HIGHLIGHTS:

- ATHA Energy has expanded its land package at the Angilak Project, acquiring the entire prospective Lac 50 structural corridor and an additional prospective parallel corridor. Both prospective corridors are related to the Snowbird Tectonic Zone, a deep crustal structure that extends from the Athabasca Basin, host to some of the largest and highest-grade uranium deposits globally, through to the Angikuni Basin, which hosts the Lac 50 Uranium Deposit.

- The Company has staked an additional 69,704 hectares within 48 mineral claims, with the Angilak Project now 158,447 hectares in size.

- The Angilak Project is host to the Lac 50 Uranium Deposit (the “Lac 50 Trend”), one of the largest high-grade deposits outside of the Athabasca Basin, with a historical mineral resource estimate of 43.3M lbs at an average grade of 0.69% U3O8.1 Drilling conducted by Latitude Uranium at the Angilak Project in 2023 intersected grades of up to 7.54% U3O8 over 1.6 m.

- The 2024 Angilak Exploration Program has concluded after twenty-five diamond drill holes were completed between early June and late August for a total of ~10,051 m. The program was highly successful and on budget.

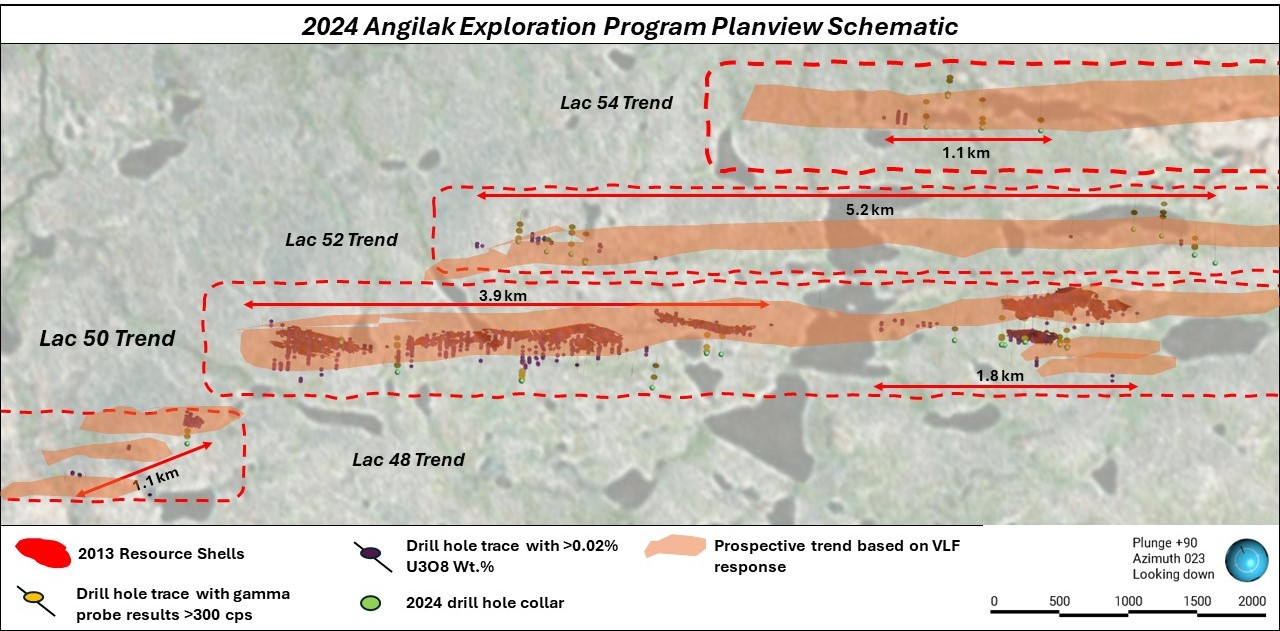

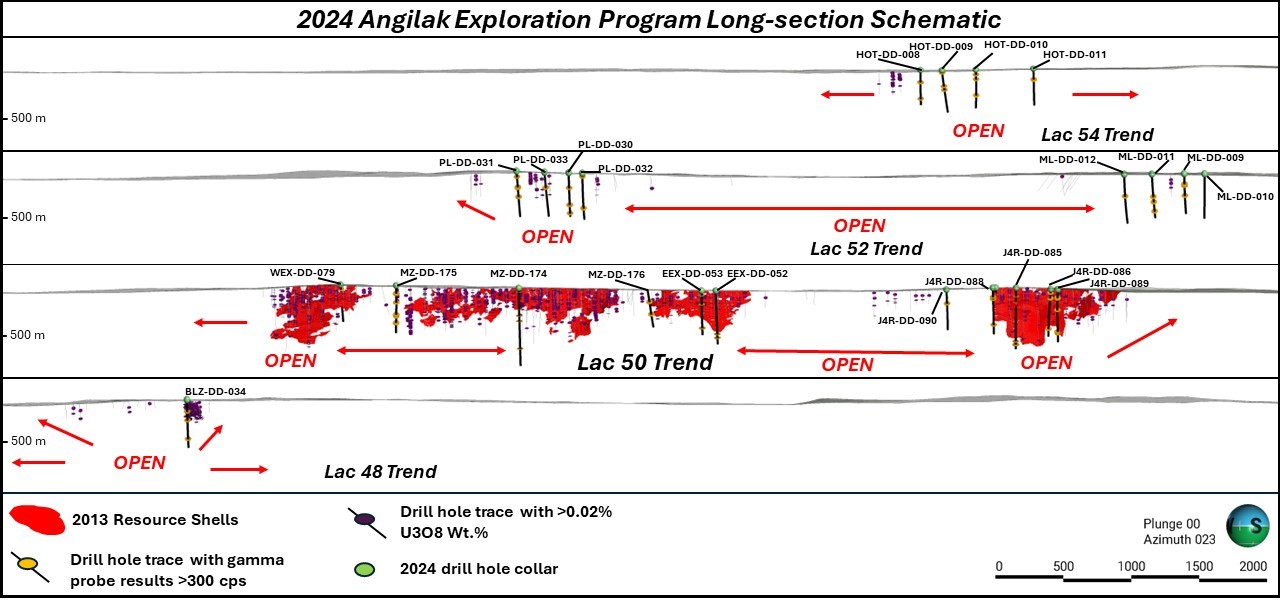

- All objectives were successfully achieved, including the expansion of the historic footprint of mineralization along the Lac 50 Trend and the identification of new parallel mineralized trends called the Lac 48, Lac 52, and Lac 54 Trends.

- The new mineral claims solidify ATHA’s dominant position along prospective structural corridors related to the Snowbird Tectonic Zone. Additionally, the new claims capture the margins of the Angikuni Basin, which remains prospective for the discovery of an unconformity-style uranium deposit.

VANCOUVER, British Columbia, Sept. 19, 2024 (GLOBE NEWSWIRE) -- ATHA Energy Corp. (TSX.V: SASK) (FRA: X5U) (OTCQB: SASKF) (“ATHA” or the “Company”), holder of the largest uranium exploration portfolio in two of the highest-grade uranium districts in the world, is pleased to announce the completion of the staking of additional claims at the Company’s 100%-owned Angilak Project in Nunavut. The Angilak Project area is now 158,447 hectares in size. The claims were staked as a follow-up to the Company’s highly successful maiden drill program that was completed in late August 