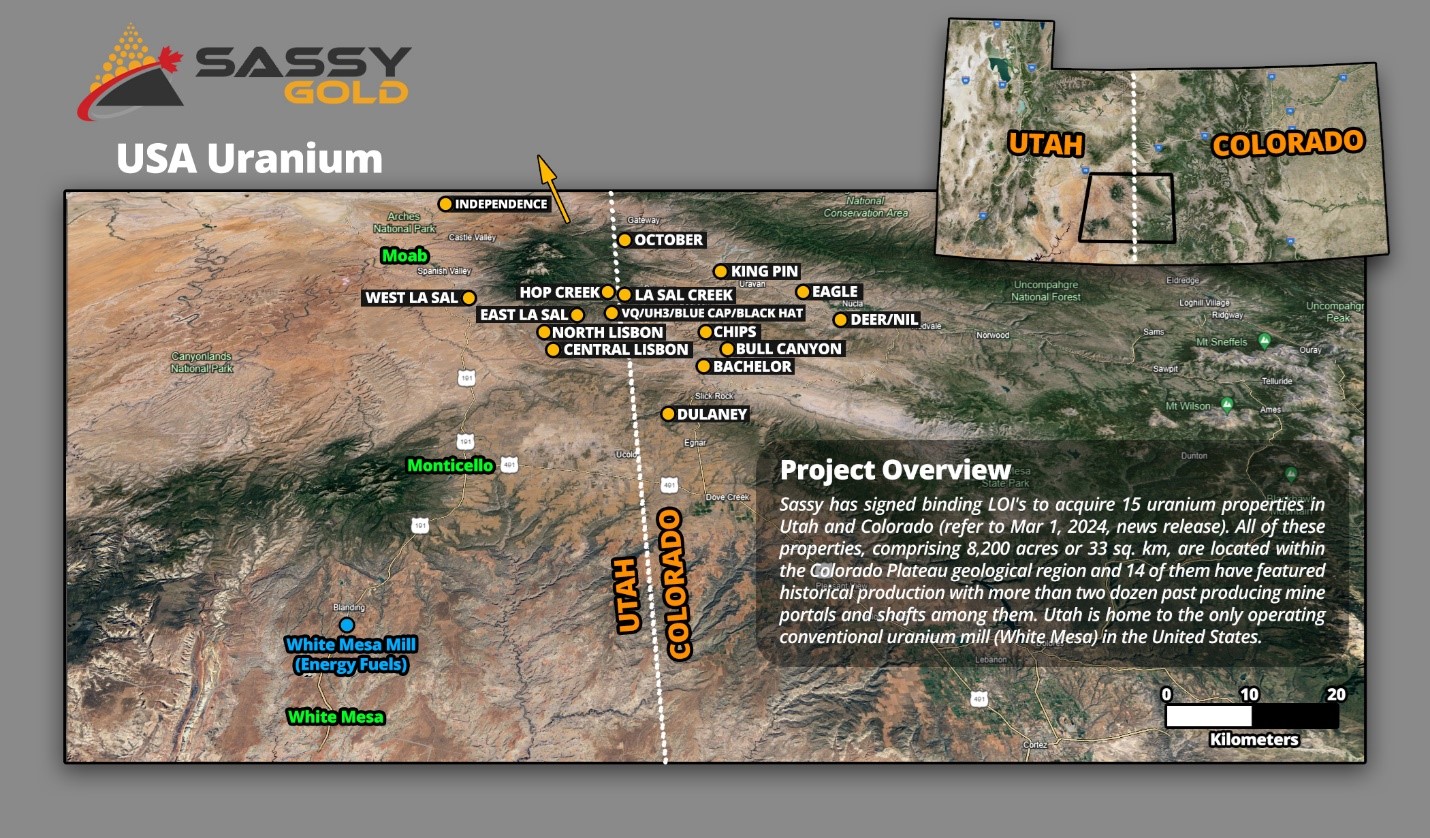

VANCOUVER, BC / ACCESSWIRE / March 1, 2024 / Sassy Gold Corp. ("Sassy" or the "Company") (CSE:SASY) (OTCQB:SSYRF) (FSE:4E7) is pleased to announce that it has signed binding letters of intent with various arms-length vendors (the "Vendors") to acquire a total of fifteen (15) advanced uranium properties in Utah and Colorado, USA (the "Transaction"). All of these properties, comprising 8,200 acres or 33 sq. km, are located within the Colorado Plateau geological region and fourteen (14) of them have featured historical production with more than two dozen past producing mine portals and shafts among them (the "Properties").

This strategic move into Utah and Colorado, at a favorable time in the uranium cycle, builds significantly on Sassy's existing uranium footprint in Saskatchewan's Athabasca Basin where the company owns a 20% interest in the Highrock Uranium Project. In addition, Sassy owns 100% of the Foremore Gold-Silver-Base Metal Project in Northwest B.C.'s Eskay Camp and also owns significant share positions and corresponding assets in MAX Power Mining Corp., Gander Gold Corp., and Galloper Gold Corp., with the latter now approved for listing on the CSE.

