Sure, short-term gains from the hip "stock of the moment" can be an exciting roller coaster ride, but if you're a truly savvy investor in 2023, you're going to be hunting for stocks that can provide solid returns over the long term, no matter what the market does. Blue-chip stocks are, of course, one of the best places to find that. Who wouldn't want to invest in a time-tested, well-established business with established brands, stable earnings and a long history of profitability?

But what are the best blue chip stocks to buy now? To help you better understand where to place your money in the current market, we've compiled a list of the top blue-chip stocks to buy now. These stocks offer a strong combination of value, stability and potential upside in the long run.

Overview of the Best Blue Chip Stocks

When finding the best blue-chip stocks to buy in today’s market, you can look at any number of factors. Still, by far the most important is the company’s track record of success. A long history of profitability and stability are both signs that the stock could be worth investing in. You always want to look at the share price to see if it's currently undervalued. Grabbing up shares at a discount often increases your returns in the long run.

Why Invest in the Best Blue Chip Stocks?

There's a reason investors flock to blue-chip stocks year after year. For one, these stocks represent well-established companies with proven track records that have generated steady profits for years. Looking at their financials, you'll see strong balance sheets and reliable cash flows. For you, all of that means security over more volatile investments.

Blue-chip stocks are also less likely to experience dramatic price fluctuations, making them a more conservative choice if you're a long-term investor looking to preserve your capital. These stocks often pay dividends that can help generate additional income over time.

If you choose the right blue chip stocks, you might even be able to buy into them at very appealing valuations compared to their peers. When the stock increases in value over time, you win.

7 Best Blue Chip Stocks

So, what are the best blue chip dividend stocks, anyway? Below, we've compiled a list of the best blue chip stocks to buy. However, before investing your hard-earned money into any stock, be smart and do your research first, such as reading annual reports or researching the company's market position, sector and competition.

|

Name |

Ticker |

Market Capitalization |

Industry |

|

Walmart Inc. |

(NYSE: WMT) |

$424.98 billion |

Retail |

|

ExxonMobil Corporation |

(NYSE: XOM) |

$433.35 billion |

Oil and gas |

|

Johnson & Johnson |

(NYSE: JNJ) |

$432.08 billion |

Pharmaceuticals |

|

Procter & Gamble |

(NYSE: PG) |

$361.94 billion |

Consumer staples |

|

The Coca-Cola Company |

(NYSE: KO) |

$261.15 billion |

Food and beverage |

|

Verizon Communications Inc. |

(NYSE: VZ) |

$140.20 billion |

Telecommunications |

|

Bank of America Co. |

(NYSE: BAC) |

$226.47 billion |

Financial services |

1. Walmart Inc.

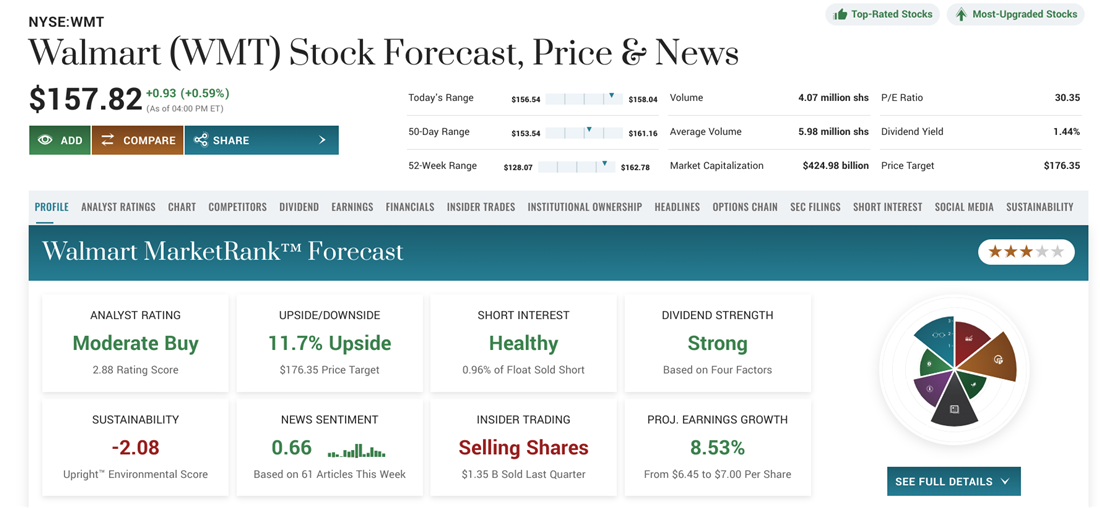

One of the top blue chip stocks on the market right now is Walmart Inc. (NYSE: WMT). The ubiquitous retail giant has been around for decades and year after year, proves one of the most profitable companies in its sector. Its stock price has been relatively stable over time, making it a good pick if you're seeking steady returns.

