Electronic system and device provider Bel Fuse (NASDAQ:BELFA) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 22.1% year on year to $123.6 million. On the other hand, next quarter’s revenue guidance of $121 million was less impressive, coming in 3% below analysts’ estimates. Its GAAP profit of $0.65 per share was 20.7% below analysts’ consensus estimates.

Is now the time to buy Bel Fuse? Find out by accessing our full research report, it’s free.

Bel Fuse (BELFA) Q3 CY2024 Highlights:

- Revenue: $123.6 million vs analyst estimates of $122.6 million (in line)

- EPS: $0.65 vs analyst expectations of $0.82 (20.7% miss)

- EBITDA: $20.62 million vs analyst estimates of $20.14 million (2.4% beat)

- Revenue Guidance for Q4 CY2024 is $121 million at the midpoint, below analyst estimates of $124.8 million

- Gross Margin (GAAP): 36.1%, up from 35% in the same quarter last year

- Operating Margin: 9.3%, down from 16.5% in the same quarter last year

- EBITDA Margin: 16.7%, in line with the same quarter last year

- Free Cash Flow Margin: 19.2%, down from 24.1% in the same quarter last year

- Market Capitalization: $1.07 billion

“We were pleased that our third quarter results landed above the midpoint of guidance for both sales and gross margin,” said Daniel Bernstein, President and CEO.

Company Overview

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ:BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Sales Growth