Utah/Colorado Property Highlights

- The 15 properties each are known to contain sandstone-hosted, roll-front uranium deposits;

- Clear path to potential near-term extraction at the Independence Property located in the San Rafael Swell, immediately off Interstate 70 near the community of Green River, Utah;

- Uranium mineralization outcrops at surface at Independence, a notable past producer in the region, and dips east toward Western Uranium's San Rafael Project;

- Independence is currently permitted for small-scale underground extraction and surface disturbance;

- Strong exploration upside at each of the 15 properties through data compilation and relatively shallow drilling to build on historical results;

- Infrastructure already in place at most of the mine sites, combined with the relatively shallow depth of the tabular sandstone-hosted deposits, is expected to keep the redevelopment capital cost of these properties low;

- Properties are within trucking distance to the only operating conventional uranium mill in the United States (White Mesa);

- Partnership with property vendors, who provide local expertise, surface drilling and underground mining;

- Abundant opportunities to improve historic economics of region's uranium/vanadium deposits;

- All properties are full-year road accessible from local workforce communities and services;

- Exploration work will commence with confirmatory drilling, along with the digitization of the existing extensive library of geological data, past production data and mine plans.

Uranium Mining in Utah

Energy Fuels reported December 21, 2023, that it had commenced uranium production at its La Sal Complex in Utah comprising its La Sal and Pandora mines in the vicinity of Energy Fuels' White Mesa Mill.

Most of Utah's historical production (122 million lbs U3O8 since 1904) has been from the sandstone-hosted deposits in the Salt Wash Member of the Morrison Formation, which Sassy will target at several of the Utah and Colorado properties, including Independence. The average grade of uranium mineralization in Utah's sandstone-hosted deposits is 0.30% U3O8, higher than in many other significant uranium producing districts worldwide with the exception of course of Canada's Athabasca Basin (source: Utah Dept. of Natural Resources, 2021, Open-File Report 735).

The North Lisbon and Central Lisbon Valley properties are located in the heart of Utah's Lisbon Valley District which has accounted for 64% of the state's total historical production, according to data from the Utah Dept. of Natural Resources.

Historical mineralization and production may not be indicative of future performance of the properties to be acquired by Sassy.

CEO Comments

Mark Scott, Sassy's President and CEO, commented, "This acquisition of past producing uranium mines with known deposits, on reasonable terms, is undeniably a big step forward for Sassy Gold. These advanced projects, with their accessible, shallow, tabular-style deposits, give the Company multiple development and deal-making options moving forward. We intend to launch a study aimed at identifying the commercially optimal mix and sequence of extraction, mining method, technology and equipment options presented by these projects. While that is ongoing, there is at least one of the mines with an obvious path to possible near-term extraction, which we will begin studying and pursuing concurrent with the work being performed regarding the other sites."

Project Map

Mark Scott added, "The strength of our team and the assets, their proximity to the only available route to market in the United States, uranium's long-term pricing fundamentals and the market's current enthusiasm for uranium make the timing of this deal extremely favorable. For good reason, our entire team is excited about our direction forward with this transaction, which took several months of concerted effort to bring together."

Property Details

The Company and the Vendors progress toward completion of the Definitive Agreements.

A Qualified Person (as defined in NI 43-101) has not done sufficient work to verify the historical drilling data. Additional work, including confirmatory drilling and logging, will be required to confirm and update the historical drilling and logging data, including a review of data integrity, assumptions, parameters, methods, and testing. Historical exploration data do not meet reporting requirements as prescribed under NI-43-101. Sassy is not treating the historical data as current and it should not be relied upon.

Terms of the Transaction

Sassy has signed three LOI's with the Vendors, as it relates to the Properties, on February 16, 2024. Under the terms of the LOI's, Sassy will pay a total value of $8,391,326 USD, of which 25%, or a total of $2,097,832 USD will be paid in cash over four equal payments of $524,458 on closing of the Transaction, and on the 6-month, 12-month and 24-month anniversaries of the closing of the Transaction. Common shares of Sassy ("Shares") will be issued to the beneficial owners of the Vendors on the same schedule as the cash payments, with 75% of the Transaction's value payable in Shares. The value and number of the Shares will be determined by the price of the financing completed immediately prior to the closing of the Transaction and based on the prevailing CAD/USD exchange at that time. The Vendors maintain a 1% gross royalty on most of the properties, with exclusions for two state leases which are already subject to state royalties, and the "BM Claims" within the Independence Property, which are already subject to two 1.5% Net Smelter Royalties payable to a third, unrelated party. Additionally, each LOI includes a provision which will pay a maximum of one "PEA Bonus" per LOI, in the amount of $100,000 cash and 1 million Company shares, upon the Company publishing a positive Preliminary Economic Assessment (PEA) for any property covered by that LOI. As at December 31, 2023, Sassy had over $26 million CAD in assets on its balance sheet and cash/marketable securities of over $3 million CAD.

