Cloud computing provider DigitalOcean (NYSE: DOCN) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 12.1% year on year to $198.5 million. The company expects next quarter’s revenue to be around $200 million, close to analysts’ estimates. Its non-GAAP profit of $0.52 per share was 28.7% above analysts’ consensus estimates.

Is now the time to buy DigitalOcean? Find out by accessing our full research report, it’s free.

DigitalOcean (DOCN) Q3 CY2024 Highlights:

- Revenue: $198.5 million vs analyst estimates of $196.8 million (in line)

- Adjusted EPS: $0.52 vs analyst estimates of $0.40 (28.7% beat)

- EBITDA: $86.72 million vs analyst estimates of $73.54 million (17.9% beat)

- Revenue Guidance for Q4 CY2024 is $200 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS Guidance for Q4 CY2024 is $0.30 million at the midpoint, missing analysts' expectations

- Gross Margin (GAAP): 60.2%, in line with the same quarter last year

- Operating Margin: 12.4%, down from 20% in the same quarter last year

- EBITDA Margin: 43.7%, in line with the same quarter last year

- Free Cash Flow Margin: 37%, up from 19.4% in the previous quarter

- Annual Recurring Revenue: $798 million at quarter end, up 11.9% year on year

- Net Revenue Retention Rate: 97%, in line with the previous quarter

- Billings: $197.3 million at quarter end, up 11.3% year on year

- Market Capitalization: $3.76 billion

“We had a successful quarter, enabling us to raise our full year revenue guidance while still maintaining full year free cash flow margin guidance,” said Paddy Srinivasan, CEO of DigitalOcean.

