Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Wynn Resorts (NASDAQ:WYNN) and the best and worst performers in the casino operator industry.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 9 casino operator stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

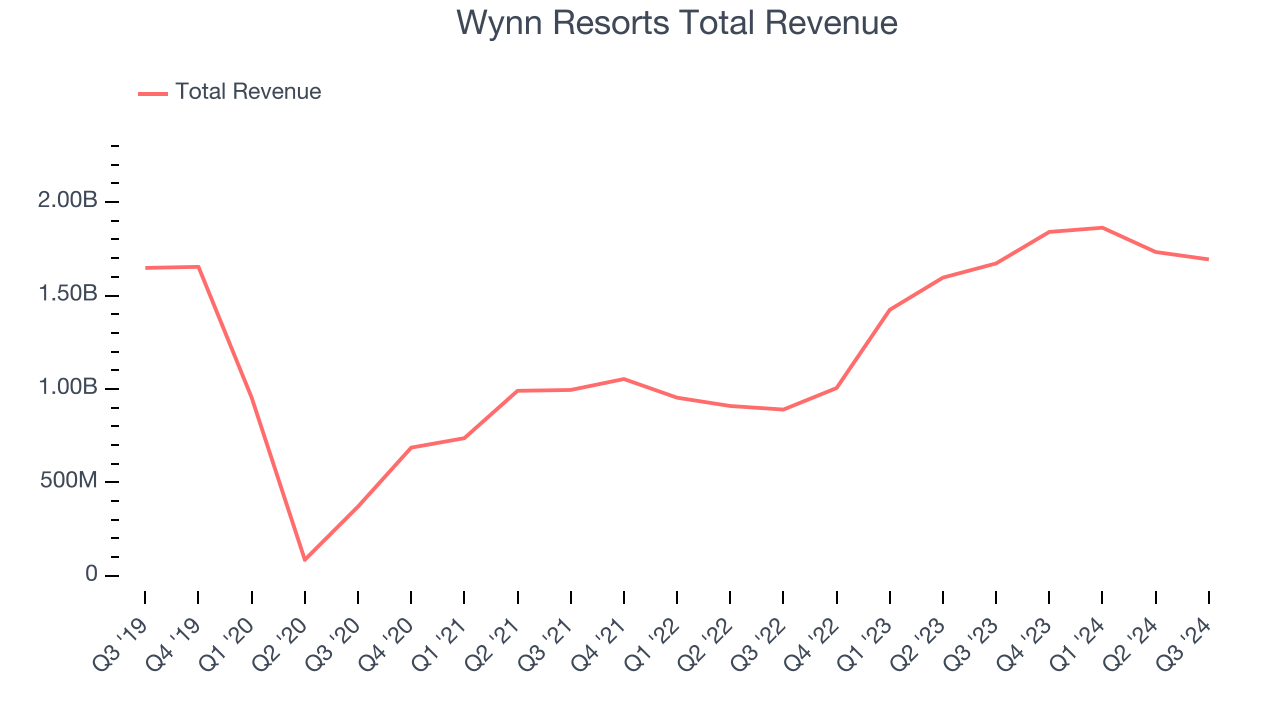

Weakest Q3: Wynn Resorts (NASDAQ:WYNN)

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ:WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Wynn Resorts reported revenues of $1.69 billion, up 1.3% year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

Unsurprisingly, the stock is down 10% since reporting and currently trades at $86.10.

Read our full report on Wynn Resorts here, it’s free.

