In spite of a generally positive outlook, more dealers expect valuations and profits to decline than in 2023; Kia projected to have highest valuation increase, while Toyota is the franchise most trusted by dealers, according to the recently released 2023 Kerrigan Dealer Survey

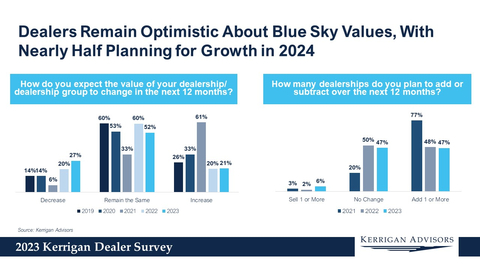

Auto dealers remain generally positive about the valuation of their dealerships over the next twelve months, according to the newly released 2023 Kerrigan Dealer Survey, with 52% expecting 2023’s strong valuations to extend into 2024, and 21% projecting a valuation increase. But, as dealers anticipate that earnings will start to normalize from record-high levels - 38% expect profits to decrease over the next 12 months – more dealers (27%) are also expecting valuations to decrease, the highest level since the survey’s inception in 2019, and almost double 2019 and 2020’s levels.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231106002997/en/

Dealers Remain Optimistic About Blue Sky Values, With Nearly Half Planning for Growth in 2024 (Graphic: Kerrigan Advisors)

This has led to an increase in the number (albeit a small number at 6%) of dealers who say they will sell their dealerships over the next 12 months versus 2023. That being said, nearly half (47%) of dealers surveyed are looking to acquire one or more dealerships, leveraging their significant capital accounts resulting from more than three years of record profits. Kerrigan Advisors estimates the industry has amassed over $200 billion in pre-tax profits since 2020.

“The majority of dealers remain bullish on the industry, with 62% or more expecting earnings and valuations to remain at or near peak levels. This positive sentiment is leading nearly half of all dealers to seek acquisitions and expansion, certainly an endorsement of the industry’s future,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “Dealerships remain one of the most lucrative investments dealers can make in the private sector with an average return on equity of 33% in 2023 – those returns far surpass alternative investment opportunities in the market. As a result, it is not surprising dealers are seeking to allocate their capital to dealership acquisitions even in today’s high interest rate environment.”

The 2023 Kerrigan Dealer Survey queried over 650 auto dealers about their views on the future value of their businesses, as well as their perspectives on franchise valuations and acquisitions, with the results illustrating the changing auto retail environment and dealership relationships with OEMs. The survey revealed distinctly varying views on specific franchises, with some OEMs eliciting a lack of trust and confidence in future franchise profits, while others earned a high level of trust and a positive profit outlook.

Kia, Hyundai, Lexus, Toyota and Porsche were the franchises with the highest expected valuation gains. Dealers were most bullish about Kia, with 44% expecting its valuations to increase, more than double the industry average. Hyundai was second with 37% expecting valuation increases. This marks the second year Kia and Hyundai have exceeded Toyota to top the valuation growth expectation list.

While the majority of dealers surveyed believe individual franchises will either increase or remain the same in value over the next 12 months, every franchise saw a reduction in the percentage of dealers projecting an increase, along with a rise in those expecting a value decline. “We believe this is emblematic of the rising discontent within the dealer body regarding OEMs’ electric vehicle (“EV”) strategies and the increasing EV inventories on many dealers’ lots,” said Kerrigan.

Dealers, however, are less worried about the effects of planned OEM changes to the dealer model in 2024 than they were for 2023: nearly every franchise saw a rise in the percentage expecting no impact on profitability as a result. “Dealers are skeptical about the OEMs’ ability to execute on their proposed retailing changes and aggressive EV strategies, particularly given weak consumer demand for EVs,” continued Kerrigan.

Dealers were also asked about how much they trust the franchise OEMs. Toyota received by far the top results, with 72% of dealers expressing a high level of trust in the franchise, over three times higher than the survey average. By contrast, 48% of dealers reported they had no trust in Ford, which is consistent with the expectation of a decline in future Ford dealer profits due to changes to the OEM’s retailing strategy.