The LOI's commit the Company and the Vendors to a 30-day due diligence period, which may be extended by the Company for the purpose of completing any required financing and further due diligence, along with any required stock exchange, regulatory and/or shareholder approvals (see below). The parties will complete the drafting of the Definitive Agreements for the Transaction during this due diligence period.

Sassy Private Placement

The Company announces the launching of a non-brokered private placement offering (the "Offering") for an aggregate of $2.5 million. The Offering will consist of one share of the Company at a price of CAD $0.0375 (3.75 cents) per share, with no warrants attached. The Offering is subject to CSE approval and all securities will be subject to a four-month hold period. Closing of the Offering will occur respective of the closing of the Transaction and funds from the Offering will be used for working capital for the Company and its projects or bona fide debt settlements, as applicable.

Shareholder Approval

Pursuant to CSE Policy 4.6(3), securityholders' approval is required if the number of shares issued may be more than 50% of the total number of securities or votes of the listed issuer outstanding (calculated on a non-diluted basis) accompanied by a new Control Person (as defined in the CSE Policies) or 100% of the total number of securities or votes outstanding. The Company intends to rely on the exemption in CSE Policy 4.6(1)(b) whereby the CSE's requirement for approval may be satisfied by a written consent signed by shareholders owning more than 50% of the outstanding common shares.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Ian Fraser, P. Geo., Vice President of Exploration for Sassy Gold. Mr. Fraser is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Sassy Gold Corp.

Sassy is an exploration stage resource company currently engaged in the identification, acquisition and exploration of high-grade precious metal and base metal projects in North America. Its focus is the Foremore Project located in the Eskay Camp, Liard Mining Division, in the heart of Northwest B.C.'s prolific Golden Triangle. Sassy also holds significant equity positions in Gander Gold Corp., Galloper Gold Corp., and MAX Power Mining Corp., as well as a 20% interest in the Highrock uranium project, giving the Company and its investors direct and indirect exposure to gold, copper, lithium and uranium.

Caution Regarding Forward Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "continues", "projects", "potential", "budget" and similar expressions, or are events or conditions that "will", "would", "may", "could" or "should" occur or be achieved. Such forward-looking statements reflect the current views of the Company with respect to future events, and are subject to certain risks, uncertainties and assumptions.

Certain information and statements contained in this news release constitute forward-looking statements, including: the signing of the Definitive Agreement; the closing of the Transaction; satisfaction of any conditions precedent, and satisfaction of those conditions with the Definitive Agreement, is not assured; closing of the Offering; any historical production and quality thereof; path and timing to future extraction; any potential exploration upside of the Properties or potential future drilling and target areas; payment methods for the Transaction; history of stone-hosted, roll-front uranium on any of the Properties; future opportunities to improve historic economics of the region's uranium/vanadium deposits; historic mineralization and production within the State of Utah and State of Colorado and any inferred indication of future performance of properties to be acquired; accuracy of historical drilling or exploration data; certainty of any exchange, regulatory or securities approval, if applicable.

The forward-looking statements are based on certain assumptions that the Company has made in respect thereof as at the date of this news release regarding, among other things: that all required regulatory approvals can be obtained or maintained on the necessary terms and in a timely manner, as applicable; that counterparties to the Company's agreements and contracts will comply with the terms thereof in a timely manner; that there are no unforeseen events preventing the performance of contracts; and that there are no unforeseen material costs relating to exploration of the Company's properties.

Although the Company believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements are made, undue reliance should not be placed on the forward-looking statements because the Company can give no assurances that such statements and information will prove to be correct and such statements do not guarantee future performance. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties.

Actual performance and results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to known and unknown risks, including those set forth in the Company's Management Discussion and Analysis (a copy of which can be found under Sassy's profile on SEDAR+ at www.sedarplus.ca). Accordingly, readers should not place undue importance or reliance on the forward-looking statements. Readers are cautioned that the list of factors is not exhaustive. Statements, including forward-looking statements, contained in this news release are made as of the date they are given and the Company disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Additional information on these and other factors that could affect the Company's operations and financial results are included in reports on file with applicable securities regulatory authorities and may be accessed under the Company's profile on SEDAR+ at www.sedarplus.ca.

All currency within the news release is intended to be in USD, unless otherwise stated.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Contact Information

Mark Scott

Chief Executive Officer

info@sassygold.com

Terry Bramhall

Corporate Communications & Investor Relations

terry.bramhall@sassygold.com

1.604.833.6999 (mobile)

1.604.675.9985 (office)

SOURCE: Sassy Gold Corp.

View the original press release on accesswire.com