Makes direct indexing available to customers with its flagship product “Frec Direct Indexing”

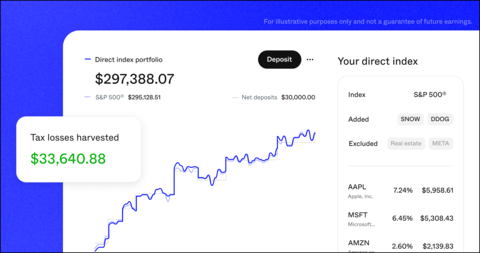

Today Frec1 emerges from stealth with a suite of automated self-service products to simplify sophisticated investment products traditionally only available via wealth managers. Its flagship product, Frec Direct Indexing, is one of the first direct-to-consumer products that enables customers to track S&P2 indices – delivering the benefits of index investing, with added tax savings and customization.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231003358651/en/

Frec Direct Indexing Main Page (Graphic: Business Wire)

With Frec Direct Indexing, customers benefit from:

- Up to an additional 2.11% on top of market returns. Powerful algorithms perform daily tax loss harvesting that can capture up to 45% of the value of an investment in capital losses - or $19 in real tax savings for every $100 deposited. When reinvested, this can increase returns by 2.11%3 annually.

- Frec’s license of the S&P indices, enabling them to customize their portfolio by adding or removing companies and sectors.

- A flat .10% fee for direct indexing, priced similarly to buying an ETF directly, compared to some robo-advisors charging .25%4 for basic index investing, or a wealth advisor, who could charge up to 1%5 for direct indexing.

“We built Frec for the financially-savvy who want access to more sophisticated products than are currently offered by existing retail investment platforms, and have qualms about working with expensive wealth managers and old-school brokerages with complicated UI,” said Mo Al Adham, founder of Frec. “We made it our mission to build a modern, self-service platform that enables access to advanced financial products, like direct indexing, portfolio lines of credit, and high yield treasury funds to help them stay invested, even in a volatile market.”

Frec today also announced:

- Frec Treasury, offering up to 5.02%6 on cash. Highly liquid, low-risk, and comes with insurance7 - customers can connect their bank account, set a maximum threshold and have excess cash automatically transferred into high earning treasury funds. Customers can also pay credit cards directly from Frec Treasury.

- Portfolio lines of credit, enabling customers to borrow up to a certain percentage of their stock holdings, without a complicated setup.8

- A partnership with AngelList, powering money market funds natively for venture capital funds. AngelList venture funds can earn yield on their cash in money market funds through Frec.

Frec has $26.4 million in seed and Series A funding led by Greylock with participation from Social Leverage and others.

“Frec is on the precipice of truly democratizing access to sophisticated investment products, so for us, getting into business with them was a no brainer,” said Josh McFarland, Venture Partner, Greylock. “With analysts predicting that direct indexing will grow at a higher rate than ETFs and Mutual Funds over the next five years, Frec couldn’t be launching at a better time. Mo is a visionary founder, and I am excited to continue partnering with him and the Frec team on their vision.”

About Frec

Frec offers a suite of automated self-service products to simplify sophisticated investment products traditionally only available via wealth managers, including direct indexing, portfolio lines of credit, and high-yield treasury. Optimizing for both returns and tax savings, Frec Direct Indexing is one of the first direct-to-consumer solutions that enables customers to track S&P indices – delivering the benefits of index investing, with added tax savings and customization. To learn more, visit: Frec.com.

1 The firm is a member of the Securities Investor Protection Corporation.

2 S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”).

3 The projection of 2.11% additional return was generated by Frec's Direct Indexing Model tracking the S&P 500 index and is hypothetical, does not reflect actual investment results, and is not a guarantee of future results. Simulations were run on a weekly basis in a ten-year time frame from December 17, 2003 through June 10, 2022 with a $50,000 initial deposit. The simulations averaged at the end of year ten resulted in a 45.1% accumulated tax loss savings that were reinvested with a 42.3% tax rate, and includes Frec's 0.10% fee. The prices used for stocks were adjusted for dividends. Results may vary.

4 Wealthfront: 0.25% fee; Information as of October 3, 2023, terms and conditions may vary.

5 “What to know about financial costs” U.S. News & World Report, July 27, 2023, https://money.usnews.com/financial-advisors/articles/financial-advisor-fees-and-costs.

6 Based on the highest 7-day sec yield available in Frec’s Treasury strategy including fees as of October 3, 2023. Yields are subject to change and will fluctuate over time.

7 Frec is a SIPC member.

8 Line of credit up to 70% of stock holdings. The amount you can borrow is based on several factors including which stock you own and the diversification of your portfolio. Borrowing can increase your investing risks.

Additional Information:

Investing involves risk, including the risk of loss. Tax savings will vary from client to client based on several factors including client tax status, client tax rate, and changes in tax regulations. Frec does not provide tax advice. Advisory services are provided by Frec Advisers LLC, an SEC registered investment advisory and brokerage services are provided by Frec Securities LLC, member FINRA/SIPC. Both are wholly owned subsidiaries of Frec Markets, Inc. © 2023. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231003358651/en/

Contacts

Lacey Haines

press@frec.com