Fluid and coating equipment company Graco (NYSE:GGG) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 3.8% year on year to $519.2 million. Its non-GAAP profit of $0.71 per share was also 5.8% below analysts’ consensus estimates.

Is now the time to buy Graco? Find out by accessing our full research report, it’s free.

Graco (GGG) Q3 CY2024 Highlights:

- Revenue: $519.2 million vs analyst estimates of $537.7 million (3.4% miss)

- Adjusted EPS: $0.71 vs analyst expectations of $0.75 (5.8% miss)

- Gross Margin (GAAP): 53.2%, in line with the same quarter last year

- Operating Margin: 28.1%, down from 30.2% in the same quarter last year

- Market Capitalization: $14.16 billion

"We continued to experience soft demand trends in our core end markets, especially in Asia Pacific, which negatively affected our sales for the third quarter," said Mark Sheahan, Graco's President and CEO.

Company Overview

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

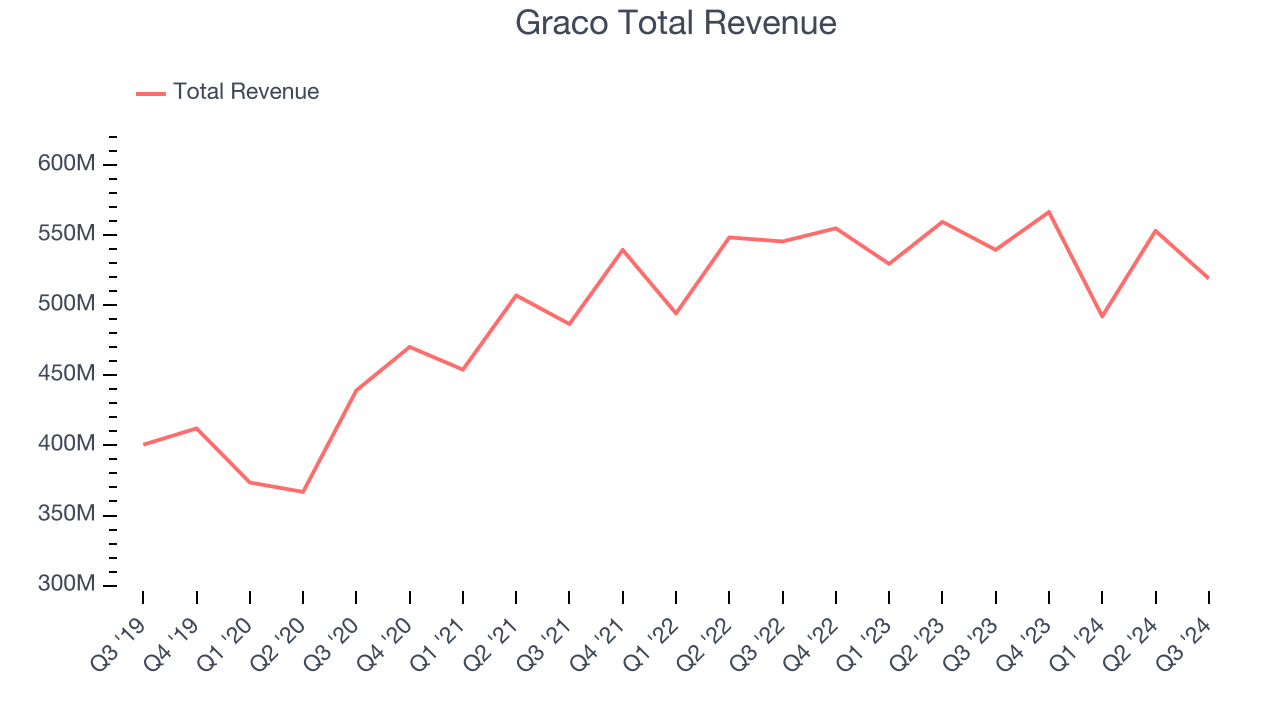

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Graco grew its sales at a tepid 5.4% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Graco’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Gas and Liquid Handling businesses have faced declining sales because of cyclical headwinds. While Graco’s growth wasn’t the best, it did perform better than its peers.

Graco also breaks out the revenue for its most important segments, Contractor and Process, which are 46.7% and 23.2% of revenue. Over the last two years, Graco’s Contractor revenue averaged 1.7% year-on-year declines. On the other hand, its Process revenue (pumps, valves, hoses) averaged 3.4% growth.

This quarter, Graco missed Wall Street’s estimates and reported a rather uninspiring 3.8% year-on-year revenue decline, generating $519.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, an acceleration versus the last two years. Although this projection indicates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

