PYX-201 Phase 1 trial clinical readout on track for fall of 2024

Executive Leadership Team expanded with the appointment of Stephen Worsley as Senior Vice President, Chief Business Officer

PYX-106 Phase 1 trial clinical readout on track for 2H 2024

Expected cash runway into 2H 2026

BOSTON, May 14, 2024 (GLOBE NEWSWIRE) -- Pyxis Oncology, Inc. (Nasdaq: PYXS), a clinical stage company focused on developing next generation therapeutics to target difficult-to-treat cancers, today reported financial results for the first quarter ended March 31, 2024, and provided a corporate update.

PYX-201, a first-in-concept tumor stroma targeting antibody-drug conjugate (ADC) against the stromal Extradomain-B Fibronectin (EDB+FN) target, has dosed 42 patients in 8 cohorts since initiating the Phase 1 trial in March 2023 with continued enthusiasm for this agent by global investigators.

"Based on encouraging early responses with late-stage patients across multiple tumor types, we are actively studying dose ranges from 5.4 mg/kg to 8 mg/kg, refining our understanding of PYX-201's therapeutic window. We are on track to report the comprehensive dataset in the fall of 2024, and we look forward to the potential future robust development plan supported by our strong balance sheet," said Lara S. Sullivan, M.D., President and CEO of Pyxis Oncology.

Dr. Sullivan added, “We plan to dose an additional 16 patients with a focus on five tumor types of interest based on an assessment of factors including immunohistochemistry target expression, stromal volume, unmet medical need, and clinical judgment. Patient recruitment at these dose levels focuses on head and neck squamous cell carcinoma (HNSCC), non-small cell lung cancer (NSCLC), ovarian cancer, soft tissue sarcoma, and pancreatic ductal adenocarcinoma cancer (PDAC). We look forward to sharing the monotherapy development path for PYX-201 this fall alongside the dose escalation phase 1 dataset presentation. PYX-201 safety data continues to support go-forward monotherapy and potential combination development strategies.”

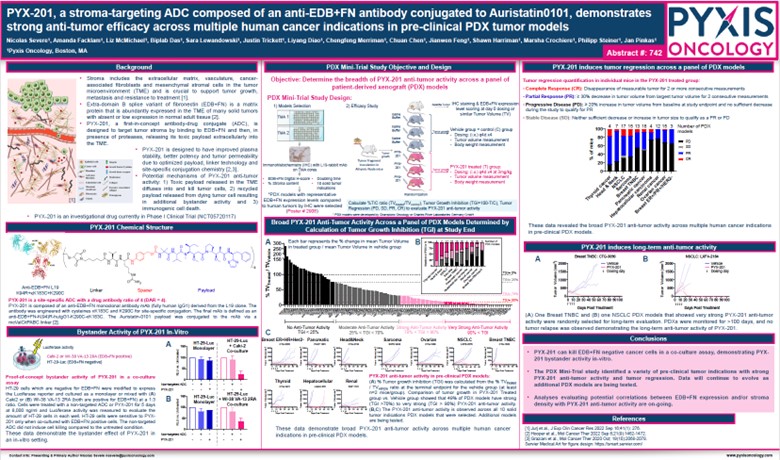

Pyxis Oncology continues to expand our understanding of PYX-201, and we were excited to share our latest preclinical data at the 2024 American Association for Cancer Research (AACR) Annual Meeting in San Diego, California, held from April 5 to 10, 2024. The preclinical data presented (Figure 1. Abstract #742) supports that PYX-201 is designed to have improved plasma stability, better potency, and tumor permeability due to optimized auristatin payload (Aur-0101) and improved linker stability through site-specific conjugation to engineered cysteine residues for a target DAR of 4. Across a panel of approximately 100 preclinical patient-derived xenograft (PDX) models representing ten tumor types, PYX-201 demonstrated broad, deep, and durable anti-tumor activity.

