Online health insurance comparison site eHealth (NASDAQ:EHTH) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 9.7% year on year to $58.41 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $482.5 million at the midpoint. Its GAAP loss of $1.83 per share was 20.3% below analysts’ consensus estimates.

Is now the time to buy eHealth? Find out by accessing our full research report, it’s free.

eHealth (EHTH) Q3 CY2024 Highlights:

- Revenue: $58.41 million vs analyst estimates of $58.86 million (in line)

- EPS: -$1.83 vs analyst expectations of -$1.52 (20.3% miss)

- EBITDA: -$34.83 million vs analyst estimates of -$34.99 million (small beat)

- The company reconfirmed its revenue guidance for the full year of $482.5 million at the midpoint

- EBITDA guidance for the full year is $16.25 million at the midpoint, below analyst estimates of $17.14 million

- Operating Margin: -74%, down from -60.9% in the same quarter last year

- EBITDA Margin: -59.6%, down from -43.4% in the same quarter last year

- Free Cash Flow was -$33.47 million compared to -$35.04 million in the previous quarter

- Estimated Membership: 1.16 million

- Market Capitalization: $149.7 million

Company Overview

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

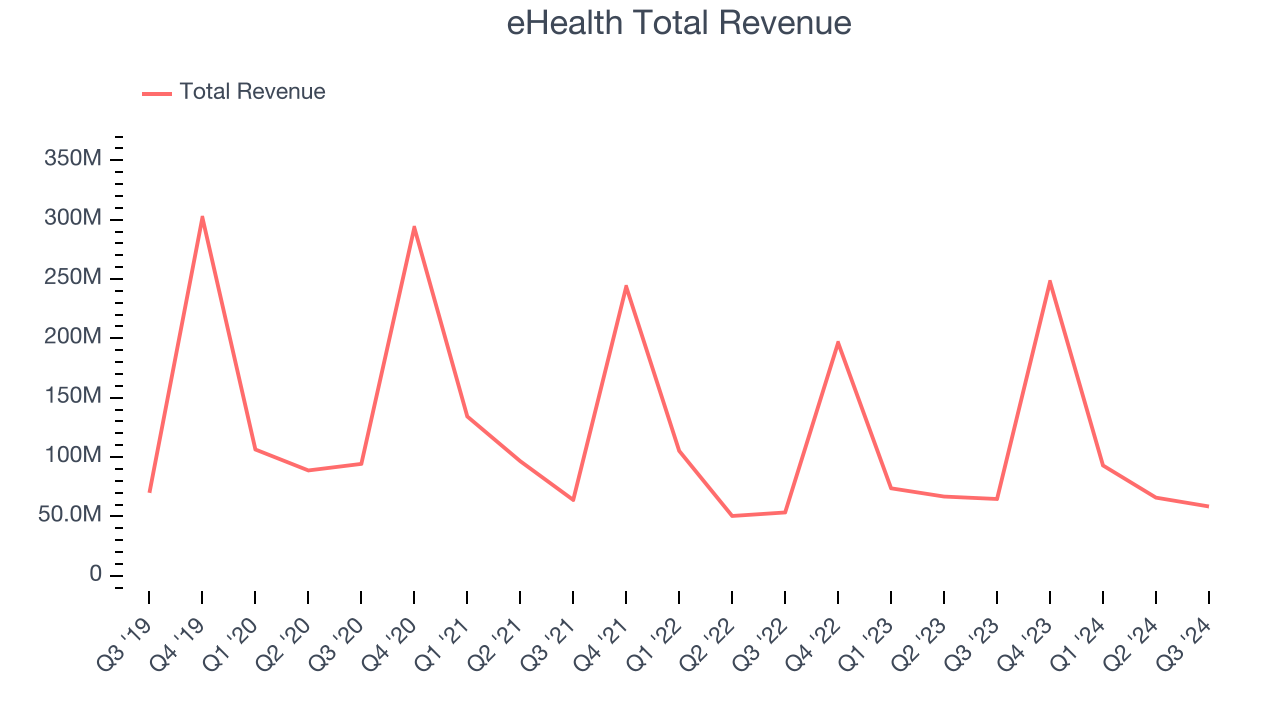

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, eHealth’s revenue declined by 7.5% per year. This shows demand was weak, a rough starting point for our analysis.

