Solar energy systems company Shoals (NASDAQ:SHLS) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell 23.9% year on year to $102.2 million. On top of that, next quarter’s revenue guidance ($102 million at the midpoint) was surprisingly good and 9% above what analysts were expecting. Its non-GAAP profit of $0.08 per share was 17.1% below analysts’ consensus estimates.

Is now the time to buy Shoals? Find out by accessing our full research report, it’s free.

Shoals (SHLS) Q3 CY2024 Highlights:

- Revenue: $102.2 million vs analyst estimates of $98.85 million (3.4% beat)

- Adjusted EPS: $0.08 vs analyst expectations of $0.10 (17.1% miss)

- EBITDA: $24.53 million vs analyst estimates of $26.51 million (7.5% miss)

- Revenue Guidance for Q4 CY2024 is $102 million at the midpoint, above analyst estimates of $93.54 million

- EBITDA guidance for the full year is $98.5 million at the midpoint, below analyst estimates of $99.91 million

- Gross Margin (GAAP): 24.8%, up from 10.5% in the same quarter last year

- Operating Margin: 4.4%, up from -7.9% in the same quarter last year

- EBITDA Margin: 24%, down from 35.8% in the same quarter last year

- Free Cash Flow Margin: 13%, down from 18.2% in the same quarter last year

- Backlog: $596.6 million at quarter end

- Market Capitalization: $961.5 million

“I’m pleased with the robust engagement we experienced in the third quarter. Customers remain cautious yet constructive as we head into the end of 2024 and look into 2025. Quoting volume across our customer base is at record levels, increasing almost 50% from the prior year period, and we are encouraged by strong interest from new customers,” said Brandon Moss, CEO of Shoals.

Company Overview

Started in Huntsville, Alabama, Shoals (NASDAQ:SHLS) designs and manufactures products that make solar energy systems work more efficiently.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

