Gaming metaverse operator Roblox (NYSE:RBLX) announced better-than-expected revenue in Q3 CY2024, with sales up 28.8% year on year to $919 million. On the other hand, next quarter’s revenue guidance of $947.5 million was less impressive, coming in 2.1% below analysts’ estimates. Its GAAP loss of $0.37 per share was also 3.2% above analysts’ consensus estimates.

Is now the time to buy Roblox? Find out by accessing our full research report, it’s free.

Roblox (RBLX) Q3 CY2024 Highlights:

- Bookings: $1.13 billion vs analyst estimates of $1.02 billion (10.8% beat)

- Revenue: $919 million vs analyst estimates of $884.1 million (3.9% beat)

- EPS: -$0.37 vs analyst estimates of -$0.38 (3.2% beat)

- EBITDA: $54.96 million vs analyst estimates of $149.8 million (63.3% miss)

- Revenue Guidance for Q4 CY2024 is $947.5 million at the midpoint, below analyst estimates of $968.2 million

- EBITDA guidance for the full year is $135 million at the midpoint, below analyst estimates of $667 million

- Gross Margin (GAAP): 25.9%, up from 22.4% in the same quarter last year

- Operating Margin: -30.4%, up from -42.1% in the same quarter last year

- EBITDA Margin: 6%, down from 11.4% in the same quarter last year

- Free Cash Flow Margin: 23.7%, up from 12.5% in the previous quarter

- Daily Active Users: 88.9 million, up 18.7 million year on year

- Market Capitalization: $27.92 billion

“Roblox’s exceptional Q3 results demonstrate the strength of our platform and the effectiveness of our growth strategies. We’re particularly proud of the progress we’ve made in empowering creators, fostering social connections, and expanding our global reach. As we look ahead, we remain committed to building the world’s largest social platform for play, and we’re confident that our continued innovation and focus on safety will drive long-term value for our shareholders and the broader Roblox community,” said David Baszucki, founder and CEO of Roblox.

