VANCOUVER, BC / ACCESSWIRE / March 18, 2024 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") reports preliminary and unaudited financial results for its fourth quarter and year ended December 31, 2023.

All figures are stated in Canadian dollars unless otherwise noted.

2023 Year End - Record Revenue and Profits

Orogen is pleased to report record preliminary total revenue of $8,000,000 for the year ended December 31, 2023, up 70% from $4,700,000 total revenue earned in 2022 including:

- 58% increase in Ermitaño royalty revenue of $5,900,000 (2022 - $3,740,000)

- 105% increase in Prospect Generation revenue of $1,800,000 (2022- $880,000)

The Company is pleased to report a preliminary after-tax net income of $1,800,000 (2022 - $840,000) for the year ended December 31, 2023, up 114% from 2022. After-tax net income also includes deductions for general and administrative expenses, impairment of mineral properties and marketable securities, income tax, other income, and deductions. Cash generated from operations was $1,800,000 (2022 - $690,000).

As at December 31, 2023, the Company has working capital of $18,500,000 (2022 - $12,080,000) and no debt.

Preliminary Q4-2023 Results

The Company earned $2,300,000 (2022 - $1,155,000) in revenue for the fourth quarter ended December 31, 2023. This is an increase of 99% in total revenue compared to the same period in 2022 and this was due to:

- 99% increase in Ermitaño royalty revenue of $1,800,000 (2022 - $905,000)

- 86% increase in Prospect Generation revenue of $400,000 (2022 - $215,000)

The Company reports a preliminary after-tax net income of $350,000 (2022 - $940,000) for the fourth quarter ended December 31, 2023, after general and administrative expense, impairment of mineral properties and marketable securities, income tax, other income, and deductions.

Paddy Nicol, CEO of Orogen, commented: "The year 2023 was transformative for Orogen where we have achieved record financial performance. This was largely due to increased production from the Ermitaño mine and strong performance in our Prospect Generation business. The market was active during the beginning of 2023, and we were able to profitably transact on several quality projects and create new royalties for Orogen. The ongoing alliance in Nevada, with Altius Minerals, has proven to be successful for both groups with new projects generated at a low cost. The Company's financial position continues to strengthen and positions the Company to take advantage of counter cyclical growth opportunities to create value for shareholders."

The Company expects the audited consolidated financial statements for the year ended December 31, 2023, to be filed before the end of April 2024.

2024 Guidance and Update on Key Assets

Ermitaño Mine

Orogen holds a 2% net smelter return ("NSR") royalty on First Majestic Silver Corp.'s ("First Majestic") Ermitaño Mine. According to First Majestic, forecasted production guidance1 from the Santa Elena mine complex in 2024 is 81,000 to 90,000 ounces gold and 1.1 to 1.2 million ounces silver, with over 90%2 of the production from the Ermitaño mine. The Company estimates that this will result in royalty revenues between $4.5 million (US$3.3 million) and $5.0 million (US$3.7 million) based on gold price of US$2,000 per ounce.

Expanded Silicon Project

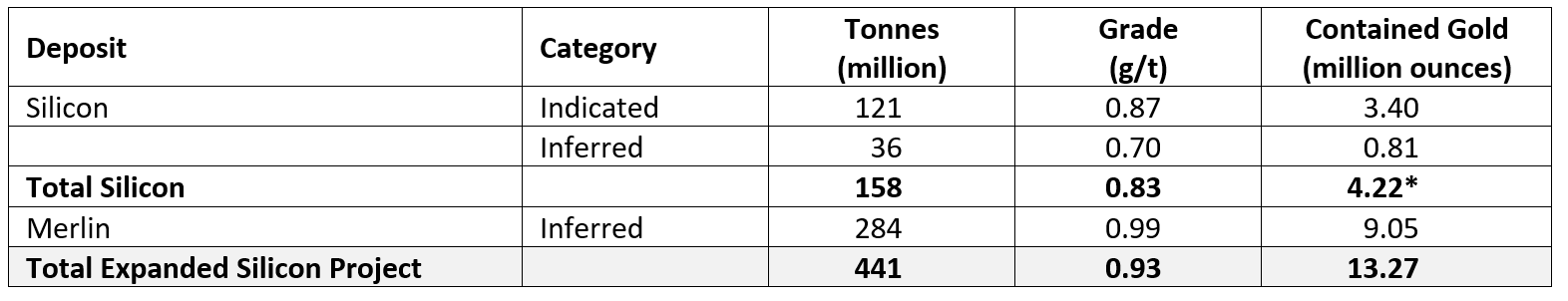

Orogen holds a 1% NSR royalty on the Expanded Silicon gold project located in Nevada, USA. On February 23, 2024, project owner AngloGold Ashanti NA ("AngloGold") announced an initial Inferred Resource of 9.05 million ounces gold at the Merlin deposit.3 The resource at Merlin is a significant discovery, separate and contiguous to the previously announced 4.22 million ounces gold resource at the Silicon deposit. 4 To date, the Company's royalty interest exposure is 13.27 million ounces gold:

