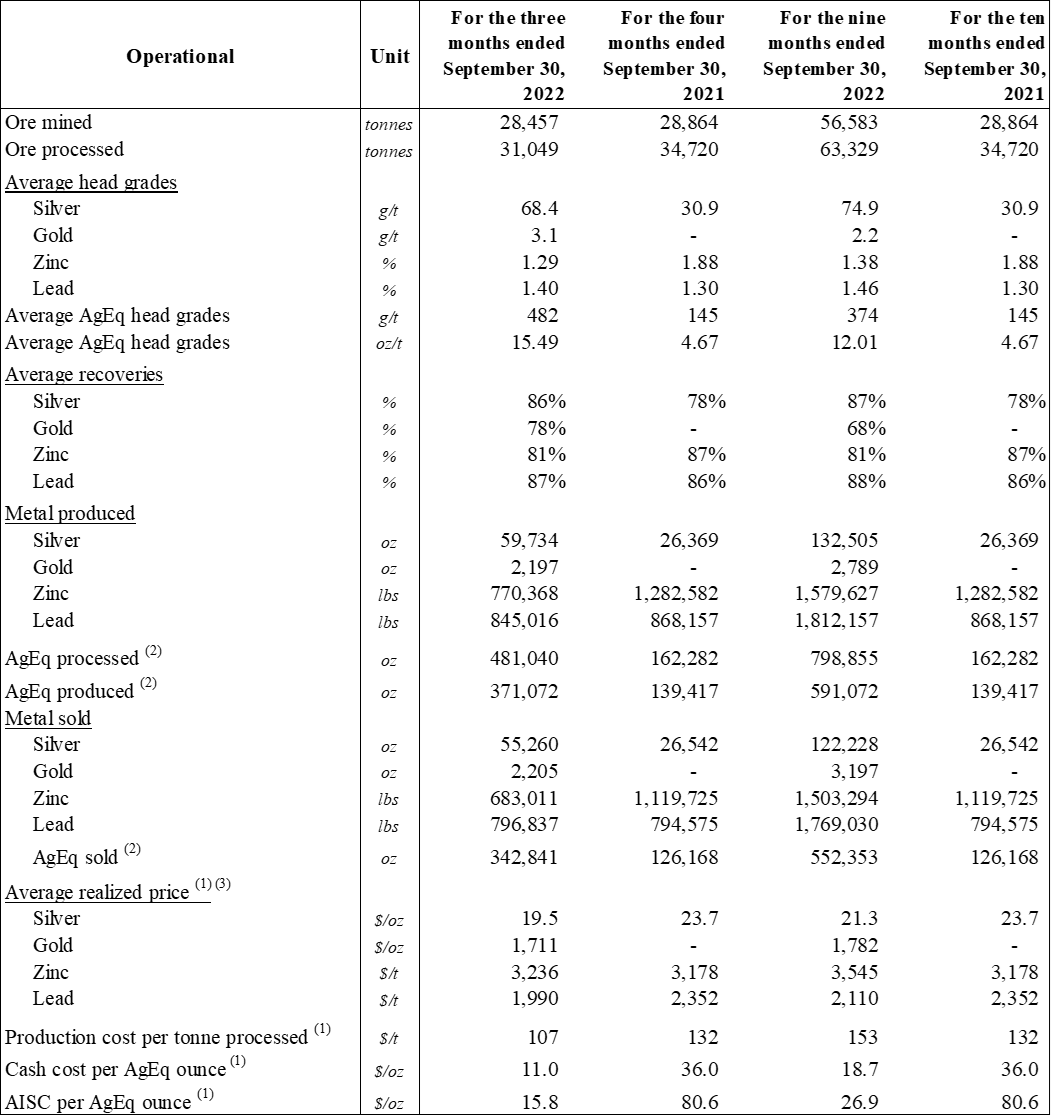

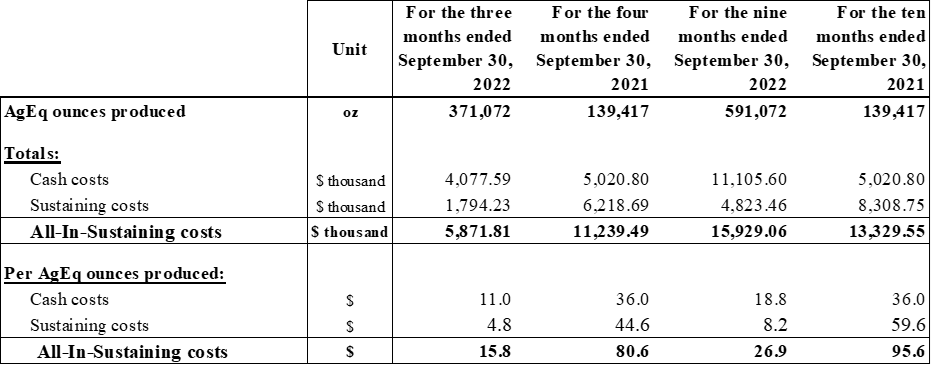

Q3 2022 Operational results

Notes:

(1) Production cost per tonne processed, cash cost per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS ratios with no standardized meaning under IFRS, and therefore may not be comparable to similar measures presented by other issuers. For further information, including detailed reconciliations to the most directly comparable IFRS measures, see "Non-IFRS Measures" in this MD&A.

