Kitchenware and home goods retailer Williams-Sonoma (NYSE:WSM) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell by 2.9% year on year to $1.80 billion. Its non-GAAP profit of $1.96 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy Williams-Sonoma? Find out by accessing our full research report, it’s free.

Williams-Sonoma (WSM) Q3 CY2024 Highlights:

- Revenue: $1.80 billion vs analyst estimates of $1.78 billion (2.9% year-on-year decline, 0.9% beat)

- Adjusted EPS: $1.96 vs analyst estimates of $1.77 (10.8% beat)

- Raised full-year 2024 guidance for revenue and operating income

- Operating Margin: 17.8%, in line with the same quarter last year

- Free Cash Flow Margin: 9.4%, down from 13.4% in the same quarter last year

- Locations: 525 at quarter end, down from 533 in the same quarter last year

- Same-Store Sales fell 2.9% year on year (-14.6% in the same quarter last year)

- Market Capitalization: $17.34 billion

“We are pleased with the results of our third quarter, beating both top and bottom-line expectations. The quarter was driven by continued improvement in our sales trend, market-share gains, and strong profit. In Q3, our comp came in at -2.9%, with an operating margin of 17.8%, delivering a 7.1% increase in earnings per share to $1.96. Our operating results reflect the operational improvements that we have been focused on all year, and demonstrate the strength of our margin profile in a difficult environment,” said Laura Alber, President and Chief Executive Officer.

Company Overview

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Williams-Sonoma is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

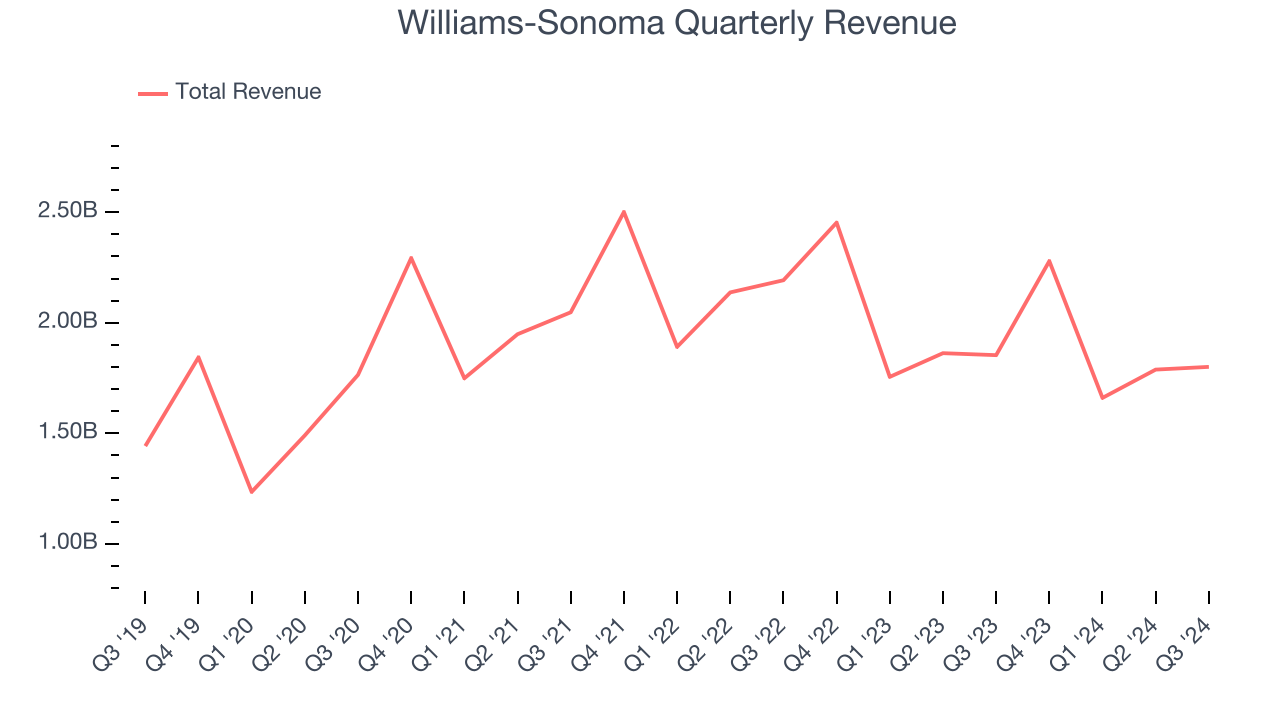

As you can see below, Williams-Sonoma’s 5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it closed stores.

This quarter, Williams-Sonoma’s revenue fell by 2.9% year on year to $1.80 billion but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