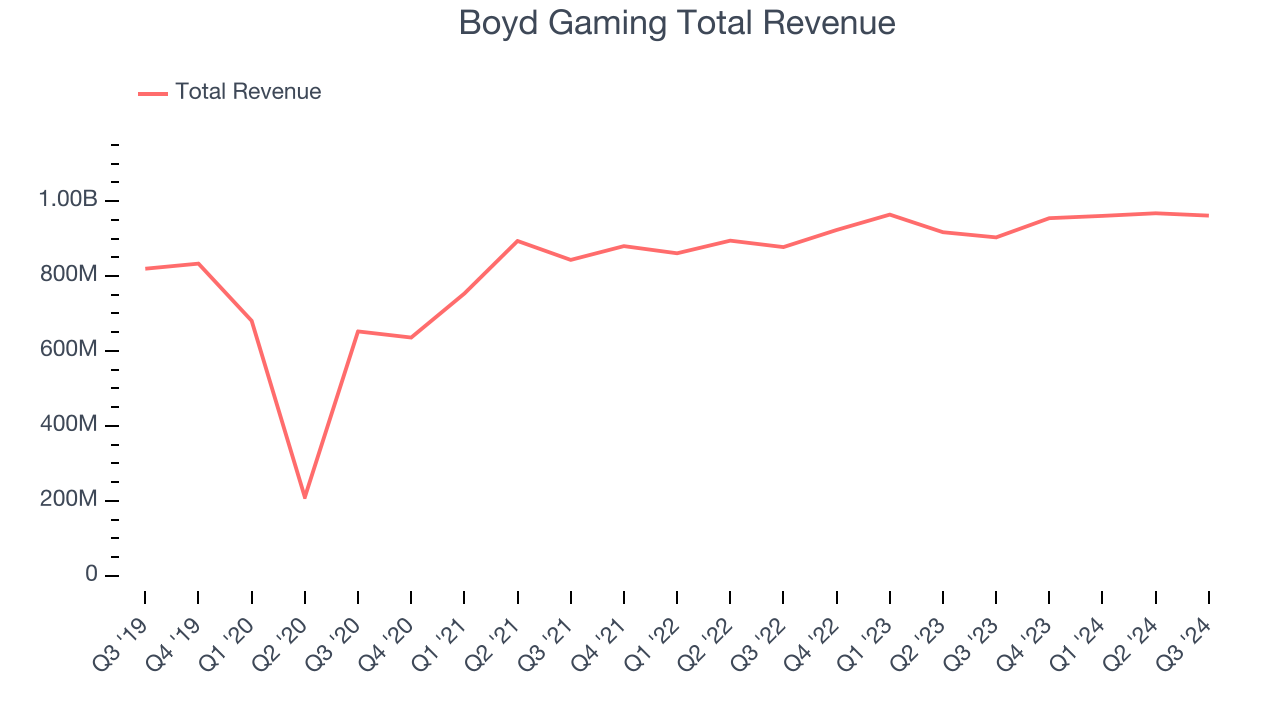

Best Q3: Boyd Gaming (NYSE:BYD)

Run by the Boyd family, Boyd Gaming (NYSE:BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming reported revenues of $961.2 million, up 6.4% year on year, outperforming analysts’ expectations by 4.8%. The business had a strong quarter with a decent beat of analysts’ Non-Gaming revenue and EBITDA estimates.

Boyd Gaming pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 14.3% since reporting. It currently trades at $73.55.

Is now the time to buy Boyd Gaming? Access our full analysis of the earnings results here, it’s free.

Bally's (NYSE:BALY)

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE:BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

Bally's reported revenues of $630 million, flat year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Bally's delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1% since the results and currently trades at $17.78.

Read our full analysis of Bally’s results here.

Monarch (NASDAQ:MCRI)

Established in 1993, Monarch (NASDAQ:MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Monarch reported revenues of $137.9 million, up 3.7% year on year. This print surpassed analysts’ expectations by 2.9%. Overall, it was a strong quarter as it also recorded a decent beat of analysts’ EPS and EBITDA estimates.

The stock is up 13.6% since reporting and currently trades at $83.68.

Read our full, actionable report on Monarch here, it’s free.

Caesars Entertainment (NASDAQ:CZR)

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Caesars Entertainment reported revenues of $2.87 billion, down 4% year on year. This number missed analysts’ expectations by 1.5%. It was a slower quarter as it also logged a significant miss of analysts’ EPS and EBITDA estimates.

The stock is down 12.7% since reporting and currently trades at $39.50.

Read our full, actionable report on Caesars Entertainment here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.