Walmart analyst ratings are at a "moderate buy" with a price target of $176.35 per share. The company's long-term prospects look promising, with an expected annual revenue growth rate of 3.2%. It also pays an annual dividend of 1.44%, providing a steady income stream.

2. ExxonMobil Corporation

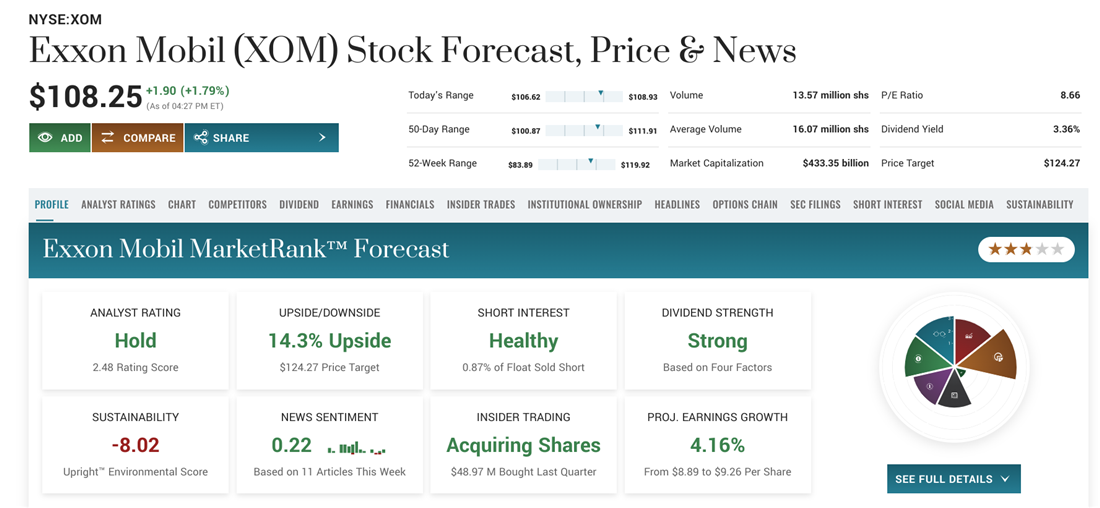

ExxonMobil Corporation (NYSE: XOM) is another one of the strong blue chip stocks worth considering. The oil and gas giant is one of the most profitable companies in its sector and has a history of providing steady and reliable returns.

Analysts have given XOM a "hold" rating with a price target of $124.27 per share. Although the company's annual revenue growth rate has been slightly lower than other major oil companies, it still offers a solid return on capital of around 22%, which indicates an efficient use of resources and the ability to generate high profits from low-cost projects. ExxonMobil has strong liquidity levels, with current ratio at 1.06, meaning the company has no trouble meeting its short-term financial obligations. It also provides an annual dividend of 3.35%, offering a nice income stream.