Top 5 Most & Least Trusted Franchises According

|

||||

Rank |

Most Trusted |

Least Trusted |

||

1 |

Toyota |

Ford |

||

2 |

Lexus |

Nissan |

||

3 |

Subaru |

Lincoln |

||

4 |

Honda |

CDJR |

||

5 |

Porsche |

Infiniti |

||

“The data on trust was quite noteworthy, again echoing dealers’ sentiment about changes to OEM retailing strategies,” said Ryan Kerrigan, Managing Director of Kerrigan Advisors. “It comes as no surprise that Toyota is the franchise that dealers trust the most, a reflection of its thoughtful approach to the rollout of EVs, and its win-win strategy when it comes to the dealer/OEM relationship.”

Based on the overall survey results, Kerrigan Advisors believes there is slightly more risk to valuations and the buy/sell market going into 2024, though transaction activity is expected to remain elevated as dealers with full coffers seek to add scale to their business and deploy their capital to expansion. And, in spite of industry noise about the disruption of OEM retailing changes, those changes are not expected to have a significant impact on future retail profits.

Notable changes in franchises’ expected valuations from the 2023 Kerrigan Dealer Survey:

- CDJR saw a 29-percentage point increase in dealers expecting the franchise to decline in value versus last year’s survey. Kerrigan Advisors believes this negative dealer sentiment is reflective of CDJR’s rising inventory levels and lack of incentive spending.

- Ford joins Lincoln as the two franchises least expected to see a rise in valuation, and Ford is the least trusted franchise amongst all OEMs, with 48% of dealers reporting no trust in the OEM. Kerrigan Advisors expects this negative sentiment will impact Ford’s blue sky multiples in 2024 and beyond.

- Kia surpassed Toyota for the second year in a row as the franchise most expected to increase in value over the next 12 months. Kia also saw one of the largest increases in positive profit expectations as a result of OEM retailing changes and is ranked the 8th most trusted franchise. These positive results are consistent with Kerrigan Advisors’ upgrade of Kia’s franchise multiple in the second quarter of 2023 and positive outlook for 2024.

- Toyota continues to outperform on every level. Its lead in the trust equation has resulted in the franchise having the highest expected increase in profits as a result of the OEMs’ retailing changes and dealers continue to expect the franchise’s value to rise, even though the franchise is currently the most valuable amongst non-luxury makes.

Methodology

The data for The Kerrigan Dealer Survey was gathered from Kerrigan Advisors’ annual survey of auto dealers in conjunction with the issuance of The Blue Sky Report. The Kerrigan Dealer Survey is based on over 650 anonymous responses from franchised auto dealers in Kerrigan Advisors’ proprietary dealer database. Responses were collected from June 2023 to October 2023.

- To download the full Kerrigan Dealer Survey report, click here.

- To download a preview of The Blue Sky Report®, published by Kerrigan Advisors, click here.

- To access The Kerrigan Index™, click here.

About Kerrigan Advisors

Kerrigan Advisors is the leading sell-side advisor and thought partner to auto dealers nationwide. Since its founding in 2014, the firm has led the industry with the sale of over 225 dealerships representing more than $7 billion in client proceeds, including the third largest transaction in auto retail history – the sale of Jim Koons Automotive Companies to Asbury Automotive Group. The firm advises the industry’s leading dealership groups, enhancing value through the lifecycle of growing, operating and, when the time is right, selling their businesses. Led by a team of veteran industry experts with backgrounds in investment banking, private equity, accounting, finance and real estate, Kerrigan Advisors does not take listings, rather they develop a customized sales approach for each client to achieve their personal and financial goals. In addition to the firm’s sell-side advisory services, Kerrigan Advisors also provides a suite of consulting and investor services including growth strategy, market valuation assessments, capital allocation, transactional due diligence, open point proposals, operational improvement and real estate due diligence.

Kerrigan Advisors monitors conditions in the buy/sell market and publishes an in-depth analysis each quarter in The Blue Sky Report®, which includes Kerrigan Advisors’ signature blue sky charts, multiples, and analysis for each franchise in the luxury and non-luxury segments. To download a preview of the report, click here. The firm also releases monthly The Kerrigan Index™ composed of the seven publicly traded auto retail companies with operations focused on the US market. The Kerrigan Auto Retail Index is designed to track dealership valuation trends, while also providing key insights into factors influencing auto retail. To access The Kerrigan Index™, click here. To read the 2023 Kerrigan Dealer Survey, click here. To read the 2023 Kerrigan OEM Survey, click here. Kerrigan Advisors also is the co-author of NADA’s Guide to Buying and Selling a Dealership.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231106002997/en/

Contacts

Kerrigan Advisors Media Contact:

Melanie Webber (melanie@mwebbcom.com), mWEBB Communications, 949-307-1723