News Source: Optimal Blue

Optimal Blue's August 2024 Market Advantage mortgage data report shows refi locks reached highest market share since The Fed began hiking rates in March 2022

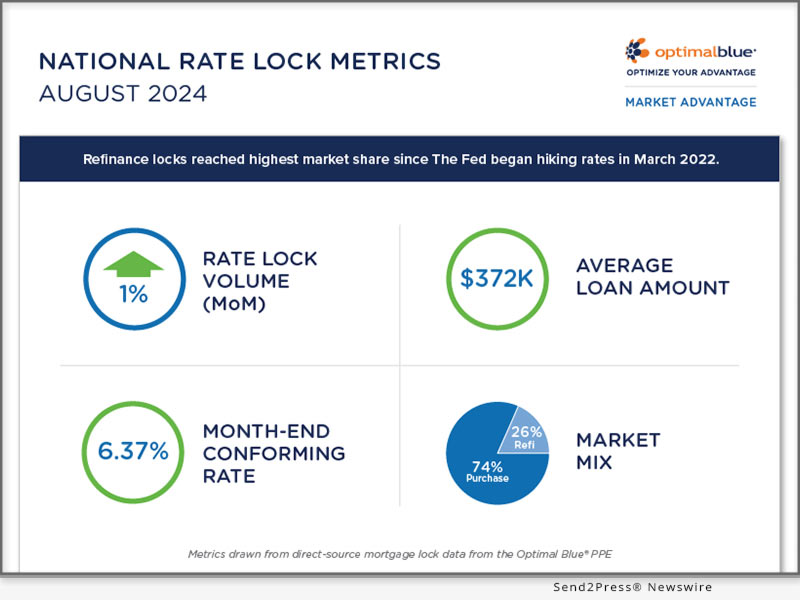

PLANO, Texas, Sept. 10, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its August 2024 Market Advantage mortgage data report, which reveals an overall 1% rise in rate lock volume despite the typical seasonal slowdown in purchase lending. Lock volume growth was driven by a surge in refinance activity as homeowners reacted to declining mortgage rates.

Image caption: August 2024 Market Advantage report.

“Refinance activity, particularly rate-and-term refinances, surged as mortgage rates declined across all loan types,” said Brennan O’Connell, director of data solutions at Optimal Blue. “Notably, August saw a remarkable 109% month-over-month (MoM) increase in rate-and-term refi volume in response to a 31-basis-point drop in the benchmark OBMMI 30-year conforming rate, which ended the month at 6.37%. Rate-and-term refi activity was up 300% from the same period last year.”

Key findings from the Market Advantage report, which are drawn from direct-source mortgage lock data, include:

- Refinance volume spikes and purchase volume falls: Refinances now account for 26% of total production, the highest level since March 2022, when the Federal Reserve began increasing interest rates. Rate-and-term refinance volume more than doubled in August, rising 109% MoM, while cash-out refinances also saw a more modest increase of 8%. Purchase volume fell by 10% MoM.

- Mortgage rates decline: 30-year mortgage rates trended downward in August across all loan types, with the biggest shift in FHA rates, which fell by 40 bps to 6.13%, and the smallest shift occurring in conforming rates, which fell by 31 bps to 6.37%.

- Narrowed spreads provide more refinance incentive: The 10-Year Treasury yield decreased by 18 bps to 3.91%, with the spread between the 10-Year Treasury and the 30-year conforming mortgage rate narrowing by 13 bps to 246 bps. This marks a significant improvement in the spread, which has fallen by over 50 bps from the same period last year.

- Purchase counts reflect persisting challenges for homebuyers: Despite the increase in refinance activity, purchase lock counts – a key indicator of housing market conditions – dropped 16% YoY due to continued affordability and inventory challenges. Purchase locks are down 45% over August 2019.

- 2024 FHA and purchase borrowers’ credit scores at highest in seven years: Throughout 2024, monthly average credit scores have been higher than average for FHA borrowers (675.3), as well as for borrowers seeking purchase loans (736.4), than any other month dating back to January 2018, when Optimal Blue started tracking the data. The average credit score across all production in August 2024 was 731.

- Loan amount and purchase price: The average loan amount rose from $369.1K to $372.4K, while the average purchase price fell from $471K to $465.5K.

View the full August 2024 Market Advantage report, which provides more detailed findings and additional insights into U.S. mortgage market trends, at (PDF): https://www2.optimalblue.com/wp-content/uploads/2024/09/OB_MarketAdvantage_MortgageDataReport_August2024.pdf.

About the Market Advantage Report:

Formerly known as the Originations Market Monitor, Optimal Blue issues the Market Advantage mortgage data report each month to provide early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE – the mortgage industry’s most widely used product, pricing, and eligibility engine – the Market Advantage provides a view of early-stage origination activity. Unlike self-reported survey data, mortgage lock data is direct-source data that accurately reflects the in-process loans in lenders’ pipelines.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue

Optimal Blue effectively bridges the primary and secondary mortgage markets to deliver the industry’s only end-to-end capital markets platform. The company helps lenders of all sizes and scopes maximize profitability and operate efficiently so they can help American borrowers achieve the dream of homeownership. Through innovative technology, a network of interconnectivity, rich data insights, and expertise gathered over more than 20 years, Optimal Blue is an experienced partner that, in any market environment, allows lenders to optimize their advantage from pricing accuracy to margin protection, and every step in between. To learn more, visit OptimalBlue.com.

This press release was issued on behalf of the news source (Optimal Blue), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/rate-and-term-refinances-surge-109-mom-in-august-as-mortgage-rates-decline/

Copr. © 2024 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P120820 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.