2024. With the additional property, the Company now controls the entire prospective Lac 50 structural corridor as well as an additional parallel corridor, both related to the Snowbird Tectonic Zone. These claims represent prospective continuations of known mineralized trends related to the Snowbird Tectonic Zone and the margins surrounding the Angikuni Basin, which is prospective to host unconformity style mineralization.

Figure 1: Plan Map detailing the Angilak Project location within Nunavut1

ANGILAK PROJECT – NUNAVUT

The Angilak Project is situated within the Angikuni Basin (Figure 1), approximately 225 km southwest of Baker Lake in the Kivalliq Region of Nunavut. The Angilak Project is host to the Lac 50 Uranium Deposit, which has a historical mineral resource estimate of 43.3M lbs at an average grade of 0.69% U3O8.1

The 2024 Angilak exploration program consisted of diamond drilling, airborne geophysical surveys, and surficial sampling and mapping programs. Exploration activities prioritized areas proximal to known zones of uranium mineralization for expansion and discovery.

During Phase I: diamond drilling, which began in early June and continued through to late August, the Company completed twenty-five diamond drill holes for a total of ~10,051 m. Drilling targeted expansion along the Lac 50 Trend while also expanding mineralization along several regional targets identified as the Lac 48, 52, and 54 Trends (see Figures 2a and 2b). All samples have been sent to SRC laboratories in Saskatoon, SK for assay analysis.

Figure 2a: 2024 Angilak Exploration Planview Schematic

Figure 2b: 2024 Angilak Exploration Long-section Schematic

Troy Boisjoli, CEO added: “Extending the Angilak project is a direct result of the successful 2024 exploration program. Over the course of 2024, ATHA materially expanded mineralization at Angilak - in doing so also gained site specific knowledge of potential district scale uranium endowment.”

Cliff Revering, VP Exploration added: “Based on the success of the 2024 exploration program at the Angilak Project and nature of this highly prospective and historically underexplored region, expanding our land position adds significant potential for further discovery and expansion of the Lac 50 Deposit. We look forward to continuing our exploration efforts at the Angilak Project and unlocking the value we see in this region.”