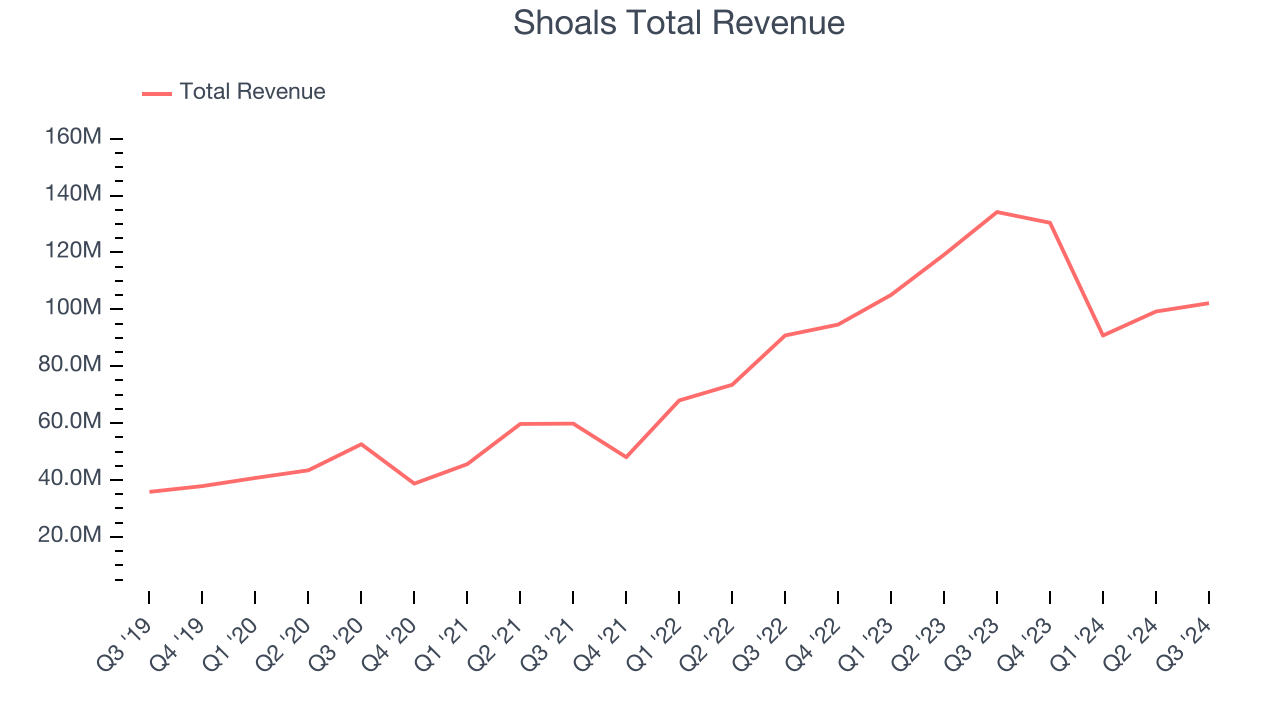

Sales Growth

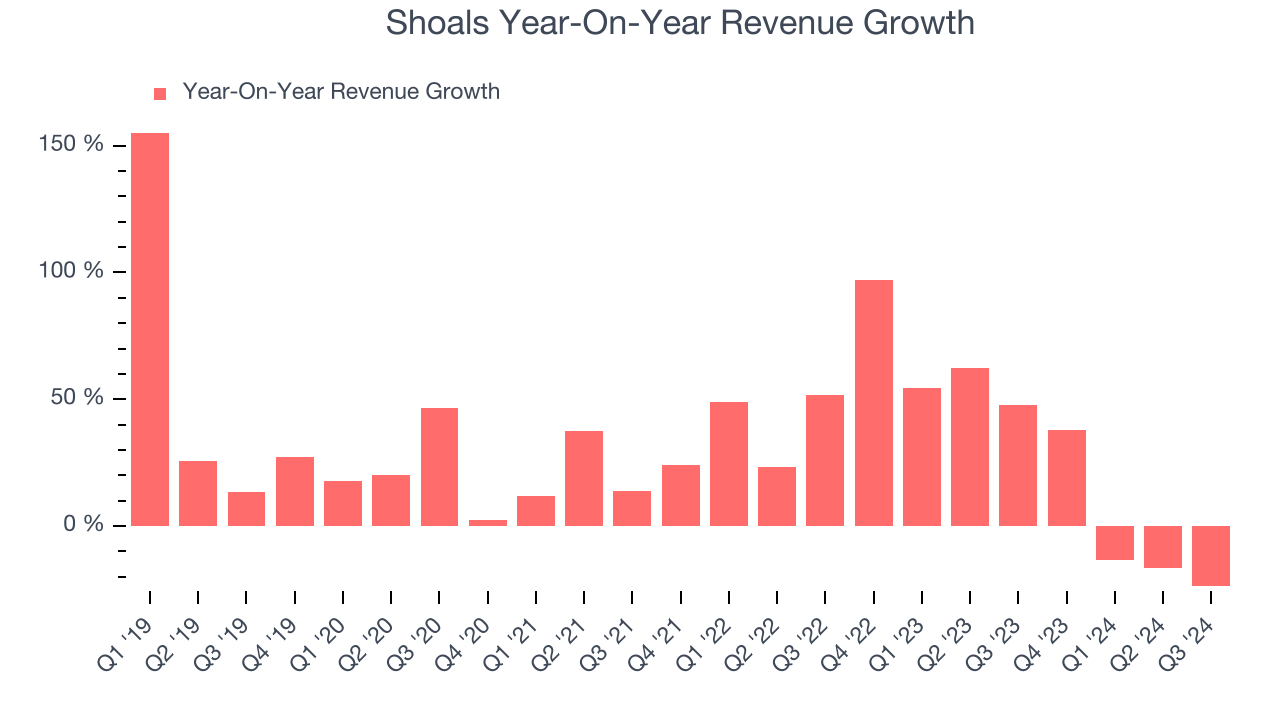

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Shoals’s 25.4% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Shoals’s annualized revenue growth of 22.8% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Shoals’s revenue fell 23.9% year on year to $102.2 million but beat Wall Street’s estimates by 3.4%. Company management is currently guiding for a 21.8% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