Company Overview

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

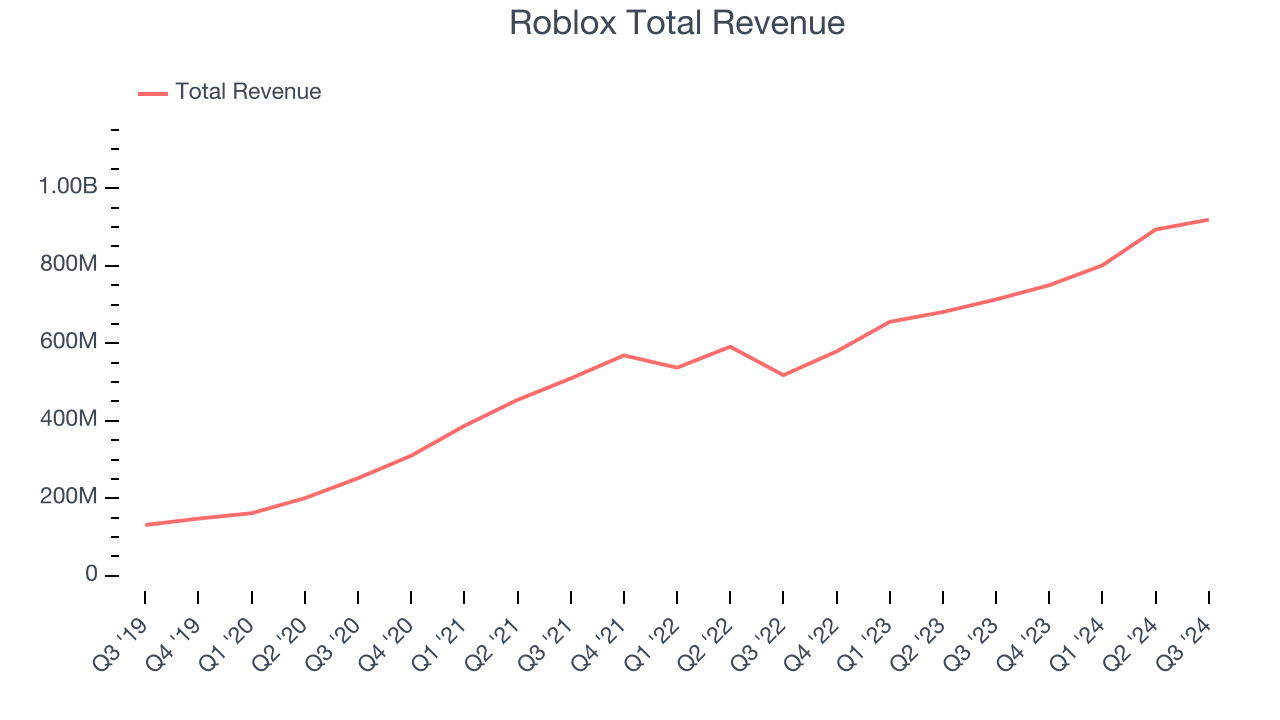

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Roblox grew its sales at an exceptional 26.5% compounded annual growth rate. This is encouraging because it shows Roblox’s offerings resonate with customers, a helpful starting point.

This quarter, Roblox reported robust year-on-year revenue growth of 28.8%, and its $919 million of revenue topped Wall Street estimates by 3.9%. Management is currently guiding for a 26.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, a deceleration versus the last three years. This projection is still noteworthy and shows the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Daily Active Users

User Growth

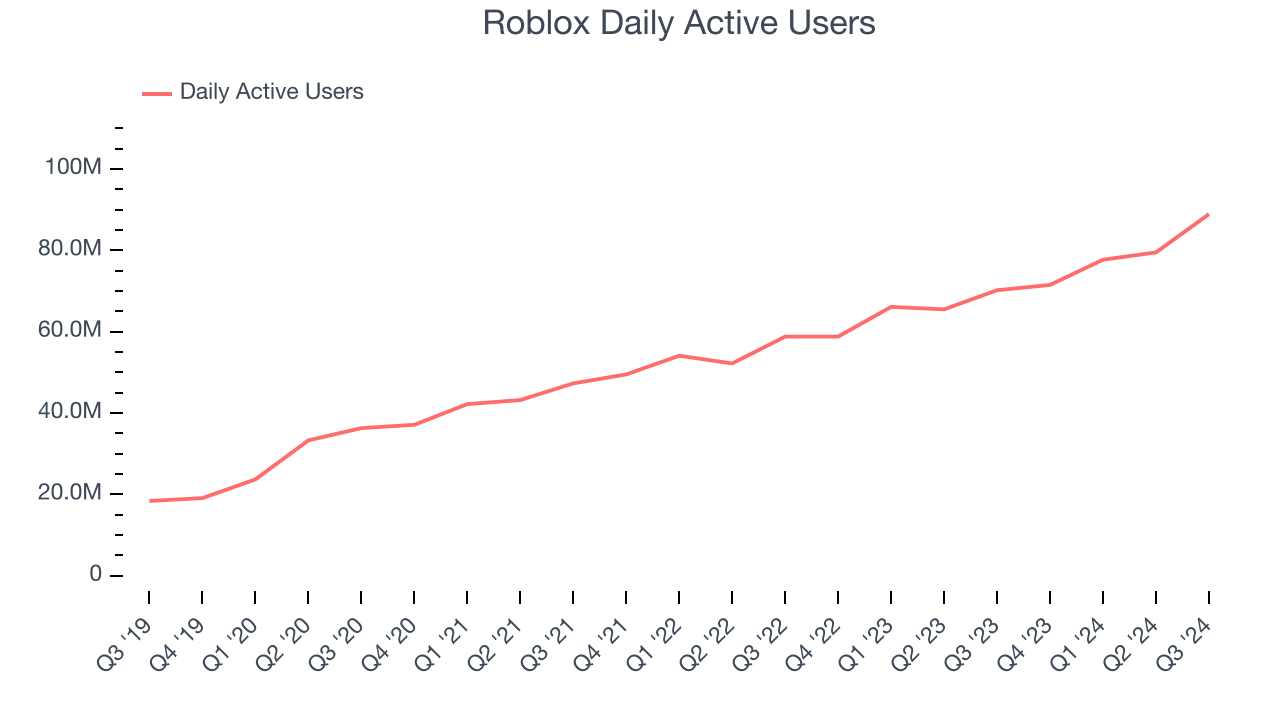

As a video gaming company, Roblox generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Over the last two years, Roblox’s daily active users, a key performance metric for the company, increased by 21.6% annually to 88.9 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its platform's popularity is exploding.

