—One of the worst flooding events in this region underscores importance for community resilience ahead of increasingly severe natural catastrophes—

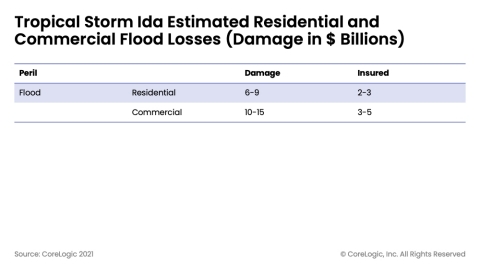

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released additional loss estimates for Hurricane Ida, following its initial release estimating between $27 billion and $40 billion in insured and uninsured losses from wind, storm surge and inland flooding in Louisiana and Mississippi. According to this new analysis, specifically for the U.S. Northeast, subsequent Tropical Storm Ida caused an estimated $16 billion to $24 billion in insured and uninsured inland flood losses to residential and commercial properties.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210908005986/en/

Tropical Storm Ida Estimated Residential and Commercial Flood Losses (Damage in $ Billions) (Graphic: Business Wire)

Total insured flood loss for residential and commercial properties in the U.S. Northeast is estimated to be between $5 billion and $8 billion, while uninsured flood loss for this area is estimated to be between $11 billion and $16 billion. Pennsylvania, New Jersey, New York, Connecticut and Massachusetts sustained approximately 90% of the losses.

“Given the prevalence of multifamily housing and below-ground structures in these areas, we’ll see more extreme interior content damages than we typically see in southern coastal areas,” said Shelly Yerkes, senior leader, insurance solutions at CoreLogic. “For example, many of the heating, ventilation and air conditioning systems in New York City buildings are in the basements, so contents damage should be substantial.”

After Hurricane Ida made landfall in Port Fourchon, La. on August 26, it continued to travel northeast as it downgraded to a tropical storm status, bringing devastating rainfall of six-to-nine inches in three hours in New York, New Jersey and surrounding states. This record-setting precipitation caused a flash flood event as the rain overwhelmed storm water drainage systems in urban areas where the average monthly rainfall is approximately three inches and little green space exists to absorb sudden inundations of water. Tropical Storm Ida’s flood event affected a region nearby Superstorm Sandy’s impact area in 2012, which caused extensive storm surge-related flooding along the coastlines and shorelines of the East River and the Hudson River. Catastrophic weather events like these are becoming more common and local governments and property owners are taking note, making infrastructure and home resilience improvements in the wake of the recent storms.

“The flooding from Superstorm Sandy was more severe than Tropical Storm Ida,” said David Smith, senior leader of science and analytics at CoreLogic. “Due to the repairs made in 2012, such as strengthening buildings and infrastructure and addressing deferred maintenance, New York was less vulnerable. Tropical Storm Ida’s effects on New Yorkers would have been worse if we hadn’t conducted these resilience-based repairs after Superstorm Sandy.”

This analysis includes residential homes and commercial properties, including contents and business interruption and does not include broader economic loss from the storm.

Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at www.hazardhq.com to get access to the most up-to-date Hurricane Ida storm data and see reports from previous weather events.

Methodology

CoreLogic offers high-resolution location information solutions with a view of hazard and vulnerability consistent with the latest science for more realistic risk differentiation. The high-resolution flood modeling using 10m digital elevation model (DEM) and structure- and parcel-based geocoding precision from PxPoint™ facilitates this realistic view of risk, including both fluvial (riverine) and pluvial (surface) flooding. Single-family residential structures less than four stories, including mobile homes, duplexes, manufactured homes and cabins (among other non-traditional home types) are included in this analysis. Multifamily residences and commercial properties are also included.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210908005986/en/

Contacts

Robin Wachner

newsmedia@corelogic.com