Investor Relations Agreements

ATHA is also pleased to announce it has entered into an agreement commencing September 16, 2024 (the “Agreement”) with Oak Hill Financial Inc. (“Oak Hill”), an arm’s length party to ATHA, to provide certain investor relations services to ATHA Energy including, without limitation, in relation to providing strategic advice with respect to ATHA’s stakeholder communication initiatives and to expand market awareness (the “Services”). Oak Hill will comply with all applicable securities laws and the policies of the TSX Venture Exchange (the “TSXV”) in providing the Services. The Agreement is subject to TSXV approval and shall be for an initial three-month term, for a monthly fee of $11,000, plus applicable taxes, which may be automatically renewed for successive one-month periods.

No securities of ATHA are being granted to Oak Hill under the terms of its engagement and to the knowledge of ATHA, neither Oak Hill nor any of its directors, officers or employees currently owns any securities of ATHA. ATHA may also reimburse Oak Hill for certain expenses incurred in connection with the Services.

Oak Hill is based in Toronto, Ontario, and specializes in leveraging the most effective investment, growth and exposure strategies for small to mid-size companies through an integrated approach to relationship development and corporate communications. The contact information for Oak Hill is Oak Hill Financial Inc., 161 Bay Street – Suite 2460, Toronto, Ontario, Canada M5J 2S1. Tel: 647.479.5803. Email: info@oakhillfinancial.ca. Damir Gunja, a Partner of Oak Hill will be principally responsible for the Services on behalf of Oak Hill.

Qualified Person

The scientific and technical information contained in this news release have been reviewed and approved by Cliff Revering, P.Eng., Vice President, Exploration of ATHA, who is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About ATHA

ATHA is a Canadian mineral company engaged in the acquisition, exploration, and development of uranium assets in the pursuit of a clean energy future. With a strategically balanced portfolio including three 100%-owned post discovery uranium projects (the Angilak Project located in Nunavut, and CMB Discoveries in Labrador hosting historical resource estimates of 43.3 million lbs and 14.5 million lbs U3O8 respectively, and the newly discovered basement hosted GMZ high-grade uranium discovery located in the Athabasca Basin). In addition, the Company holds the largest cumulative prospective exploration land package (8.4 million acres) in two of the world’s most prominent basins for uranium discoveries - ATHA is well positioned to drive value. ATHA also holds a 10% carried interest in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. and IsoEnergy Ltd. For more information visit www.athaenergy.com. 1,2,3.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

www.athaenergy.com

Historical Mineral Resource Estimates

All mineral resources estimates presented in this news release are considered to be “historical estimates” as defined under NI 43-101, and have been derived from the following (See notes below). In each instance, the historical estimate is reported using the categories of mineral resources and mineral reserves as defined by the CIM Definition Standards for Mineral Reserves, and mineral reserves at that time, and these “historical estimates” are not considered by ATHA to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and ATHA is not treating the historical estimate as a current mineral resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

Notes on the Historical Mineral Resource Estimate for the Angilak Deposit:

- This estimate is considered to be a “historical estimate” under NI 43-101 and is not considered by any of to be current. See below for further details regarding the historical mineral resource estimate for the Angilak Property.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- The quality and grade of the reported inferred resource in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource, and it is uncertain if further exploration will result in upgrading them to an indicated or measured resource category.

- Contained value metals may not add due to rounding.

- A 0.2% U3O8 cut-off was used.

- The mineral resource estimate contained in this press release is considered to be “historical estimates” as defined under NI 43-101 and is not considered to be current.

- The “historical estimate” is derived from a Technical Report entitled “Technical Report and Resource Update For The Angilak Property, Kivalliq Region, Nunavut, Canada”, prepared by Michael Dufresne, M.Sc., P.Geol. of APEX Geosciences, Robert Sim, B.Sc., P.Geo. of SIM Geological Inc. and Bruce Davis, Ph.D., FAusIMM of BD Resource Consulting Inc., dated March 1, 2013 for ValOre Metals Corp.

- As disclosed in the above noted technical report, the historical estimate was prepared under the direction of Robert Sim, P.Geo, with the assistance of Dr. Bruce Davis, FAusIMM, and consists of three-dimensional block models based on geostatistical applications using commercial mine planning software. The project limits area based in the UTM coordinate system (NAD83 Zone14) using nominal block sizes measuring 5x5x5m at Lac Cinquante and 5x3x3 m (LxWxH) at J4. Grade (assay) and geological information is derived from work conducted by Kivalliq during the 2009, 2010, 2011 and 2012 field seasons. A thorough review of all the 2013 resource information and drill data by a Qualified Person, along with the incorporation of subsequent exploration work and results, which includes some drilling around the edges of the historical resource subsequent to the publication of the 2013 technical report, would be required in order to verify the Angilak Property historical estimate as a current mineral resource.