(2) AgEq ounces produced were calculated based on all metals produced using the average sales prices of each metal for each month during the period. Revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

(3) Average realized price corresponds to the average prices for each metal on the following month after delivery, used to calculate the final value of the concentrate delivered in a given month before any deductions.

Subsequent events to the quarter ended September 30, 2022

During October 2022, the Company completed, in two tranches, a private placement offering ("Offering") of 13,554,441 units of the Company (the "Units") at a price of C$0.22 per Unit for a total gross proceeds of C$2,981,977. Each Unit consisted of one common share in the capital of the Company (each a "Share") and one-half (1/2) of Share purchase warrant (each whole such warrant, a "Warrant"). Each Warrant entitles the holder to purchase one Share at a price of C$0.33 for a period expiring two years following the applicable closing dates of the Offering. The Company paid fees to certain eligible finders consisting of C$82,144 in cash and 372,700 finder warrants, each such finder warrant exercisable to purchase one common Share at a price of C$0.33 expiring two years following the applicable closing dates of the Offering.

On November 2, 2022, the Company granted 350,000 stock options at an exercise price of C$0.23 per common Share for a period of five years to a Company consultant. The stock options will vest in installments, 50% immediately, 25% in 6 months after date of grant and 25% in 12 months after date of grant.

Also, during November 250,000 RSUs were cancelled and 575,000 RSU's and 300,000 stock options were exercised.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. A. David Heyl is a consultant for Silver X.

Non-IFRS Measures

The Company has included certain non-IFRS financial measures and ratios in this news release, as discussed below. The Company believes that these measures, in addition to measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Cash Costs and All-In Sustaining Cost

The Company uses cash costs, cash cost per AgEq ounce produced, AISC, and AISC per AgEq ounce produced to manage and evaluate its operating performance in addition to IFRS measure because Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. The Company understands that certain investors use these measures to determine the Company's ability to generate earnings and cash flows for use in investing and other activities. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

Cash costs is calculated by starting with cost of sales, and then adding treatment and refining charges, and changes in depreciation and amortization.

Total cash production costs include cost of sales, changes in concentrate inventory, changes in amortization, less transportation and other selling costs and royalties. Cash costs per AgEq ounce produced is calculated by dividing cash costs by the AgEq ounces produced.

AISC and AISC per AgEq ounce produced are calculated based on guidance published by the World Gold Council (and used as a standard of the Silver Institute). The Company presents AISC on the basis of AgEq ounces produced. AISC is calculated by taking the cash costs and adding sustaining costs. Sustaining costs are defined as capital expenditures and other expenditures that are necessary to maintain current production. Management has exercised judgment in making this determination.

The following table reconciles cash costs, cash costs per AgEq ounce, AISC and AISC per AgEq ounce produced to cost of sales, the most directly comparable IFRS measure:

The following table shows the calculation of the cash costs and AISC per AgEq ounce produced:

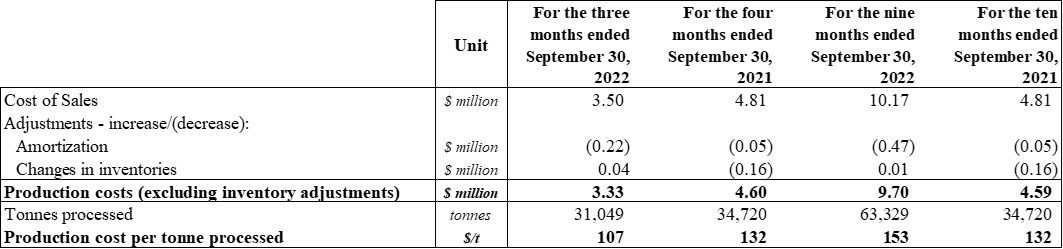

Production Cost Per Tonne Processed

A reconciliation between production cost per tonne (excluding amortization and changes in inventories) and the cost of sales is provided below. Changes in inventories are excluded from the calculation of Production Cost per Tonne Processed. Changes in inventories reflect the net cost of concentrate inventory (i) sold during the current period but produced in a previous period or (ii) produced but not sold in the current period. The Company uses Production Cost Per Tonne Processed to evaluate its operating performance in addition to IFRS measure because Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its operations to generate cash flows. Management and certain investors also use this information to evaluate the Company's performance relative to peers who present this measure on a similar basis.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of inferred mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a Canadian silver mining company with assets in Peru. The Company's flagship asset is the Tangana silver, gold, lead, zinc and copper project (the "Project") located in Huancavelica, Peru, 10 km north-northwest of the Nueva Recuperada polymetallic concentrate plant. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverxmining.com.

For further information, please contact:

Silver X Mining Corp.

José M. Garcia, CEO

+1 604 831 8070 | j.garcia@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward-looking information contained in this press release may include, without limitation, results of operations, and expected performance at the Company's Nueva Recuperada Project (the "Project"), and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedar.com from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/728563/Silver-X-Announces-Record-Operating-Earnings-of-US2-Milion-and-All-in-Sustaining-Cost-per-Silver-Equivalent-Ounce-Produced-of-US158-in-the-Third-Quarter-2022