The Dow Jones Transportation Average rose more than 8.4% in November to set a new high. Most components saw gains, with only two moving lower. The median movement is near 6%, the mean is nearly 9%, and the leading names advanced by high double-digits in the 30-day and 90-day lookback periods. This is important for the transportation sector and the broad economy because good times for transportation stocks generally mean good times for all.

More significantly, according to Dow Theory, the transportation index's move to new highs converges with the blue-chip Dow Jones Industrial Average, signaling a broad stock market rally. Drivers of this rally include persistent economic health, reduced interest rates, and an expectation for regulatory and tax-policy tailwinds to develop in 2025.

Avis Budget Group Leads Dow Transports to New Highs

Avis Budget Group (NASDAQ: CAR) is the clear leader for November, rising 30% to extend a rebound that began in September. The move has the stock trading near a five-month high and showing support at critical moving averages. Support is seen at the 30- and 150-day EMAs, which are forming a Golden Crossover. A Golden Crossover is when a shorter-term moving average crosses above a long-term moving average. In this case, the two averages align with broadly used metrics and show a convergence of conviction between short-term traders and longer-term investors.

Avis Budget Group and the car rental industry face headwinds in 2024, but analysts are optimistic about industry normalization and a return to growth in 2025. Avis's forecast is for revenue to grow by about 2% and for margins to improve significantly. The consensus forecast for earnings MarketBeat reports assumes more than 100% growth. Regarding sentiment, the consensus rating improved to Moderate Buy from Hold in 2024, and the price target assumes a 20% upside within the next 12 months.

United Airlines Flies High: Wait for the Pullback

United Airlines (NASDAQ: UAL) stock price is up strongly in 2024, rising nearly 30% in November and 125% for the year. The rally is driven by sustained growth aided by travel demand and expanding routes. Growth has slowed to the low single digits in 2024, but profitability remains solid, and an inflection point is at hand. Top-line growth is expected to accelerate in FQ4 and then again in 2025, with 2025 revenue expected to rise by nearly 7% and the margin to widen. Earnings growth is expected to approach 20%, which is good news for the capital return program. The company hasn’t paid dividends in years but resumed share repurchases in Q4. The new authorization was worth $1.5 billion or more than 5% of the market cap when it was announced.

The consensus price target reported by MarketBeat lags the price action, but the revision trend is bullish. The consensus sentiment is up to Buy from Moderate Buy on activity in November and the price target is up by nearly 50% in the last year. The most recent targets lead to the high-end range, which is good for a 50% increase in the stock price from November’s closing price.

Ryder Trends Higher: Convergences Suggest the Uptrend Will Continue

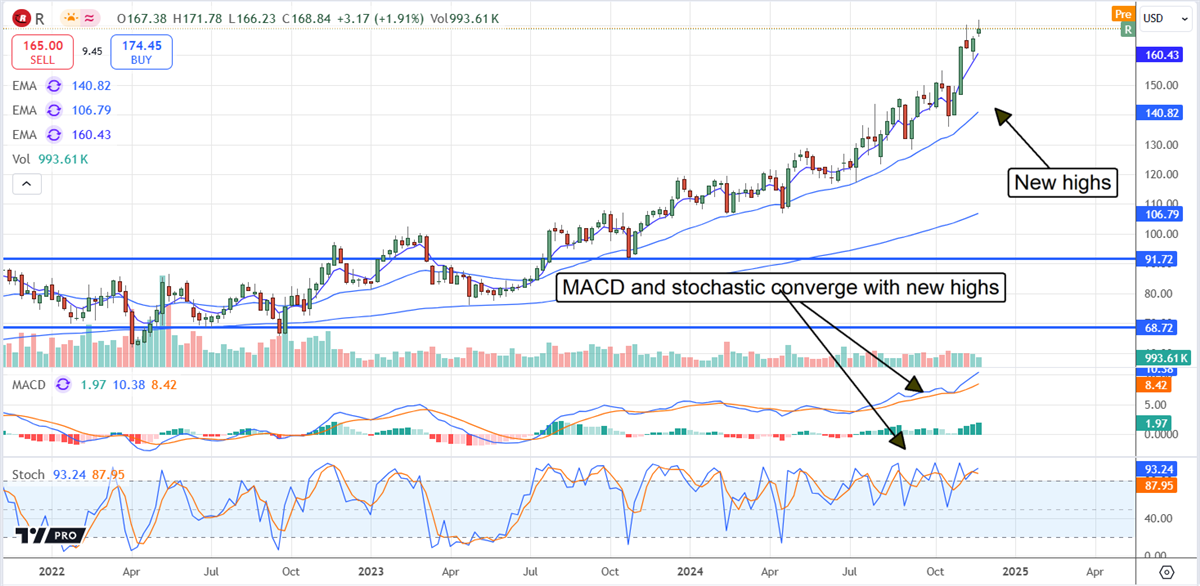

Ryder System's (NYSE: R) stock price has been up nearly 100% in the last year, and convergences in the indicators suggest the uptrend will continue. Convergences exist in the MACD and stochastic, which show that the bulls are in charge of this market. Price action may pull back in December, but the uptrend is intact.

The critical resistance is near the $170 level and highs set in November, and the critical support target is near $150 and the top of October’s consolidation zone. The uptrend is driven by the resumption of growth in 2024, outperformance on the bottom line, and an expectation for acceleration and a wider margin in 2025. The forecasts for 2025 include nearly 9% top-line growth and 14% earnings growth.