VANCOUVER, BC / ACCESSWIRE / March 19, 2024 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN)(OTCQB:BYAGF) announces the filing of the Technical Report to support the Updated Mineral Resource Estimate ("MRE") in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards incorporated by reference in National Instrument 43-101 ("NI 43-101") for the AurMac Project. The AurMac Project is located in the Mayo Mining district, approximately 40 kilometres ("km") northeast from the village of Mayo, Yukon and 356 km north of Whitehorse, Yukon (the "AurMac Property or "AurMac"). The Technical Report was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., Tawnya Thornton, P.Eng., of JDS Energy & Mining Inc. and Deepak Malhotra, PhD., of Forte Dynamics. The Technical Report is available for review on SEDAR at www.sedar.com and on the Company's website at www.banyangold.com.

As announced on February 7, 2024, the Updated AurMac Mineral Resource comprises a total inferred mineral resource of 7,003,000 ounces of gold (Table 1) on the road accessible AurMac Project. The updated MRE contains an Inferred Mineral Resource of 7.0 million ("M") ounces ("oz") of gold (as defined in the CIM Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43‑101).

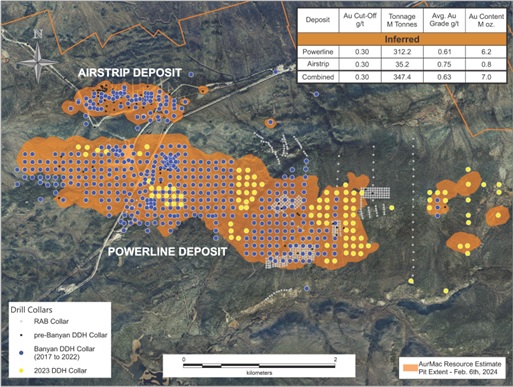

The pit constrained MRE is contained in two near/on-surface deposits: The Airstrip and Powerline[1] deposits in the road accessible AurMac Project. The updated MRE is summarized below in Table 1.

"AurMac's 7 million oz gold Resource is one of the largest potentially open-pit mineable resources in North America," said Tara Christie, Banyan President and CEO. "AurMac also benefits from being in a safe jurisdiction with a proven mine permitting process, adjacent to two existing mines and possessing existing all-season roads and hydro power infrastructure on the property."

Table 1: Pit-Constrained Inferred Mineral Resources - AurMac Project(1)(2)(3)(4)(5)

Deposit |

Gold Cut-Off g/t |

Tonnage Tonnes |

Average Gold Grade g/t |

Gold Content oz. |

Inferred | ||||

Airstrip |

0.30 |

35,243,000 |

0.75 |

845,000 |

Powerline1 |

0.30 |

312,243,000 |

0.61 |

6,158,000 |

Combined Inferred |

0.30 |

347,486,000 |

0.63 |

7,003,000 |

Notes to Table 1:

- The effective date for the MRE is February 6, 2024.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.30 g/t gold for all deposits, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,800/ounce, US$2.50/t mining cost, US$5.50/t processing cost, US$2.00/t G+A, 80% gold recoveries, and 45° pit slopes.[2]

- The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

The pit outlines used to constrain the MRE are shown in Figure 1. Detailed images of the Mineral Resource model, including an interactive 3D model and additional information can be found at: https://www.banyangold.com/projects/aurmac/

Figure 1: Plan Map Showing the Mineral Resource Estimate Extents and Drill Collar Locations.

Qualified Persons

Paul D. Gray, P.Geo., is a "Qualified Person" as defined under NI 43-101, and has reviewed and approved the content of this news release Mr. Gray is Banyan Gold's geological consultant and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Upcoming Events

- Banyan US Roadshow• Seattle, Los Angeles, Dallas, Houston - April 4 - 10

- Arctic Indigenous Investment Conference - May 7 - 8

- Invest Yukon Investment Conference & Property Tours - June 21 - 26

About Banyan

The 173 square kilometres ("sq km") AurMac Project lies 30 km from Victoria Gold's Eagle Project and adjacent to Hecla Mining's high grade Keno Hill Silver mine. The AurMac Project is transected by the main Yukon highway and access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Project benefits from a 3-phase powerline, existing power station and cell phone coverage. Banyan has the right to earn up to a 100% interest, in both the Aurex and McQuesten Properties respectively, subject to certain royalties.

In addition to the AurMac Project, the Company holds the Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt (the "Hyland Project"). The Hyland Project represents a sediment hosted, structurally controlled, intrusion related gold deposit, within a large land package (over 125 sq km), accessible by a network of existing gravel access roads.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN" and is quoted on the OTCQB Venture Market under the symbol "BYAGF". For more information, please visit the corporate website at www.BanyanGold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD-LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend(s)", "believe", "potential" and "continue" or the negative thereof or similar variations. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's plans for exploration; and statements regarding exploration expectations, prospectivity of the Company's property interests, potential mining processes, pricing assumptions and mineral resource estimates; mineral recoveries and anticipated mining costs. Factors that could cause actual results to differ materially from such forward-looking information include uncertainties inherent in resource estimates, continuity and extent of mineralization, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the estimation of mineral resources and the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

[1] Includes Aurex Hill deposit (Aurex Hill was included as a standalone deposit in previous May 18, 2023 MRE). The 2023 drill program connected Powerline and Aurex Hill deposits into a single deposit, now defined as Powerline.

[2] The gold price and cost assumptions are consistent with current pricing assumptions and costs and, in particular, with those employed for recent technical reports for similar pit-constrained Yukon gold projects.

SOURCE: Banyan Gold Corp.

View the original press release on accesswire.com