While more than two-thirds of retailers are taking action to lower transportation and processing costs, decision-making authority for returns improvements is split inside retail organizations

Pitney Bowes (NYSE:PBI), a global shipping and mailing company that provides technology, logistics, and financial services, today released new findings from its BOXpoll surveys, indicating that US online retailers face significant logistical and financial challenges due to the high cost and increasing number of ecommerce returns.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220414005151/en/

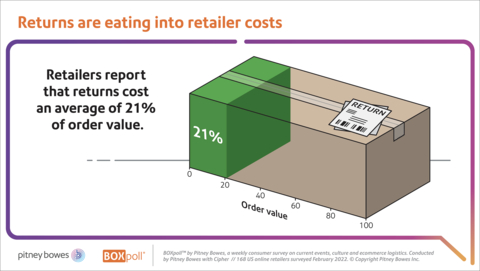

BOXpoll: Returns are eating into retailer costs (Graphic: Business Wire)

According to the BOXpoll survey of medium and large-size digital and omnichannel brands, online returns cost retailers an average 21% of order value, with several brands reporting ratios considerably higher. The financial burden is compounded by the fact that ecommerce return rates are at historic highs—an average of 20.8% in 2021 versus 18.1% in 2020, according to the National Retail Federation.

“One of the grand ironies of ecommerce is that both retailers and consumers struggle with returns because each sees the other as making the process more difficult,” said Vijay Ramachandran, VP Market Strategy for Global Ecommerce at Pitney Bowes. “Three out of four consumers say their recent returns experiences have been inconvenient. At the same time, more than two out of three retailers say they’re actively trying to lower the cost of returns. This means brands have yet to find an effective balance between returns convenience and cost. Dialing up the ‘right’ balance will be different for every brand based on what they’re selling and who they’re selling to. This is what we’re working with our clients to solve using market intelligence from our BOXtools platform.”

According to the BOXpoll survey, 70% of retailers say they are actively trying to lower the cost of returns by addressing transportation and/or processing costs. However, this goal is complicated by shared accountability for returns strategies. The survey found that while 42% of retailers give their logistics/operations leaders final authority on selecting a returns transportation vendor (with the remainder split between customer care, ecommerce, procurement, marketing, and IT functions), only 25% give operations leaders the same authority for selecting returns technology vendors. This division of responsibility is more likely to create gridlock when it comes to decision making.

“We know from listening to our clients that our uniquely modular combination of returns technology and logistics services gives brands the flexibility to find a better balance for their returns strategy,” said Ramachandran. “Our research has found that software-only or logistics-only point solutions create wedges inside organizations by fracturing decision-making among different functions. These teams could collaborate more effectively with holistic, modular returns solutions that can be configured to satisfy cross-functional needs—such as offering your most loyal customers more convenient options or opportunistically expediting only the return of items with limited stock. After all, consumers don’t differentiate between software and logistics services—they only see ‘experience.’”

These findings lay the foundation for a forthcoming series of BOXpoll surveys of both online retailers and consumers that will explore the best balance of convenience and friction for returns processes.

The BOXpoll retailer surveys are conducted by Pitney Bowes with Cipher Research. The retailer trends outlined in this release are based on a sample of 168 US online retailers surveyed in February 2022.

Consumer Perceptions of Delivery Speed

While the significant increase in online shopping due to the pandemic has impacted return rates, it has also influenced consumers’ perceptions of delivery speed. To understand how consumers’ perception of speed has changed over the past two years, Pitney Bowes launched several BOXpoll consumer surveys, revealing:

- In October 2020, shoppers had come to expect delivery delays due to COVID-19, and their definition of “fast” shipping was slower than it had been pre-pandemic.

- By late April 2021, consumers’ definitions of “fast” had slowed further, extending by about one-third of a day for most product categories.

- As of February 2022, BOXpoll surveys had found the definition of “fast” has shifted back to similar expectations from October 2020—but remains slower than pre-pandemic expectations. The current definition of “fast” is 3.1 days for all products in general.

Methodology

BOXpoll by Pitney Bowes, part of the BOXtools insights platform, is a weekly survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly consumer polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. The consumer interviews were conducted online, and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. Results from the consumer surveys have a margin of error of +/- 2 percentage points. Cipher Research conducts periodic surveys on behalf of Pitney Bowes among a national sample of more than 150 digital and omnichannel brands fulfilling more than 25,000 online orders per year. The results included in this press release are extracted from surveys conducted over the past two months. Visit www.pitneybowes.com/boxpoll for the latest BOXpoll findings.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500. Small business, retail, enterprise, and government clients around the world rely on Pitney Bowes to remove the complexity of sending mail and parcels. For the latest news, corporate announcements and financial results visit https://www.pitneybowes.com/us/newsroom.html. For additional information, visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220414005151/en/

Contacts

Brett Cody, Pitney Bowes, (203) 218 1187, brett.cody@pb.com