Amica Ranks Highest in Property Claims Satisfaction

There were 28 catastrophic weather events in 2023 that each caused more than $1 billion in damage—more than any previous year—and caused a combined total of $92.9 billion in damage nationwide.1 According to the J.D. Power 2024 U.S. Property Claims Satisfaction StudySM, released today, the increase of severe storms has led to a larger number of high-severity claims and notably longer time frames for all major steps of claims—estimating the damage, paying the customer and completing the work—all negatively affecting satisfaction, which declines to the lowest level in seven years.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240319207108/en/

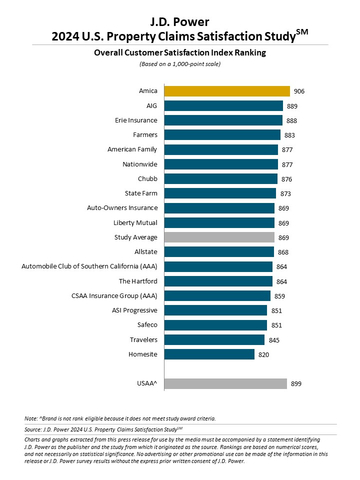

J.D. Power 2024 U.S. Property Claims Satisfaction Study (Graphic: Business Wire)

“Catastrophic weather events are straining an already fragile system still experiencing supply chain issues that affect the availability and cost of materials,” said Mark Garrett, director of claims intelligence at J.D. Power. “Resources become strained for both insurers and the contractors doing the work. Unfortunately, it’s when claims last beyond three weeks that J.D. Power sees things decline. When claims last less than three weeks, satisfaction improves, so it’s the longer claims that are solely responsible for the decline. Insurers are challenged to manage expectations and proactively communicate during longer claim periods as customers tend to have more questions when experiencing delays.”

Following are some key findings of the 2024 study:

- Repair cycle times through the roof: The average claims cycle time—the amount of time from reporting the claim to finished repairs—is now 23.9 days, which is more than six days longer than what was reported in the 2022 study. For claims related to catastrophic events, that average repair cycle time jumps to 34.2 days. Not surprisingly, customer satisfaction has moved in the opposite direction, falling five points to 869 (on 1,000-point scale) from a year ago. The average overall satisfaction score among customers who experienced catastrophic claims is 841.

- Live by efficiency improvements, die by efficiency improvements: Customers who use digital tools for reporting their claim or submitting photos used in the estimation process experience faster claim cycle times but don’t always have higher levels of overall satisfaction. Claims taking longer than expected are partially to blame as satisfaction drops at a greater pace among digital users than non-digital users. For example, overall satisfaction among customers reporting their claim digitally is 903 when the claim is settled in less than three weeks. That score falls to just 727 after 31 days. “Insurers are offering digital tools and managed repair partners to help streamline the process, but these efforts are met with mixed results,” Garrett said. “Customers still expect things to move along quicker so expectation management is key.”

- Higher costs take their toll amid rising premiums: Many customers are experiencing rising insurance premiums, so when they have a claim and need to cover $1,500 or more in costs, satisfaction is negatively affected, even if it is to cover their deductible. Policies often have higher deductibles for catastrophic weather (wind, hail, named storms, etc.) so as these events increase in frequency, more customers can be paying higher deductibles. J.D. Power has seen a five-percentage-point increase to 28% from 23% in 2022 among those spending $1,500 or more for either their deductible or out-of-pocket expenses—and satisfaction has declined 27 points among this group during that period.

- Digital is helping, but still falling short of customer expectations: Customers who use digital tools for reporting their claim and submitting photos tend to have lower severity claims and report notably faster repair cycle times of 15 days, on average. This compares with nearly 28 days among non-digital users. So, while the process is notably faster for digital users, the expectation is that it should even be shorter—those who state the process took as long as expected say they had an average repair time of only 11 days. “No time is more critical than during the initial reporting of the claim,” Garrett said. “The biggest declines in satisfaction are related to explaining the claims process to customers and showing concern for their situation. To navigate this difficult stage, insurers need to redouble their efforts to proactively manage customer expectations and streamline the claims process.”

- Service consistency is key when interacting with multiple reps: There can often be several insurance reps dealing with a customer during a claim and the consistency of service is an important driver of satisfaction. From sharing information so the customer does not need to repeat themselves to reps having similar knowledge and soft skills is critical in delivering very consistent levels of service. Among the 27% of customers who say that level was not achieved, satisfaction drops 200 points.

Study Ranking

Amica ranks highest in property insurance claims experience with a score of 906. AIG (889) ranks second and Erie Insurance (888) ranks third.

The U.S. Property Claims Satisfaction Study measures satisfaction with the property claims experience among insurance customers who have filed a claim for property damages by examining five factors (listed in order of importance): settlement; claim servicing; FNOL; estimation process; and repair process. The study is based on responses from 6,019 homeowner insurance customers who filed a claim within the previous nine months. The study was fielded from January 2023 through December 2023.

For more information about the U.S. Property Claims Satisfaction Study, visit https://www.jdpower.com/business/resource/us-property-claims-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024022.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023). https://www.ncei.noaa.gov/access/billions/

View source version on businesswire.com: https://www.businesswire.com/news/home/20240319207108/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com