Strength in nonresidential building starts drove the month higher

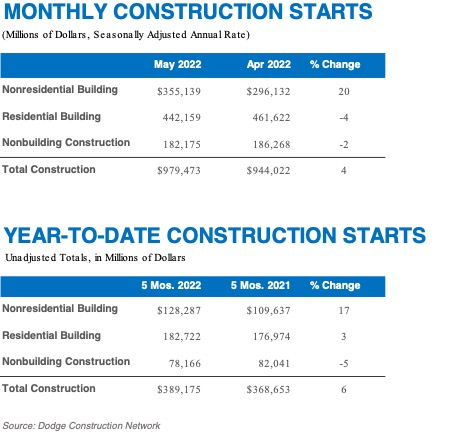

Total construction starts rose 4% in May to a seasonally adjusted annual rate of $979.5 billion, according to Dodge Construction Network. Nonresidential building starts rose 20%, while residential starts fell by 4% and nonbuilding lost 2% during the month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220617005054/en/

Total construction starts rose 4% in May to a seasonally adjusted annual rate of $979.5 billion, according to Dodge Construction Network. (Graphic: Business Wire)

Year-to-date, total construction was 6% higher in the first five months of 2022 compared to the same period of 2021. Nonresidential building starts rose 17% and residential starts gained 3%, while nonbuilding starts were 5% lower. For the 12 months ending May 2022, total construction starts were 10% above the 12 months ending May 2021. Nonresidential starts were 20% higher, residential starts gained 8% and nonbuilding starts were down 3%.

“The construction sector has become increasingly bifurcated over the past several months,” said Richard Branch, chief economist for Dodge Construction Network. “Nonresidential building construction is clearly trending higher with broad-based resilience across the commercial, institutional and manufacturing spaces. However, growth in the residential market has been choked off by higher mortgage rates and rapidly falling demand for single family housing. Nonbuilding starts, meanwhile, have yet to fully realize the dollars authorized by the infrastructure act. While the overall trend in construction starts is positive, the very aggressive stance taken by the Federal Reserve to combat inflation risks slowing the momentum in construction.”

Below is the breakdown for construction starts:

-

Nonbuilding construction starts fell 2% in May to a seasonally adjusted annual rate of $182.2 billion. Highway and bridge starts showed marginal growth over the month, while utility/gas plant starts jumped 22%. The drag on growth came from environmental public works starts, which fell 14% in May, and miscellaneous nonbuilding starts, which lost 3%. Through the first five months of the year, total nonbuilding starts were 5% lower than in 2021. Highway and bridge starts gained 22% through five months and environmental public works projects were 2% higher. At the same time, miscellaneous nonbuilding and utility/gas plants starts dropped 35% and 41% (respectively) through five months.

For the 12 months ending May 2022, total nonbuilding starts were 3% lower than in the 12 months ending May 2021. Environmental public works starts were up 9%, and street/bridge starts gained 7%. Miscellaneous nonbuilding starts were 33% lower and utility/gas plant starts were down 15%.

The largest nonbuilding projects to break ground in May were the $1.6 billion Samson Solar Energy Center in Franklin, Lamar and Red River Counties, TX, the $523 million Danish Fields Solar Farm and Battery Storage in Matagorda County, TX and the $307 million widening of highway 10 in Beaumont, TX.

-

Nonresidential building starts rose 20% in May to a seasonally adjusted annual rate of $355.1 billion. In May, commercial starts rose 35% due to a large gain in office starts. Institutional starts rose 9% and manufacturing starts fell 5%. Through the first five months of 2022, nonresidential building starts were 17% higher than during the first five months of 2021. Commercial starts advanced 17% and institutional starts rose 2%, while manufacturing starts were 97% higher on a year-to-date basis.

For the 12 months ending May 2022, nonresidential building starts were 20% higher than in the 12 months ending May 2021. Commercial starts grew 18%, institutional starts rose 9%, and manufacturing starts swelled 116% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in May were the $950 million Meta Hyperscale data center in Temple, TX, the $940 million Digital Dulles data center in Dulles, VA and a $540 million mixed-use building in New York, NY.

-

Residential building starts fell 4% in May to a seasonally adjusted annual rate of $442.2 billion. Single family starts dropped 10% and multifamily starts rose 8%. Through the first five months of 2022, residential starts were 3% higher than in the first five months of 2021. Multifamily starts were up 21%, while single family housing slipped 3%.

For the 12 months ending May 2022, residential starts improved 8% from the same period ending May 2021. Single family starts were 2% higher and multifamily starts were 27% stronger on a 12-month rolling sum basis.

The largest multifamily structures to break ground in May were the $800 million Two Bridges building in New York, NY, the $329 million Reston Next residential building in Reston, VA and the $294 million 500 Main Street residential building in New Rochelle, NY.

Regionally, total construction starts in May rose in the Northeast, Midwest and South Central regions, but fell in the South Atlantic and West.

About Dodge Construction Network

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry.

The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem.

Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220617005054/en/

Contacts

Cailey Henderson | 104 West Partners | dodge@104west.com