This quarter, eHealth reported a rather uninspiring 9.7% year-on-year revenue decline to $58.41 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, an acceleration versus the last three years. Although this projection illustrates the market thinks its newer products and services will catalyze better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

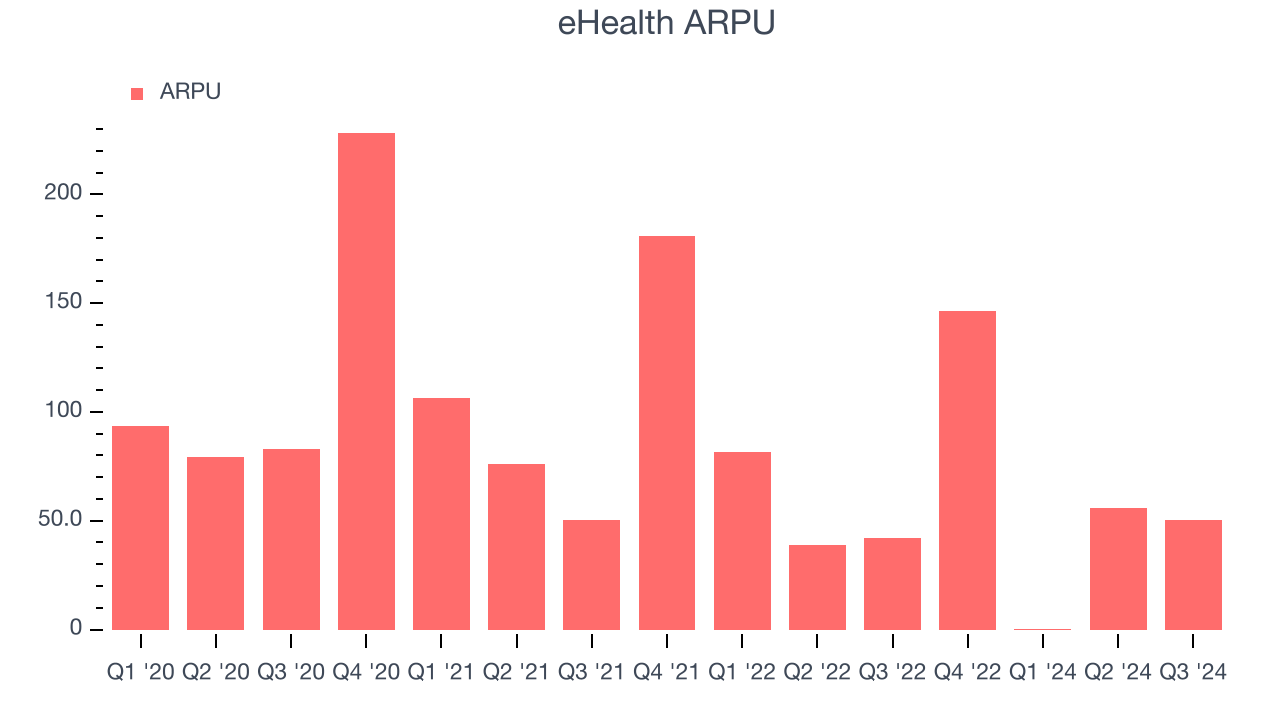

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like eHealth because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and eHealth’s take rate, or "cut", on each order.

eHealth’s ARPU fell over the last two years, averaging 18.9% annual declines. This raises questions about its ability to engage users and signals its platform’s value is eroding.

Key Takeaways from eHealth’s Q3 Results

We struggled to find many strong positives in these results as its EPS missed analysts' expectations and its full-year EBITDA guidance fell short. Overall, this quarter could have been better, but the stock traded up 7.8% to $5.50 immediately after reporting. This could be due to Donald Trump winning the presidential election and investors making speculative bets on small-cap companies as they go "risk-on".

Is eHealth an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.