- Widening consumer stress gap hints at incumbent advantage for second straight month

- LegalShield’s Consumer Stress Legal Index rose in April, along with Consumer Finance, Bankruptcy and Foreclosure sub-indices

- Consumer billing disputes second highest all-time

New data from LegalShield focusing on legal services inquiries from consumers in key battleground states could bode well for the incumbent president's re-election bid this November.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240523800066/en/

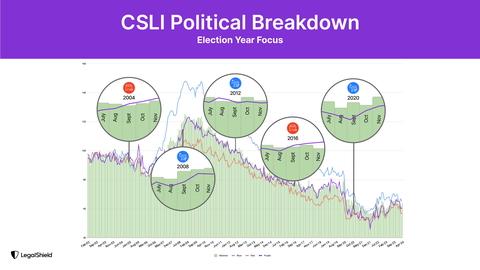

LegalShield's Consumer Stress Index Points to 2024 Trend: Higher Battleground Stress Has Preceded Republican Wins, Lower Stress Favored Democrats in Last Five Elections (Graphic: Business Wire)

For the second straight month, a gap favoring a President Biden hold on the White House has held between consumer stress felt in battleground states (as shown by requests for legal assistance) as compared to the average consumer stress level felt across the nation.

LegalShield's Consumer Stress Legal Index (CSLI) shows a growing divergence between consumer stress measured in battleground states (purple) compared to the country as a whole – a pattern that has historically preceded a Democrat elected to office in 2008, 2012, and 2020.

When battleground states exhibited higher stress compared to the national average, a Republican was elected in 2004 and 2016. The legal inquiries that fuel the CSLI offer a unique lens into the mindset of everyday Americans as they navigate personal and financial challenges.

“Two key things happened in April: the national consumer stress level went up and the margin between the battleground states’ stress level and the national index grew further apart,” said Matt Layton, LegalShield senior vice president of consumer analytics. “It’s too early to tell how consumer stress will rise or fall in the coming months, but April’s numbers are suggestive of a trend to the incumbent party’s path to victory.”

LegalShield’s CSLI is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. On average, LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

The national CSLI rose 2.4 points to 63.8 in April.

Red, Blue, Purple Legal Requests

This election cycle, LegalShield is reviewing consumer stress levels on a politically geographic basis, separating red, blue, and purple battleground states. LegalShield classified states based on the outcome of the 2020 election. Battleground states for 2024 are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

Consumer stress in the battleground states rose slightly in April, up 0.7 points over March, to 60.7.

The margin between purple states and the national index more than doubled in April to 3.1 points, up from a margin of 1.4 points in March.

“Our data tracks actions taken by consumers to seek legal advice,” said Warren Schlichting, LegalShield CEO. “Those inquiries, in aggregate, are more revealing to Americans’ collective state of mind than polls or surveys. This data follows a trend in the last five presidential elections over the past 20 years and we continue to watch these trends in 2024.”

April’s numbers continue to show a split in stress among blue states at the high end and red states lower, though the gap narrowed slightly. Blue states saw stress decline 1.9 points to 64.9. Red states’ stress increased a half point to 57.0.

National Consumer Stress on the Rise

LegalShield’s benchmark CSLI rose 2.4 points over March to 63.8, up 2.8 points, or 4.5% from April a year ago. The nationally recognized index serves as a barometer for the legal and financial anxieties facing everyday Americans.

Since its inception, the CSLI has been a 60–90-day leading indicator of the closely watched Consumer Confidence Index (CCI) with an inverse correlation level of -0.85. As consumer stress rises, confidence tends to drop two to three months later. The CCI reported a 7.7-point drop to 97.0 in April, down 13.9 points, or 12.5% since the start of the year.

The rise in LegalShield’s CSLI coincides with a jobs report that fell short of expectations, with 175,000 jobs added. Unemployment also ticked up to 3.9%, slightly higher than the steady 3.8% most economists expected. The Consumer Price Index reported an increase of 0.3% in April, slightly below estimates. Annual inflation is still at 3.4%, in line with most economists’ expectation. That rate is still above the Federal Reserve target of approximately 2.0% to consider lowering interest rates.

“The macro data is a bit mixed, with inflation being a key metric for consumers,” said Layton. “With rising prices and interest rates remaining at the current level, pressure on consumers continues.”

Consumer Finance, Bankruptcy and Foreclosure Indices Rise

All three sub-indices that make up the CSLI - the Consumer Finance, Bankruptcy, and Foreclosure Indices - ticked up, bucking movement in the opposite direction in March.

The Consumer Finance Index, which tracks approximately 60 areas of law related to personal finances, saw the greatest increase of the three sub-indices, moving to 103.2 in April, up from 99.7 in March, which was its lowest level since the start of the pandemic in 2020.

As Consumer Finance issues escalate, calls to LegalShield provider law firms about billing disputes continue to rise. April was the second-highest month on record and the high-water mark since March 2021.

The Bankruptcy Index rose to 31.1 in April, up 1.1 points month over month and 35% year over year. LegalShield’s Bankruptcy Index historically leads actual bankruptcy filings as reported by the U.S. court system by two quarters, with a .98 correlation.

“The Bankruptcy Index is on a steady rise since Q4 of 2021 after a sharp drop-off as pandemic relief funds hit in 2020,” said Layton. “Bankruptcy appears to be creeping back to pre-pandemic levels and given our index’s leading nature of actual filings, we are watching closely to see where the next plateau may be.”

The Foreclosure Index rose 2.2 points to 38.4, down 4% year over year and below the two-year average of 39.3.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three sub-indices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240523800066/en/

Contacts

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com