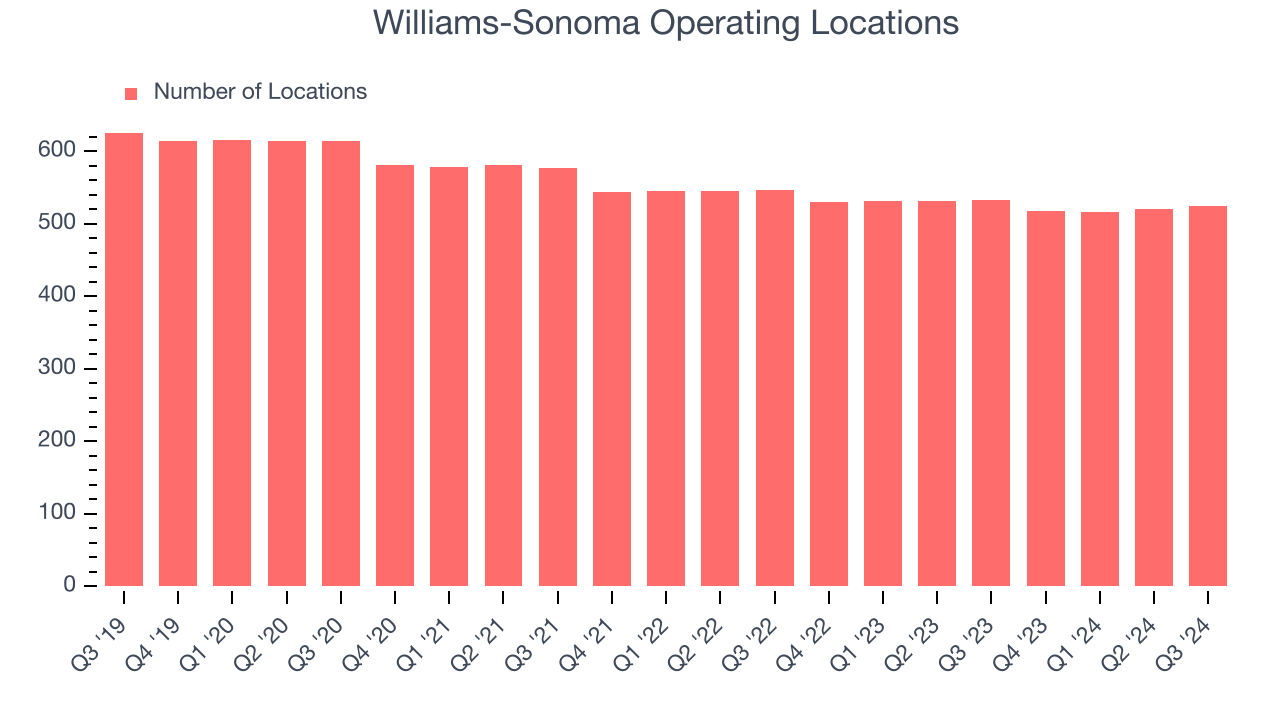

Williams-Sonoma operated 525 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at shops open for at least a year.

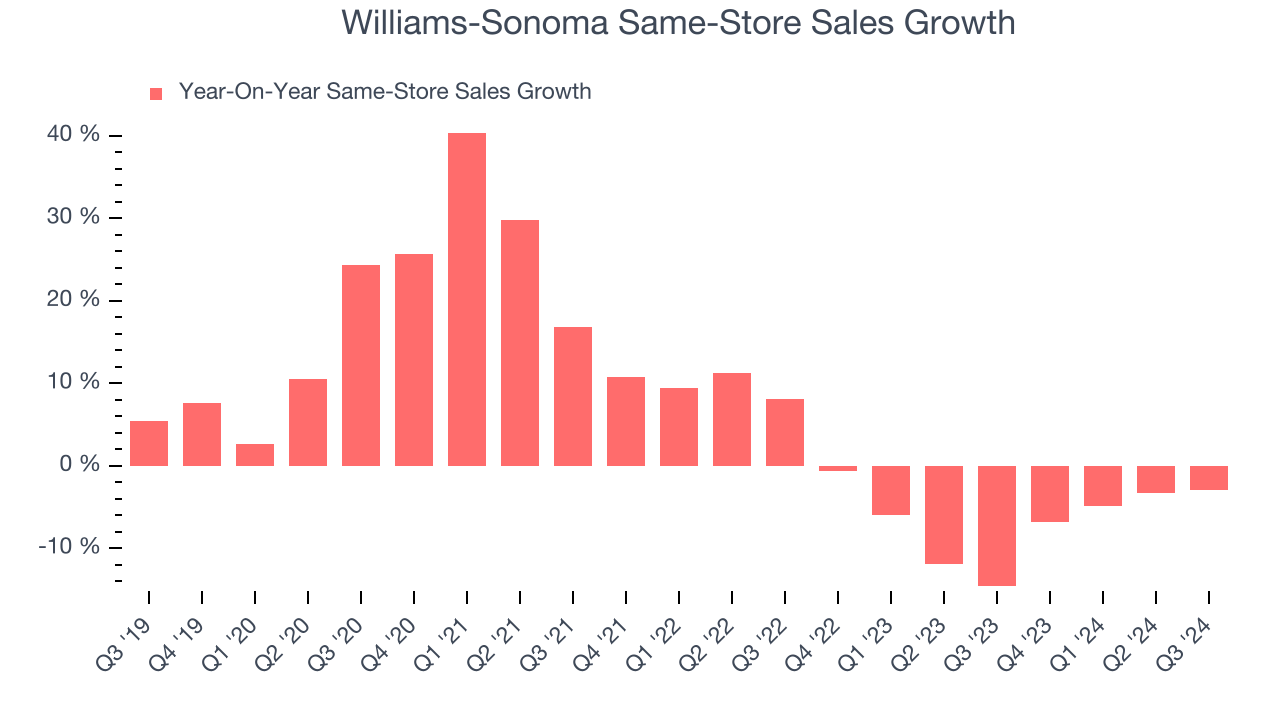

Williams-Sonoma’s demand has been shrinking over the last two years as its same-store sales have averaged 6.4% annual declines. This performance isn’t ideal, and Williams-Sonoma is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Williams-Sonoma’s same-store sales fell by 2.9% year on year. This decrease was an improvement from its historical levels. It’s always great to see a business’s demand trends improve.

Key Takeaways from Williams-Sonoma’s Q3 Results

It was encouraging to see Williams-Sonoma beat analysts’ revenue and EPS expectations this quarter. We were also happy it raised its full-year revenue and operating income guidance. Overall, this was a good quarter with some key metrics above expectations. The stock traded up 20.8% to $165.80 immediately following the results.

Indeed, Williams-Sonoma had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.