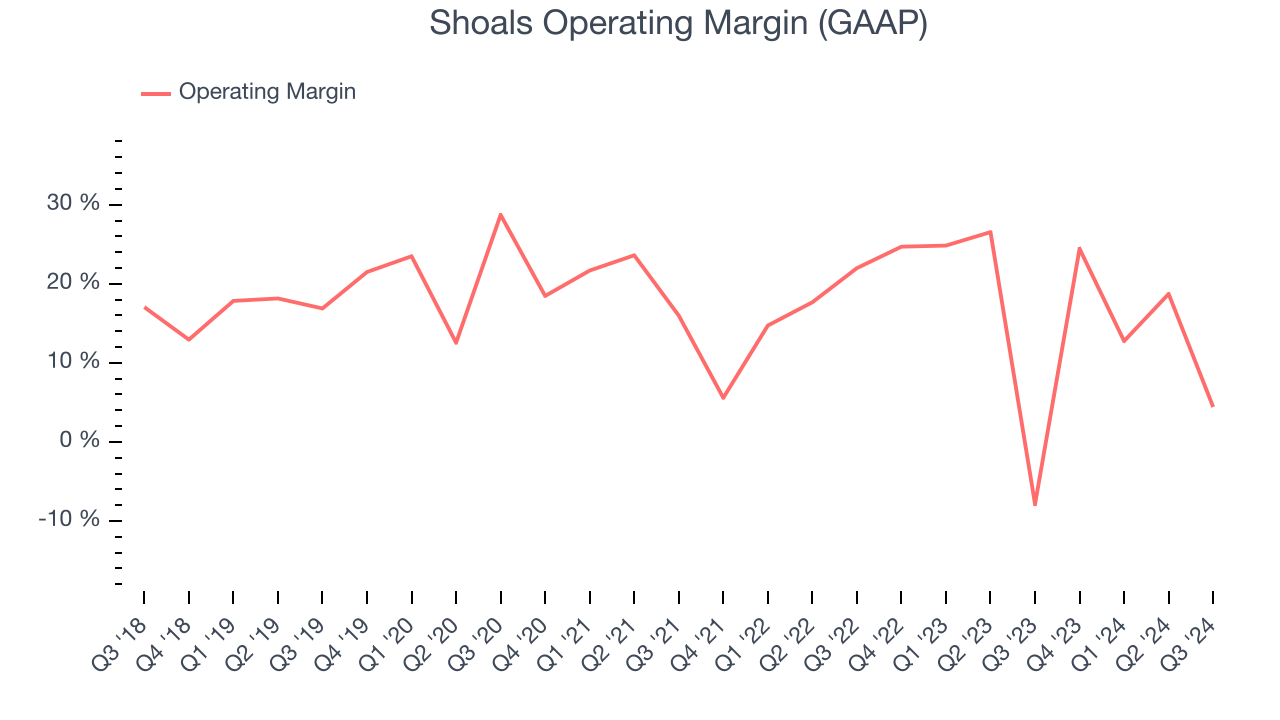

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Shoals has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Shoals’s annual operating margin decreased by 6.2 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Shoals become more profitable in the future.

This quarter, Shoals generated an operating profit margin of 4.4%, up 12.3 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

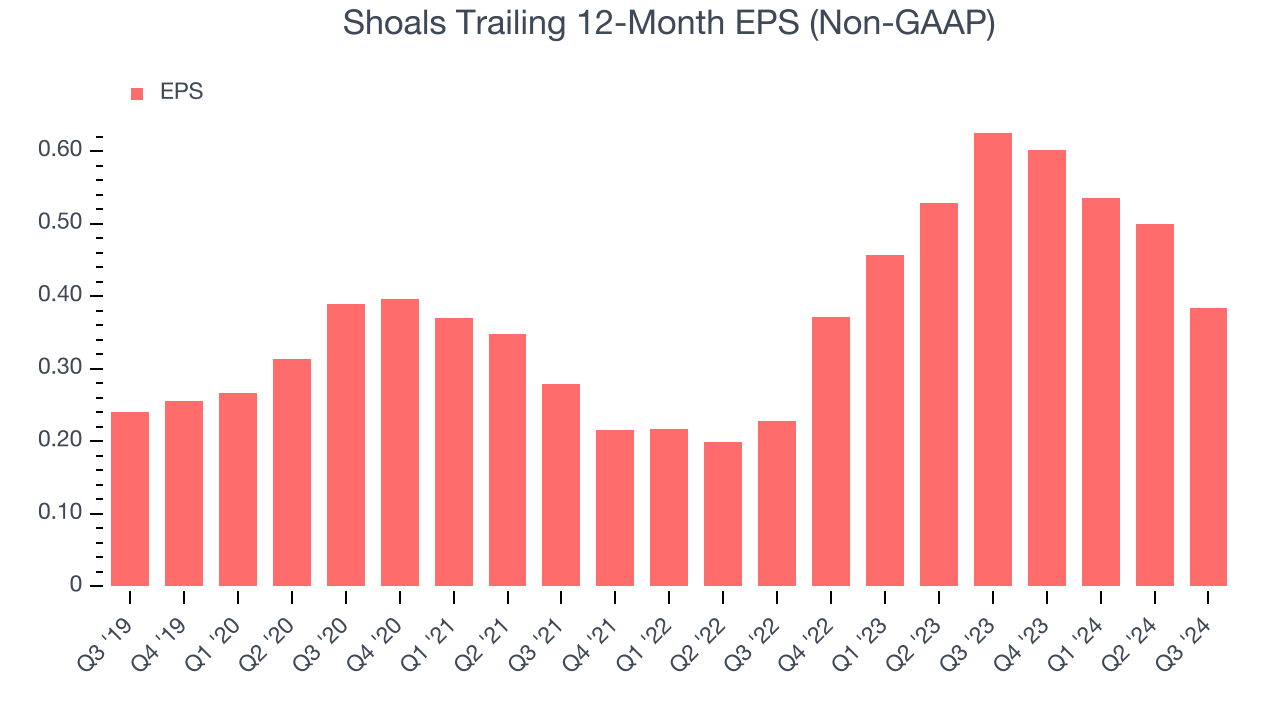

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Shoals’s EPS grew at a decent 9.8% compounded annual growth rate over the last five years. However, this performance was lower than its 25.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Shoals’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Shoals’s operating margin improved this quarter but declined by 6.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Shoals, its two-year annual EPS growth of 29.6% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Shoals reported EPS at $0.08, down from $0.20 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Shoals to perform poorly. Analysts forecast its full-year EPS of $0.38 will hit $0.44.

Key Takeaways from Shoals’s Q3 Results

We were impressed by Shoals’s revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year revenue guidance came in higher than Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $5.80 immediately following the results.

So should you invest in Shoals right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.