Table 1: Expanded Silicon Project Summary Mineral Resources3,4

*Note: Some figures may be rounded. AngloGold reports content for gold to two decimal places.

Over US$73.9 million was invested by AngloGold on the Expanded Silicon project in 2023 including 129,000 metres of drilling, with a focus on the Merlin deposit5. AngloGold has initiated a Prefeasibility Study for the Expanded Silicon project focused on mining, processing, and infrastructure trade-off studies, drilling for resource conversion and extension, and exploration programs.6 In addition, AngloGold is working on hydrogeological, geotechnical, and metallurgical programs.

Other projects

Orogen has several projects that it has sold or are under active option agreements including the Maggie Creek project, optioned to Nevada Gold Mines, the Ball Creek East (HWY 37) project, optioned to Kingfisher Metals, the Spring Peak project, optioned to Headwater Gold, the Ghost Ranch project, optioned to Ivy Minerals, the Cuprite project, sold to StrikePoint Gold, and the MPD South project, sold to Kodiak copper.

The Company expects active exploration programs on these projects in 2024 including a minimum of six drill programs.

Qualified Person Statement

All new technical data, as disclosed in this press release, has been reviewed by Laurence Pryer, Ph.D., P.Geo., VP. Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant referenced partner. Additional information can be found on the links in the footnotes or on SEDAR (www.sedarplus.ca) or EDGAR (www.sec.gov).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon gold project (1.0% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. The forward looking statements in this news release reflect the Company's current expectations and projections about its future results. These forward looking statements may include statements regarding the future price of gold and the estimation of mineral reserves and resources, realization of mineral reserve estimates, the timing and amount of estimated future production, the Company's growth strategy and expectations regarding the inclusion of revenue guidance for 2024 or other statements that are not statements of fact.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Forward-looking information in this news release includes disclosures regarding NSR royalty payments to be paid to the Company by First Majestic Silver Corp. ("First Majestic"), the owners and operator of the Ermitaño mine located in Mexico and that the forecasted revenue which are based on First Majestic "NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates" having an effective date of June 30, 2021. In addition to the technical report, the disclosure herein also contains and the updated mineral reserve and resource estimates for the Ermitaño mine based on the Santa Elena Mineral Reserve, Resource Estimates with an effective date of December 31, 2022 as announced by First Majestic on March 31, 2023 and as disclosed in their December 31, 2022 AIF, and First Majestic's MD&A for the period ended March 31, 2023. Forward-looking statements are based on several material assumptions, which management of the Company believe to be reasonable, including, but not limited to, the continuation of mining operations in respect of which the Company will receive NSR royalty payments, that the commodity prices will not experience a material adverse change, mining operations that underlie the royalty will operate in accordance with the disclosed parameters and other assumptions may be set out herein.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a Royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a Royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds Royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds Royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's Royalty or other interest. Orogen's Royalty or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

References

- https://www.firstmajestic.com/investors/news-releases/first-majestic-produces-66-million-ageq-oz-in-q4-2023-and-269-million-ageq-oz-in-2023-announces-2024-production-and-cost-guidance-and-announces-conference-call-details

- https://event.choruscall.com/mediaframe/webcast.html?webcastid=znRy5NNl

- https://thevault.exchange/?get_group_doc=143/1708693258-PreliminaryFinancialUpdate2023-Report.pdf

- https://reports.anglogoldashanti.com/22/wp-content/uploads/2023/05/AGA-RR22.pdf

- https://thevault.exchange/?get_group_doc=143/1708690482-YearEnd2023ExplorationReport.pdf

- https://thevault.exchange/?get_group_doc=143/1708694171-PreliminaryFinancialUpdate2023-Presentation.pdf

SOURCE: Orogen Royalties Inc

View the original press release on accesswire.com