3. Johnson & Johnson

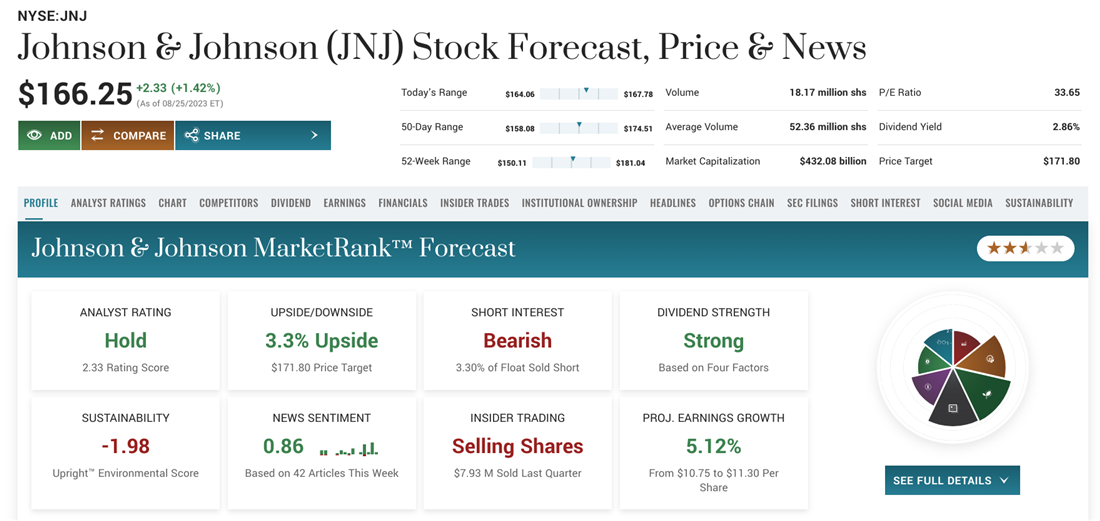

Johnson & Johnson (NYSE: JNJ) is one of the best blue chip dividend stocks. Although it's underperformed some of its peers regarding share price growth over the last few years, most analysts are confident it will continue to deliver solid returns. It's had a high return on invested capital of 20.4%, indicating an efficient use of resources. It also pays out a generous Johnson & Johnson dividend yield of 2.7%, meaning an immediate income stream.

Analysts have given JNJ a "hold" rating with a price target of $171.80 per share, signaling its potential for long-term growth. The company also has a low-risk profile, which makes it a good option for conservative investors looking for steady returns.

4. Procter & Gamble Co.

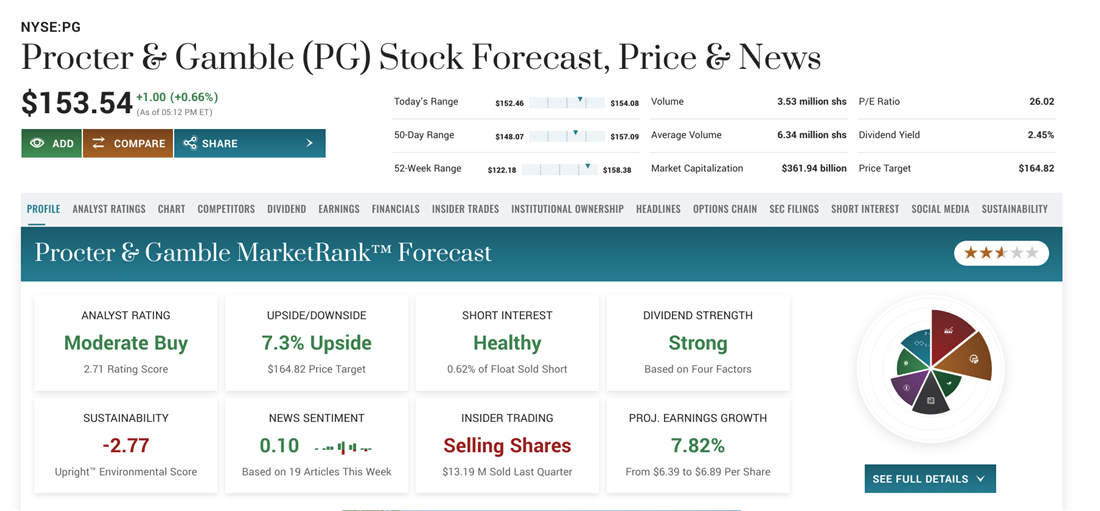

Procter & Gamble Co. (NYSE: PG) is another blue-chip stock to consider adding to your portfolio. This consumer goods company has provided consistent returns to its shareholders for a long time, with a relatively stable stock price.

Procter & Gamble analyst ratings are at a "moderate buy" with a price target of $164.82 per share, which means growth potential. You'll get income from an annual dividend yield of 2.45%. P&G's strong balance sheet, with a low debt-to-equity ratio and high return on equity of 34.7%, means the company's well positioned to weather any economic downturns and keep expanding. Its incredibly diverse product portfolio, including well-known brands from Tide laundry detergent to Crest toothpaste, helps reduce the risk of dependence on one product.