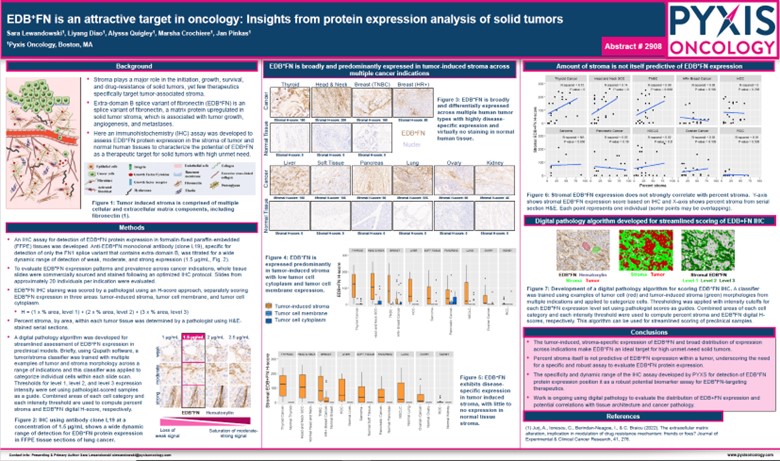

Another poster (Figure 2. Abstract #2908) Pyxis Oncology presented on PYX-201 detailed the development of an immunohistochemistry (IHC) assay to detect our novel EDB+FN protein target and shared our scoring method to quantify expression in tumor stroma. This research further supports that EDB+FN is broadly and predominantly expressed in tumor-induced stroma across multiple cancer indications (10 tumor types) with virtually no expression in healthy tissues.

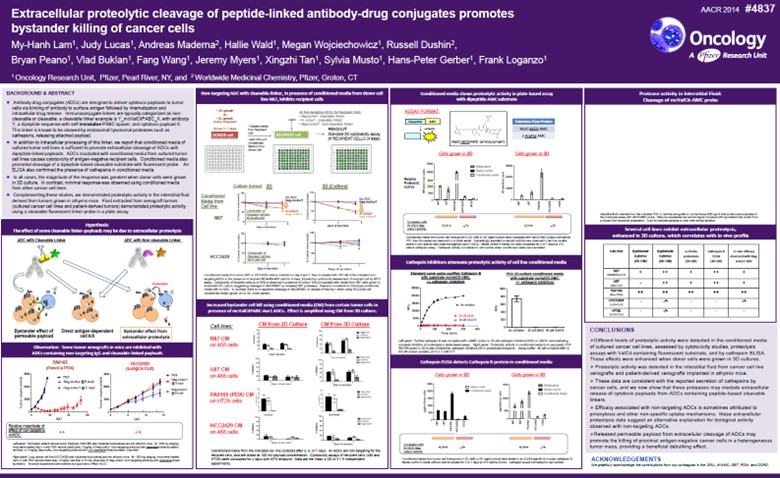

Given the observed anti-tumor activity for our non-internalizing mechanism of action, Pyxis Oncology also had the opportunity to review insights from a legacy 2014 AACR poster (Figure 3. Abstract #4837) on the extracellular cleavage of ADCs that promotes bystander cell killing. This poster described mechanisms of extracellular proteolytic cleavage of ADCs and, for an EDB+FN-targeted ADC specifically, the release of Aur-0101 payload capable of bystander cell killing, which provides support for our novel mechanistic approach of payload cleavage in the extracellular matrix.

In summary, Pyxis Oncology’s preclinical data provides insights into the mechanism associated with this novel agent observed across multiple solid tumors. PYX-201 has potential applications in both monotherapy and combination therapy and maintains a well-tolerated safety profile based on the lack of EDB+FN expression in healthy cells.

Concurrently, Pyxis Oncology is actively enrolling our Phase 1 study evaluating PYX-106, a fully human immunotherapy antibody candidate aimed at inhibiting Siglec-15 activity in non-small cell lung cancer, colorectal cancer, breast cancer, and other tumors of interest. We plan to share the initial PYX-106 clinical results in the second half of 2024 after our PYX-201 results.

Pyxis Oncology is also delighted to announce the appointment of Stephen Worsley as its new Chief Business Officer. With a wealth of experience in the biotechnology and pharmaceutical sectors, Stephen brings invaluable expertise to Pyxis Oncology's leadership team.

In his role, Stephen will oversee Pyxis Oncology's business development strategies and forge partnerships to advance the company's assets, PYX-201 and PYX-106. His proven track record in fostering successful collaborations and executing strategic initiatives aligns seamlessly with Pyxis Oncology's mission to develop breakthrough treatments for patients with difficult-to-treat cancers. As a business development executive, Stephen has led negotiations of transformative and award-winning technology and clinical product partnerships for leading therapeutics companies, focused primarily on oncology with antibody and ADC modalities. These include global co-development agreements on behalf of Abgenix with Immunex/Wyeth (led to acquisition by Amgen for $2.7B) with Vectibix® (panitumumab); on behalf of Peregrine a deal with Oncologie Inc. for clinical Phase III level bavituximab; on behalf of Zosano Pharmaceutical with Asahi Kasei Pharma Corporation (AKP) Asahi Kasei Pharma Corporation (AKP) on ZP-PTH®; on behalf of Raven Biotechnologies with B7-H3 & B7-H4 mAbs with Macrogenics (leading to the merger of the two companies); and also on behalf of Raven with Abbott (AbbVie) a collaboration focused on five key mAbs (for ADC development) programs.