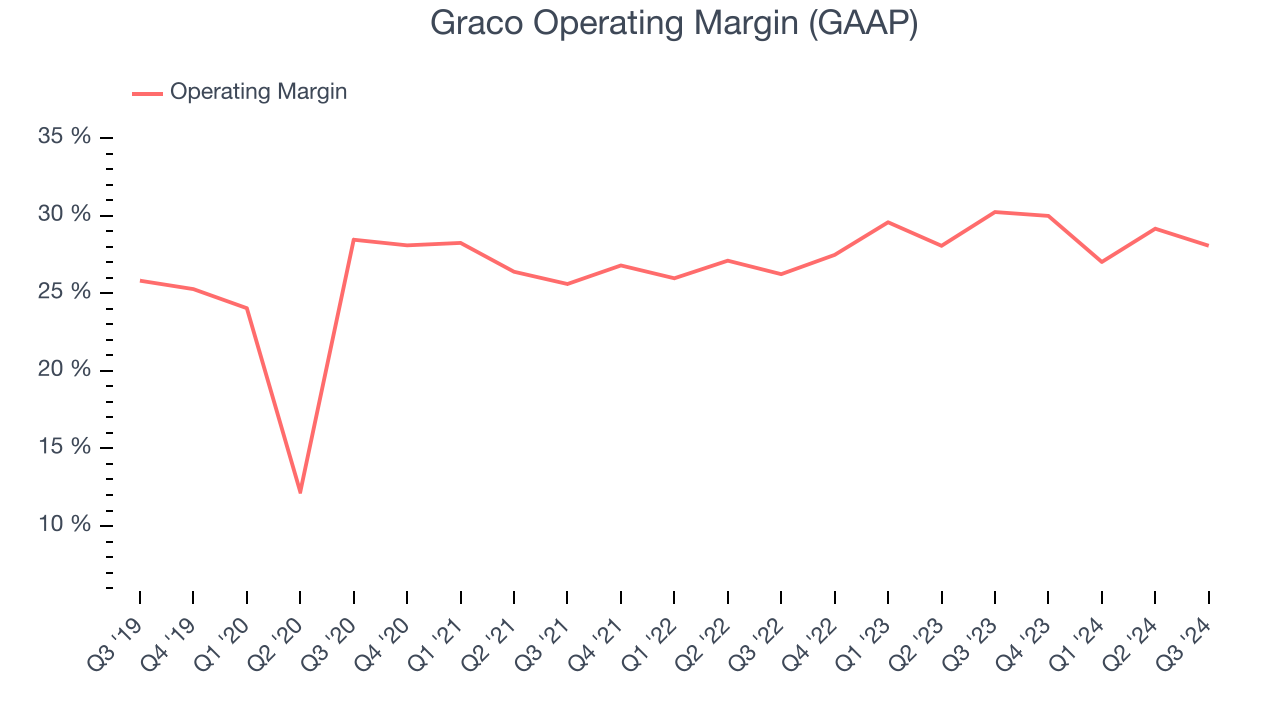

Operating Margin

Graco has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Graco’s annual operating margin rose by 5.8 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Graco generated an operating profit margin of 28.1%, down 2.2 percentage points year on year. Since Graco’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

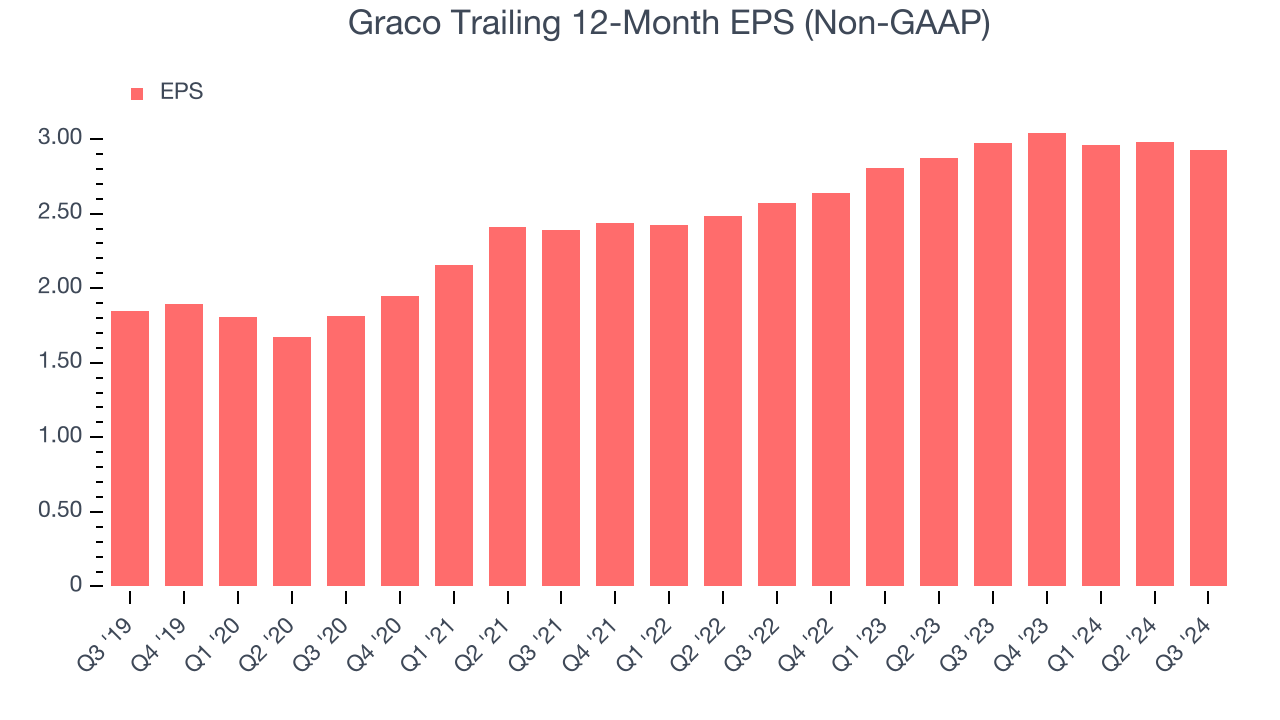

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Graco’s EPS grew at a decent 9.6% compounded annual growth rate over the last five years, higher than its 5.4% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Graco’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Graco’s operating margin declined this quarter but expanded by 5.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For Graco, its two-year annual EPS growth of 6.7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Graco reported EPS at $0.71, down from $0.76 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Graco’s full-year EPS of $2.93 to grow by 6.7%.

Key Takeaways from Graco’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.7% to $78.94 immediately after reporting.

The latest quarter from Graco’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price.The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.