Company Overview

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

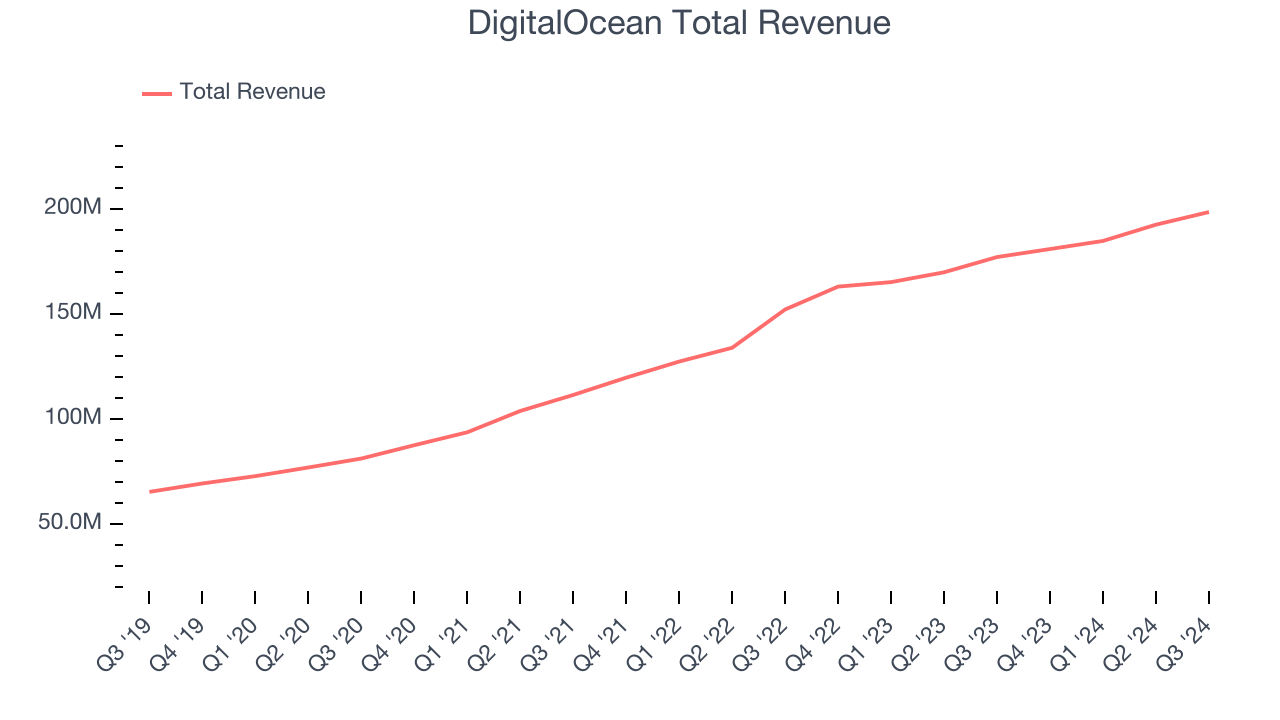

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, DigitalOcean grew its sales at a solid 24% compounded annual growth rate. This is a useful starting point for our analysis.

This quarter, DigitalOcean’s year-on-year revenue growth was 12.1%, and its $198.5 million of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 10.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and illustrates the market is factoring in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

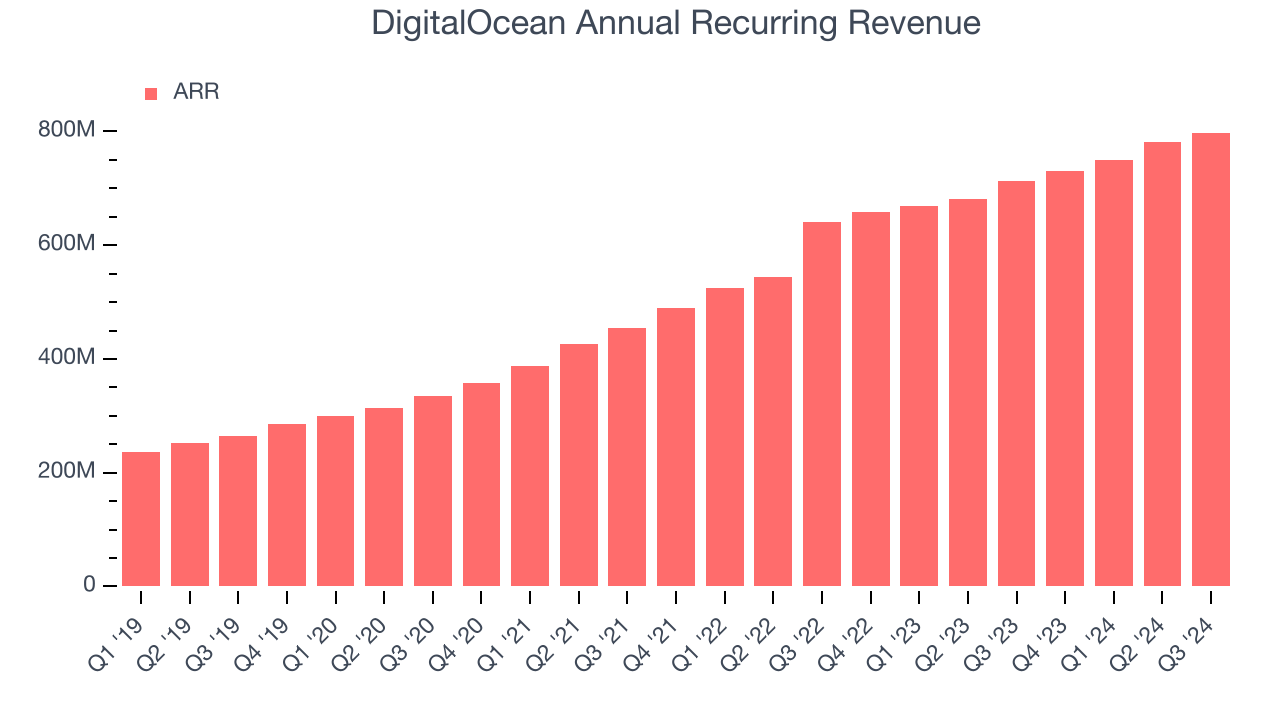

Annual Recurring Revenue

Investors interested in DigitalOcean should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, DigitalOcean’s ARR growth has slightly outpaced the sector, averaging 12.3% year-on-year increases and punching in at $798 million in the latest quarter. This performance was in line with its revenue growth and shows that the company is securing longer-term commitments. Its growth also contributes positively to DigitalOcean’s revenue predictability, a trait long-term investors typically prefer.