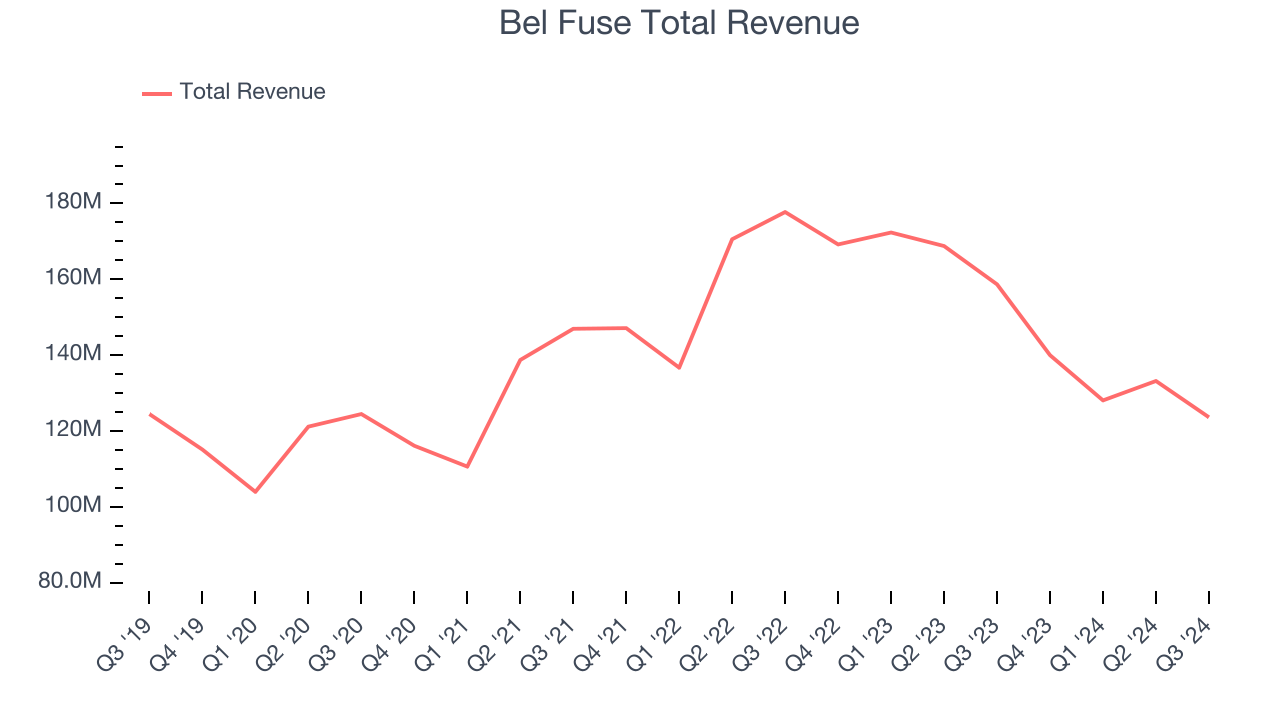

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Bel Fuse’s demand was weak over the last five years as its sales were flat, a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Bel Fuse’s recent history shows its demand has stayed suppressed as its revenue has declined by 8.9% annually over the last two years. Bel Fuse isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Bel Fuse reported a rather uninspiring 22.1% year-on-year revenue decline to $123.6 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 13.6% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, an acceleration versus the last two years. While this projection shows the market believes its newer products and services will spur better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

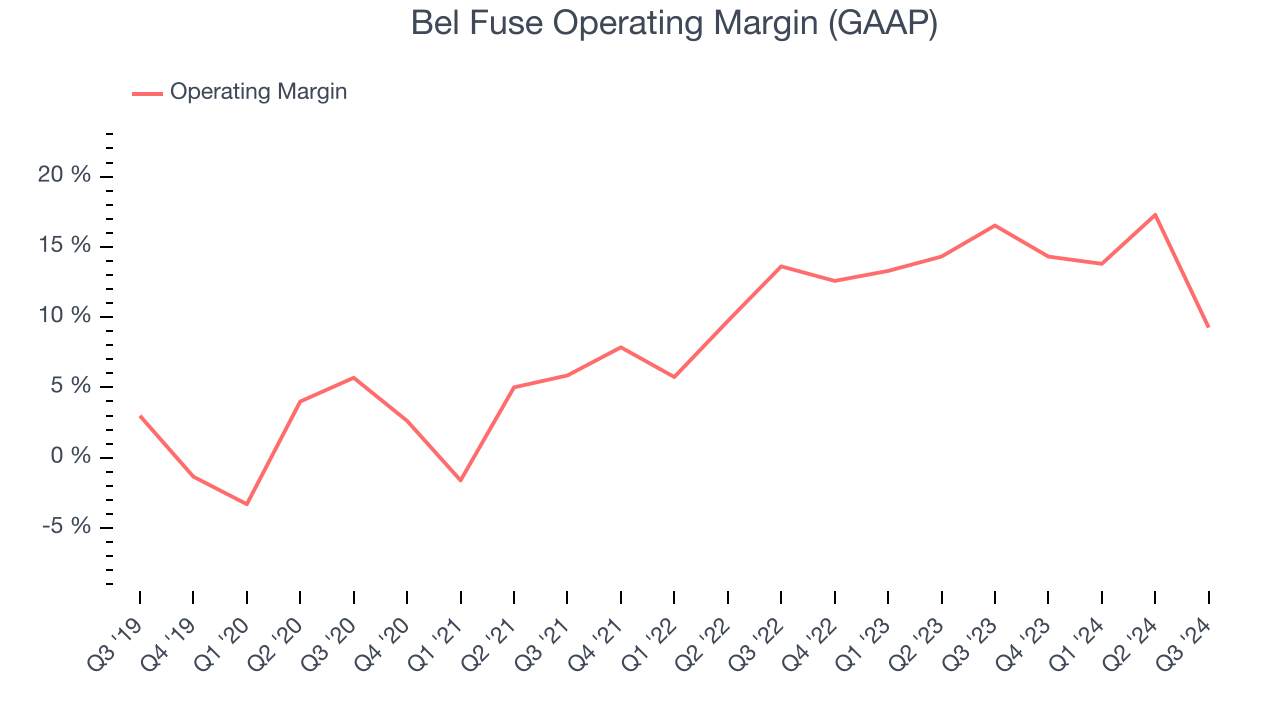

Bel Fuse has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.9%, higher than the broader industrials sector.

