Tangerine Bank Ranks Highest for Third Consecutive Year

A year and a half into the COVID-19 pandemic, credit card customers in Canada are more optimistic about their personal financial outlook and the economy while adapting to the new realities and curtailing their credit card spending, according to the J.D. Power 2021 Canada Credit Card Satisfaction Study,SM released today. Nearly one-third (30%) of credit card holders cite high confidence (rating of 8-10 on a 10-point scale) in their personal financial outlook—up from 20% in 2020—and 19% express a positive outlook about the economy, up from 11% in 2020. But even with this renewed sense of optimism, customers are using their credit cards prudently, with the average monthly spend on primary cards declining to $1,155 from $1,200 year over year. This trend echoes a broader spending reduction in 2021 across all types of payments, including cash and debit cards.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210916005038/en/

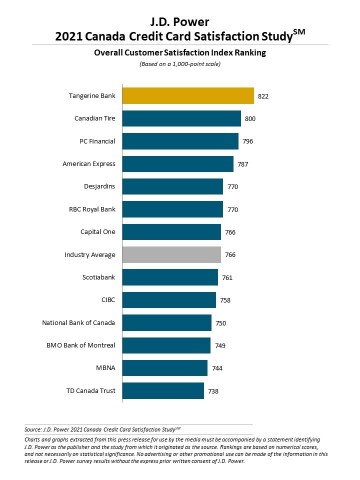

J.D. Power 2021 Canada Credit Card Satisfaction Study (Graphic: Business Wire)

Despite the decline in credit card spend, customers are more satisfied with their primary credit card issuer, as the average satisfaction score reaches 766 (on a 1,000-point scale) compared with 764 a year ago. According to the study, the main attributes elevating customer satisfaction are the communication of benefits and the range of benefits and services offered, with more customers being offered account protection, purchase return guarantees and no annual fees.

“Many Canadian credit card issuers are doing significantly better in terms of improving overall customer satisfaction compared to their U.S. counterparts,” says John Cabell, director of banking and payments intelligence at J.D. Power. “The lift in customer satisfaction amid the pandemic is the result of an effective industry response to customers’ changing needs and solid communication during these unprecedented times, coupled with customer savviness with card utilization.”

Following are some key findings of the 2021 study:

- Satisfaction improves with card features: Customer satisfaction is higher this year compared with 2020 with both the benefits and services (+5 points) and rewards (+1) that are tied to their cards. Issuers’ efforts to communicate and adapt these features around the disruption of customer spending patterns during the pandemic has mostly paid off with cardholders. Notably, rewards satisfaction, on average, improves slightly for many types of credit cards, including cash back, retail-affiliated cards and even travel cards. That said, it is still a good time for customers to review the alignment of their personal spending with the credit card they use most often.

- No annual fee means higher satisfaction: More than one-fifth (22%) of customers this year say they switched their primary card in the past 12 months to avoid paying an annual fee, up from 16% in 2020. Concurrently, satisfaction among customers with a no-fee credit card is much higher with their card issuer (747) than among customers with an annual fee (707).

- Perception declines with financial difficulties: More than one-fifth (22%) of customers say they are financially vulnerable and 11% say they are financially stressed. Of those most financially vulnerable who struggle to pay bills and have no planning, only 18% say their credit card issuer acts in their best interest vs. 31% of those who say they are financially healthy. Financial health also affects brand advocacy, with the Net Promoter Score®1 among the financially healthy group nearly eight times higher than that of financially vulnerable cardholders (38 vs. 5, respectively, on a scale of 100).

- Reward redemption delayed and travel benefits usage declines: Despite overall rewards satisfaction improvements, twice as many customers (22%) this year have postponed reward redemption for more than a year, compared with 11% who did so a year ago. Not surprisingly, travel-related benefits have declined in usage for insurance (-5%), lounge clubs (-5%), free checked bags and no foreign exchange fees (-3%). The prolonged timeframe of reward redemption has had a dampening effect on customer satisfaction, especially among those who have redeemed travel-related rewards (759 in 2021 vs. 763 in 2020).

- Call centre woes: Call centres continue to be the industry’s Achilles’ heel as it relates to customer satisfaction. While the study shows a decline in the average number of contacts to a call centre (1.8 in 2021 vs. 1.9 in 2020), customer satisfaction with call centres has decreased to 794 from 811 a year ago. This is an area where card issuers should pay closer attention, especially around efficiency and phone representative clarity, with more customers this year noting instances of being transferred, put on hold, asked for the same information multiple times or having difficulties understanding the representative than last year.

Study Ranking

Tangerine Bank ranks highest in overall customer satisfaction for a third consecutive year, with a score of 822. Canadian Tire (800) ranks second and PC Financial (796) ranks third.

The Canada Credit Card Satisfaction Study measures satisfaction of cardholders’ primary credit card issuer. The study measures performance in six factors critical to the customer experience (in alphabetical order): benefits and services; communication; credit card terms; customer interaction; key moments; and rewards. The study was fielded in May-June 2021 and includes responses from 6,699 cardholders who used a major credit card in the past three months.

For more information about the Canada Credit Card Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-credit-card-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2021112.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://canada.jdpower.com/.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210916005038/en/

Contacts

Media Relations Contacts

Nicole Herback, Cohn & Wolfe; 403-200-1187; nicole.herback@cohnwolfe.ca

Gal Wilder, Cohn & Wolfe; 647-259-3261; gal.wilder@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com