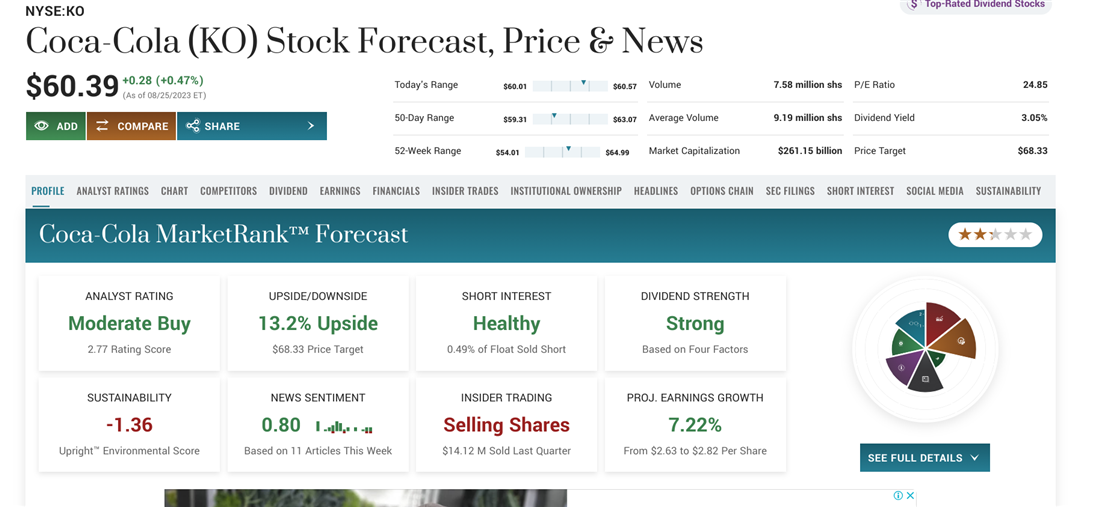

5. The Coca-Cola Company

The Coca-Cola Company (NYSE: KO) has been a staple in the beverage industry for over a century, and it remains a staple in the top ten blue chip stocks to buy right now. Its strong brand recognition reaches the world over, and it's a promising investment if you're seeking stability and reliable returns.

Analysts have given KO a "moderate buy" rating with a price target of $68.33 per share. Coca-Cola financials are impressive, with a return on equity of 43.06%, meaning it's using shareholder capital efficiently. It has a track record for consistently paying out dividends, with an annual dividend yield of 3.05% that's been increasing consistently over time. Recently, the beverage giant has been expanding its product portfolio to include healthier options, including 180 low- and no-calorie beverages in North America, showing that it's willing to adapt to changing consumer preferences. Coca-Cola's strong balance sheet, with a good debt-to-equity ratio and liquidity ratios, makes an appealing investment option even when economic times turn uncertain.

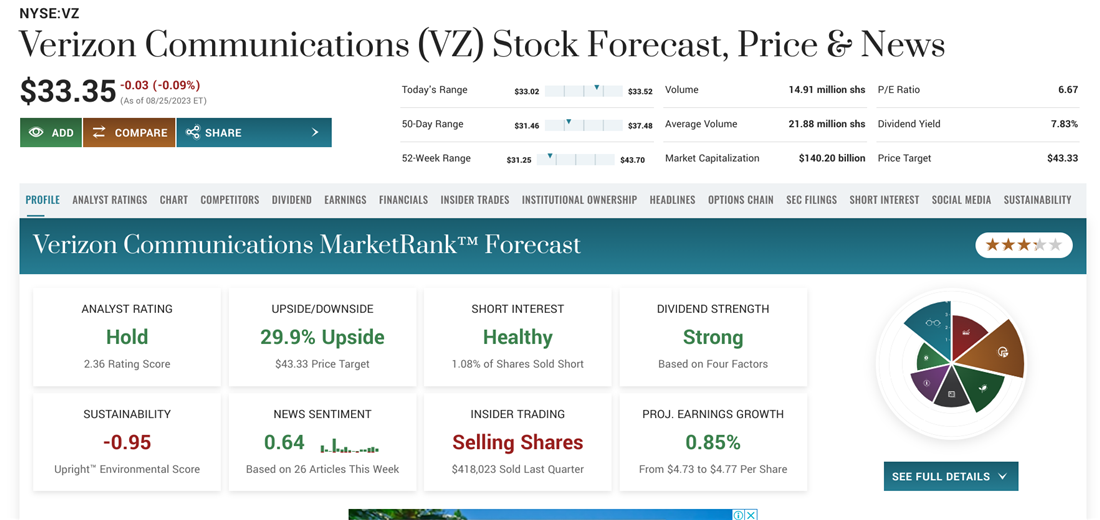

6. Verizon Communications Inc.

Verizon Communications Inc. (NYSE: VZ) can diversify your portfolio, providing a great blue-chip stock option. The company has a strong telecommunications industry presence and pays a high dividend yield of 7.83%. Analysts have given VZ a “hold” rating with a price target of $43.33 per share, indicating growth potential.