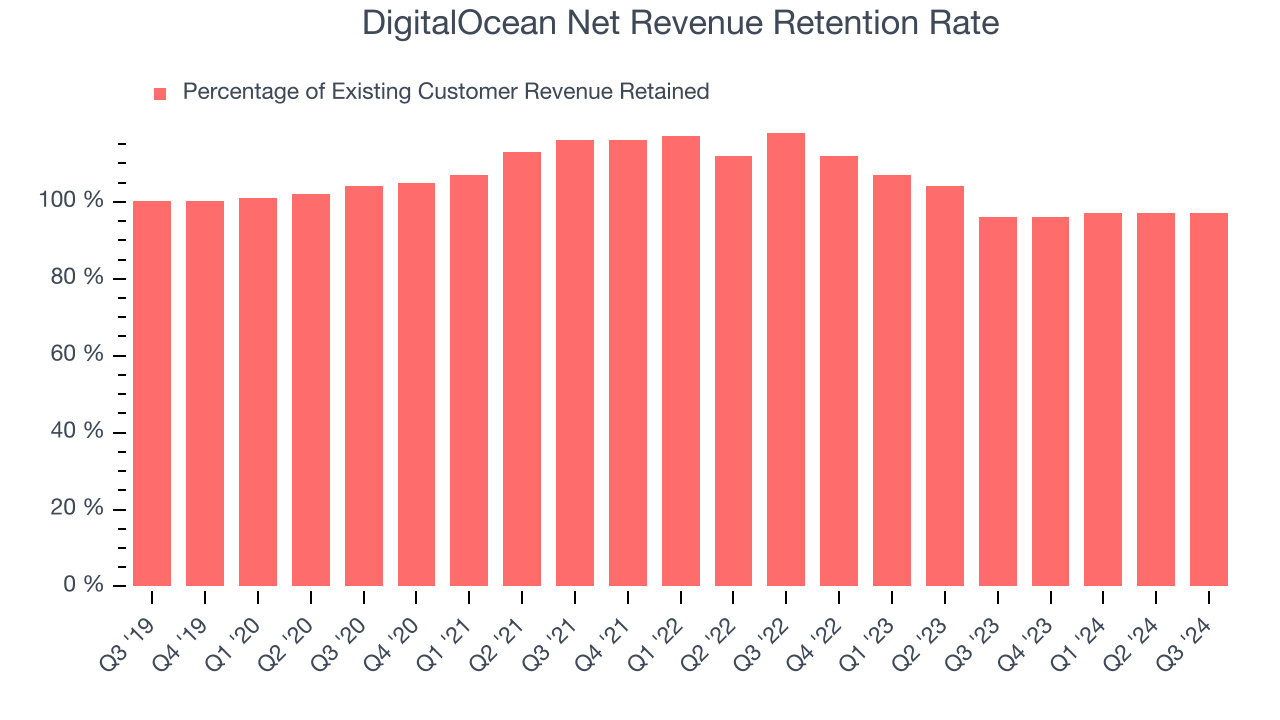

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

DigitalOcean’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 96.8% in Q3. This means DigitalOcean’s revenue would’ve decreased by 3.2% over the last 12 months if it didn’t win any new customers.

DigitalOcean has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

Key Takeaways from DigitalOcean’s Q3 Results

We liked that DigitalOcean beat analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue guidance for Q4 was just in line and its EPS forecast for next quarter missed. Overall, this quarter was mixed, with the guidance weighing on shares. The stock traded down 10.6% to $36.50 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.