In Q3, Roblox added 18.7 million daily active users, leading to 26.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

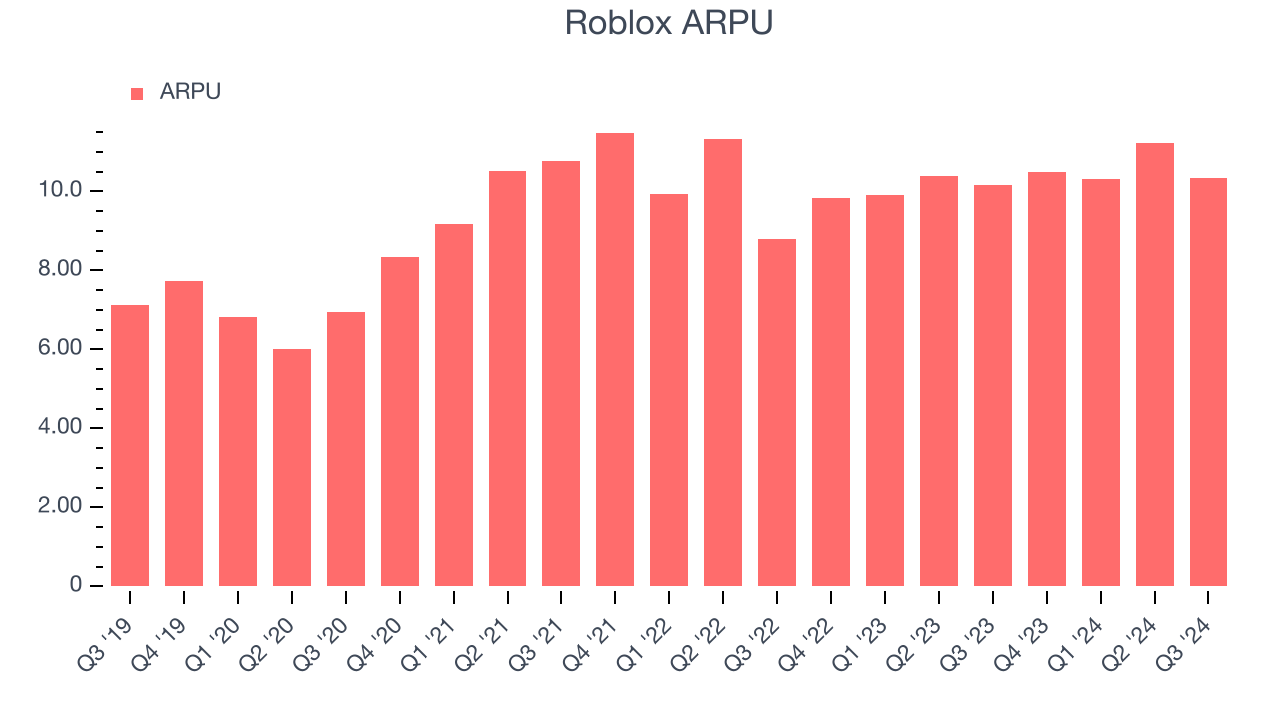

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Roblox because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Roblox’s ARPU growth has been subpar over the last two years, averaging 1.6%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roblox tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Roblox’s ARPU clocked in at $10.34. It grew 1.7% year on year, slower than its user growth.

Key Takeaways from Roblox’s Q3 Results

We enjoyed seeing Roblox increase its number of users this quarter. We were also excited its revenue, bookings, and EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EBITDA guidance missed analysts’ expectations. Overall, this quarter was softer due to the weaker guidance, but the market seems very excited about the 10%+ bookings beat (bookings also accelerated from 22% year-on-year growth last quarter to 34% this quarter). The stock traded up 17.3% to $50.62 immediately following the results.

Big picture, is Roblox a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.