- The historical mineral resource estimate was calculated in accordance with NI 43-101 and CIM standards at the time of publication and predates the current CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November, 2019).

- A thorough review of all historical data performed by a Qualified Person, along with additional exploration work to confirm results would be required to produce a current mineral resource estimate prepared in accordance with NI 43-101.

- Notes on the Historical Mineral Resource Estimate for the Moran Lake Deposit:

- Jeffrey A. Morgan, P.Geo. and Gary H. Giroux, P.Eng. completed a NI 43-101 technical report titled “Form 43-101F1 Technical Report on the Central Mineral Belt (CMB) Uranium Project, Labrador, Canada, Prepared for Crosshair Exploration & Mining Corp.” and dated July 31, 2008, with an updated mineral resource estimate for the Moran Lake C-Zone along with initial mineral resources for the Armstrong and Area 1 deposits. They modelled three packages in the Moran Lake Upper C-Zone (the Upper C Main, Upper C Mylonite, and Upper C West), Moran Lake Lower C-Zone, two packages in Armstrong (Armstrong Z1 and Armstrong Z3), and Trout Pond. These mineral resources are based on 3D block models with ordinary kriging used to interpolate grades into 10 m x 10 m x 4 m blocks. A cut-off grade of 0.015% U3O8 was used for all zones other than the Lower C Zone which employed a cut-off grade of 0.035%. A thorough review of all historical data performed by a Qualified Person, along with additional exploration work to confirm results, would be required to produce a current mineral resource estimate prepared in accordance with NI 43-101 standards.

- Notes on the Historical Mineral Resource Estimate for the Anna Lake Deposit:

- The mineral resource estimate contained in this table is considered to be a “historical estimate” as defined under NI 43-101, and is not considered to be current and is not being treated as such. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources. A qualified person would need to review and verify the scientific information and conduct an analysis and reconciliation of historical drill and geological data in order to verify the historical estimate as a current mineral resource.

- Reported by Bayswater Uranium Corporation in a Technical Report entitled “Form 43-101 Technical Report on the Anna Lake Uranium Project, Central Mineral Belt, Labrador, Canada”, prepared by R. Dean Fraser, P.Geo. and Gary H. Giroux, P.Eng., dated September 30, 2009.

- A 3-dimensional geologic model of the deposit was created for the purpose of the resource estimate using the Gemcom/Surpac modeling software. A solid model was created using a minimum grade x thickness cutoff of 3 meters grading 0.03% U3O8. Intersections not meeting this cutoff were generally not incorporated into the model. The shell of this modeled zone was then used to constrain the mineralization for the purpose of the block model. Assay composites 2.5 meters in length that honoured the mineralized domains were used to interpolate grades into blocks using ordinary kriging. An average specific gravity of 2.93 was used to convert volumes to tonnes. The specific gravity data was acquired in-house and consisted of an average of seventeen samples collected from the mineralised section of the core. The resource was classified into Measured, Indicated or Inferred using semi-variogram ranges applied to search ellipses. All resources estimated at Anna Lake fall under the “Inferred” category due to the wide spaced drill density. An exploration program would need to be conducted, including twinning of historical drill holes in order to verify the Anna Lake Project estimate as a current mineral resource.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. These forward-looking statements or information may relate to ATHA’s proposed exploration program, including statements with respect to the expected benefits of ATHA’s proposed exploration program, any results that may be derived from ATHA’s proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA’s proposed exploration program, any results that may be derived from the diversification of ATHA’s portfolio, the successful integration of the businesses of ATHA, Latitude Uranium and 92 Energy, the prospects of ATHA’s projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA’s business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA’s projects, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA’s proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA’s exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA’s proposed exploration program, that ATHA will be able to execute on its current plans, that ATHA’s proposed explorations will yield results as expected, the synergies between ATHA, 92 Energy and Latitude Uranium’s assets, and that general business and economic conditions will not change in a material adverse manner. Although each of ATHA and 92E have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; in ability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA’s portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA’s current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; any impacts of COVID-19 on the business of ATHA and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA’s profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7837a7f7-64b3-4fa7-92d7-7e56277bcad8

https://www.globenewswire.com/NewsRoom/AttachmentNg/28d47750-808a-4bee-ab1c-d49c08936f67

https://www.globenewswire.com/NewsRoom/AttachmentNg/519bbf53-4943-4c47-91b3-64f54a73d6a4