"We are thrilled to welcome Stephen to Pyxis Oncology as our Chief Business Officer," said Dr. Sullivan. "Stephen’s extensive experience, proven track record of transaction execution, and strategic vision will be instrumental as we continue the clinical development of our lead asset, PYX-201, a first-in-concept tumor stroma targeting ADC against EDB-fibronectin."

"Joining Pyxis Oncology is an extraordinary opportunity to contribute to a company that stands at the forefront of ADC research and development,” said Stephen. “I am excited to work with the team to build on their strong foundation and to help drive the development of transformative cancer treatments that could significantly impact patients' lives."

Stephen joins Pyxis Oncology from Lytix Biopharma, where he was the Chief Business officer and led numerous successful business development endeavors. His appointment underscores Pyxis Oncology's commitment to attracting top talent to drive its mission of transforming cancer care through innovation.

Program and Corporate Updates

- PYX-201 in the PYX-201-101 trial: To date, 42 subjects have been dosed, and the Company will enroll an additional 16 patients. Pyxis Oncology expects to report study results, including efficacy, safety, pharmacokinetics (PK), preclinical insights, further development plans, and the expected timing of the next anticipated milestones in the fall of 2024.

- PYX-106 in the PYX-106-101 trial: This is a phase 1 trial focusing on NSCLC and other tumor types. Study dosing is ongoing, with 24 subjects dosed to date. Preliminary data are anticipated in 2H 2024.

- AACR Poster Presentations. Presented new PYX-201, PYX-106 and PYX-102 preclinical data at the AACR Annual Meeting.

- Expanded Executive Leadership Team with the appointment of Stephen Worsley as Senior Vice President, Chief Business Officer.

Anticipated Upcoming Milestones

- PYX-201: Report preliminary Phase 1 data and PK/PD results in fall of 2024

- PYX-106: Report preliminary Phase 1 data and PK/PD results in 2H 2024, following the release of PYX-201 results

First Quarter 2024 Financial Results

- As of March 31, 2024, Pyxis Oncology had cash and cash equivalents, including restricted cash, and short-term investments of $158.5 million. During Q1 2024, the Company raised gross proceeds of $10.8 million via an at-the-market (“ATM”) offering, completed a $50 million private placement, and sold the Company’s rights to royalties from the commercialization of Beovu® (brolucizumab-dbll) and another asset for a one-time payment of $8 million to Novartis. Pyxis Oncology expects to have the cash runway to fund operations into 2H 2026.

- Revenues for the quarter ended March 31, 2024 were $16.1 million, compared to $0 for the quarter ended March 31, 2023. During the quarter, we entered into a settlement agreement with Novartis, pursuant to which we transferred our rights to future royalties on the net sales of Beovu® to Novartis for a one-time amount of $8.0 million and Novartis also agreed to forgo its right to reclaim royalties previously paid of $8.1 million to us and Apexigen. Both of these amounts were recognized as revenues, upon execution of the settlement agreement during the quarter ended March 31, 2024.

- Research and development expenses were $13.0 million for the quarter ended March 31, 2024, compared to $11.9 million for the quarter ended March 31, 2023. The period-over-period increase was primarily due to increased clinical trial-related expenses for our ongoing Phase 1 clinical trials of PYX-201 and PYX-106.

- General and administrative expenses were $8.2 million for the quarter ended March 31, 2024, compared to $9.1 million for the quarter ended March 31, 2023. The period-over-period decline was primarily due to lower professional and consultant fees.

- Net loss was $3.3 million, or ($0.06) per common share, for the quarter ended March 31, 2024, compared to $19.2 million, or ($0.54) per common share, for the quarter ended March 31, 2023. Net losses for the quarters ended March 31, 2024 and 2023 included $4.3 million and $4.9 million, respectively, related to non-cash stock-based compensation expense.

- As of May 13, 2024, the outstanding number of shares of Common Stock of Pyxis Oncology was 58,888,473.

About Pyxis Oncology, Inc.

Pyxis Oncology, Inc. is a clinical stage company focused on defeating difficult-to-treat cancers. The company is efficiently building next generation therapeutics that hold the potential for mono and combination therapies. PYX-201, an antibody-drug conjugate (ADC) that uniquely targets EDB+FN within the tumor stroma, and PYX-106, a fully human Siglec-15-targeting antibody designed to block suppression of T-cell proliferation and function, are being evaluated in ongoing Phase 1 clinical studies in multiple types of solid tumors. Pyxis Oncology’s therapeutic candidates are designed to directly kill tumor cells and to address the underlying pathologies created by cancer that enable its uncontrollable proliferation and immune evasion. Pyxis Oncology’s ADC and immuno-oncology (IO) programs employ novel and emerging strategies to target a broad range of solid tumors resistant to current standards of care. To learn more, visit www.pyxisoncology.com or follow us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements are often identified by the use of words such as “on track,” “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “to be,” “will,” “would,” or the negative or plural of these words, or similar expressions or variations, although not all forward-looking statements contain these words. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur and actual results could differ materially from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified herein, and those discussed in the section titled “Risk Factors” set forth in Part II, Item 1A. of the Company’s Annual Report on Form 10-K filed with SEC on March 21, 2024, and our other filings, each of which is on file with the Securities and Exchange Commission. These risks are not exhaustive. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date hereof and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Pyxis Oncology Contact