Looking at the trend in its profitability, Bel Fuse’s annual operating margin rose by 12.3 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Bel Fuse generated an operating profit margin of 9.3%, down 7.3 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

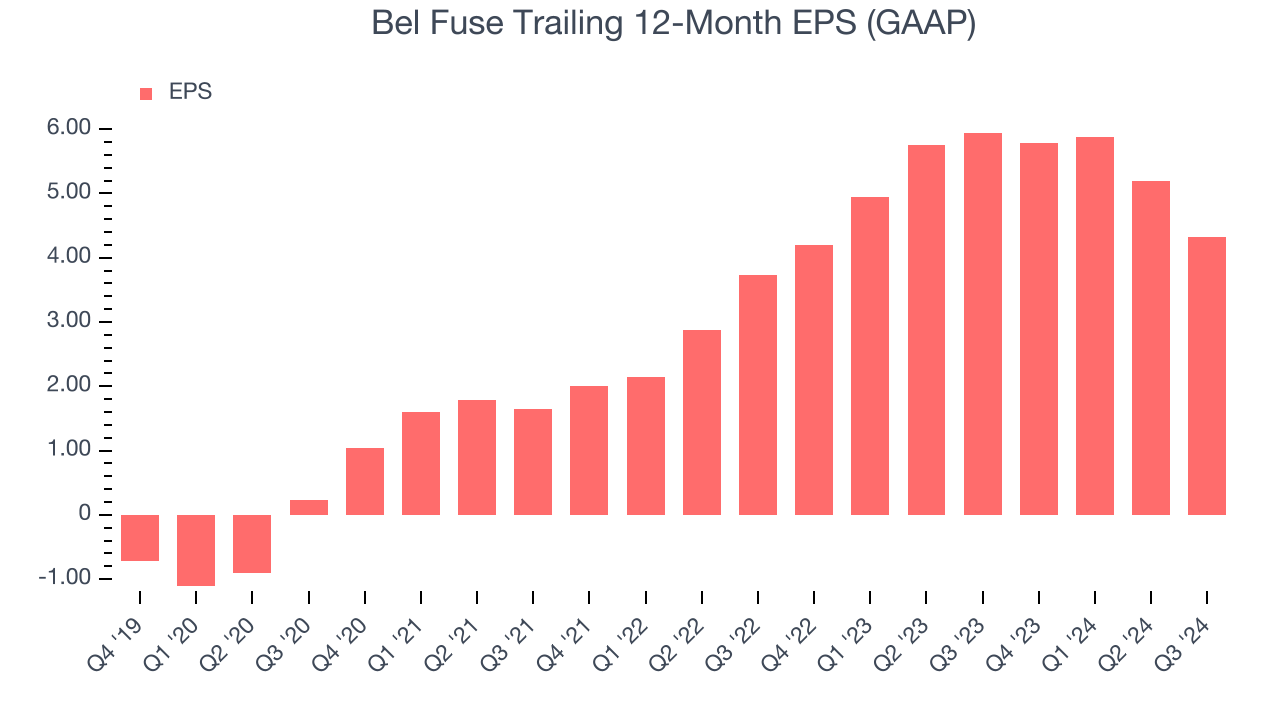

Bel Fuse’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. Bel Fuse’s EPS grew at an unimpressive 7.6% compounded annual growth rate over the last two years. This performance was better than its 0.4% annualized revenue declines but doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand during this timeframe.

We can take a deeper look into Bel Fuse’s earnings to better understand the drivers of its performance. A two-year view shows that Bel Fuse has repurchased its stock, shrinking its share count by 16.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Bel Fuse reported EPS at $0.65, down from $1.52 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Bel Fuse’s full-year EPS of $4.33 to grow by 3.4%.

Key Takeaways from Bel Fuse’s Q3 Results

It was good to see Bel Fuse beat analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.4% to $100.50 immediately following the results.

Bel Fuse’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.