One of Verizon's major selling points is its very low debt levels compared to other stocks in its sector, not to mention that it offers earnings stability due to long-term contracts from customers like AOL and Yahoo! Funds that focus on telecom companies can often be more resilient during market downturns than those invested in tech or consumer goods stocks, making VZ a good option if you're a bit more risk-averse. Verizon, while its 5G coverage only covers around 12.77% of the country, has been working hard to expand it, which will likely drive growth in the future as more consumers and businesses adopt it.

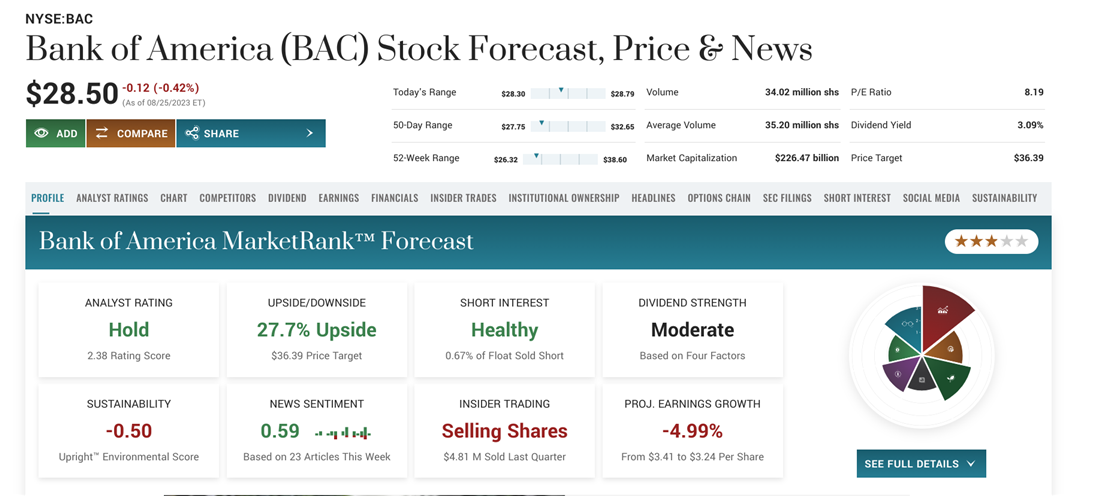

7. Bank of America Co.

Bank of America Co. (NYSE: BAC) is a prosperous blue-chip stock that investors have admired for its performance. The financial institution has remained profitable despite the worst economic downturns, offering an impressive Bank of America dividend yield of 3.09%.

According to analysts, Bank of America currently has a “hold” rating with a price target of $36.39 per share and looks set for growth in the future since rising interest rates tend to benefit banks like this one. Its return on equity of 12.01% indicates a strong use of shareholder capital, and its solid debt-to-equity ratio of 1.12 suggests it can cover its short-term debts. As one of the largest banks in the United States, Bank of America has a diverse portfolio of services and customers, making it less risky than banks more heavily dependent on one region.

Bank of America has made notable strides in upholding and meeting regulatory obligations, resulting in over $90 billion worth of legal settlements and fines since the 2008 market crash, all while investing heavily in technology to enhance its digital capabilities, which should help it remain competitive.

Blue Chip Stocks: A Reliable Choice in Any Market

There's a reason smart investors keep seeking out blue-chip stocks. No one could resist investing in large, established companies with a long record of dividend payments and financial stability. Companies like Coca-Cola, Verizon Communications and Bank of America are all great examples.

They've repeatedly proven themselves to be reliable sources of revenue, whether markets are up, down or sideways. Furthermore, these stocks also offer attractively high dividend yields, and many are primed for growth in their respective industries thanks to new products or services they've rolled out, or plan to. Investing in blue-chip stocks now is one of the smartest plans if you're looking for steady income streams and significant capital gains over the longer term.

Methodology

To choose the best blue chip stock to buy now, we start with the company's financials, such as revenues, profits, cash flows, debt levels and balance sheets. We also look at the overall market environment and gauge potential risks in buying this stock. For instance, is the industry in decline? Are there other stocks that might be better investments?

When selecting blue-chip stocks, we also pay close attention to their dividend yields. Many of these companies are known for paying above-average dividends. We take one sector or class, such as tech companies or consumer staples — and compare each company's dividend yield, looking for higher ones. We also focus on picking companies with strong fundamentals, such as high return on equity (ROE), which can help protect your investment over time.

Finally, we keep an eye out for stocks currently undervalued by the market, especially those with low price-to-earnings (P/E) ratios — these could offer nice returns if prices increase over time.

Finally, we keep an eye out for stocks that are currently undervalued by the market, especially those with low price-to-earnings (P/E) ratios– these could offer nice returns if prices increase over time.