Pamela Connealy

CFO and COO

ir@pyxisoncology.com

FIGURES

Figure 1. AACR 2024 – Abstract Number: 742

PYX-201, a stroma-targeting ADC composed of an anti-EDB+FN antibody conjugated to Auristatin0101, demonstrates strong anti-tumor efficacy across multiple human cancer indications in pre-clinical PDX tumor models

Figure 2. AACR 2024 – Abstract Number: 2908

PYX-201, EDB+FN is an attractive target in oncology: Insights from protein expression analysis of solid tumors

Figure 3. AACR 2014 – Abstract Number: 4837

Extracellular proteolytic cleavage of peptide-linked antibody-drug conjugates promotes bystander killing of cancer cells

---tables to follow---

| PYXIS ONCOLOGY, INC. Condensed Consolidated Statements of Operations and Comprehensive Loss (In thousands, except share and per share amounts) (Unaudited) | ||||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | ||||||||

| Royalty revenues | $ | 8,146 | $ | — | ||||

| Sale of royalty rights | 8,000 | — | ||||||

| Total revenues | 16,146 | — | ||||||

| Costs and operating expenses: | ||||||||

| Cost of revenues | 475 | — | ||||||

| Research and development | 13,029 | 11,901 | ||||||

| General and administrative | 8,247 | 9,053 | ||||||

| Total costs and operating expenses | 21,751 | 20,954 | ||||||

| Loss from operations | (5,605 | ) | (20,954 | ) | ||||

| Other income, net: | ||||||||

| Interest and investment income | 1,550 | 1,673 | ||||||

| Sublease income | 799 | 38 | ||||||

| Total other income, net | 2,349 | 1,711 | ||||||

| Net loss | $ | (3,256 | ) | $ | (19,243 | ) | ||

| Net loss per common share - basic and diluted | $ | (0.06 | ) | $ | (0.54 | ) | ||

| Weighted average shares of common stock outstanding - basic and diluted | 51,289,284 | 35,351,671 | ||||||

| PYXIS ONCOLOGY, INC. Condensed Consolidated Balance Sheets (In thousands, except share and per share amounts) (Unaudited) | ||||||||

| March 31, 2024 | December 31, 2023 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 27,967 | $ | 9,664 | ||||

| Marketable debt securities, short-term | 129,060 | 109,634 | ||||||

| Restricted cash | 1,472 | 1,472 | ||||||

| Accounts receivable | 8,000 | — | ||||||

| Prepaid expenses and other current assets | 5,880 | 3,834 | ||||||

| Total current assets | 172,379 | 124,604 | ||||||

| Property and equipment, net | 11,333 | 11,872 | ||||||

| Intangible assets, net | 23,730 | 24,308 | ||||||

| Operating lease right-of-use assets | 12,778 | 12,942 | ||||||

| Total assets | $ | 220,220 | $ | 173,726 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 2,293 | $ | 3,896 | ||||

| Accrued expenses and other current liabilities | 10,828 | 12,971 | ||||||

| Operating lease liabilities, current portion | 1,020 | 1,232 | ||||||

| Deferred revenues | — | 7,660 | ||||||

| Total current liabilities | 14,141 | 25,759 | ||||||

| Operating lease liabilities, net of current portion | 19,759 | 20,099 | ||||||

| Deferred tax liability, net | 2,164 | 2,164 | ||||||

| Total liabilities | 36,064 | 48,022 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, par value $0.001 per share | — | — | ||||||

| Common stock, $0.001 par value per share | 59 | 45 | ||||||

| Additional paid-in capital | 473,638 | 411,821 | ||||||

| Accumulated other comprehensive (loss) income | (60 | ) | 63 | |||||

| Accumulated deficit | (289,481 | ) | (286,225 | ) | ||||

| Total stockholders’ equity | 184,156 | 125,704 | ||||||

| Total liabilities and stockholders’ equity | $ | 220,220 | $ | 173,726 | ||||

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab8e54f0-f5b9-493c-9c94-0623bf1b0e93

https://www.globenewswire.com/NewsRoom/AttachmentNg/76e0d9fd-3532-4460-9926-a6bec1ce56c0

https://www.globenewswire.com/NewsRoom/AttachmentNg/89db2061-133e-43a4-bc33-3cc7780ba80e