Action camera company GoPro (NASDAQ:GPRO) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell 12% year on year to $258.9 million. Its non-GAAP loss of $0 per share was also 100% above analysts’ consensus estimates.

Is now the time to buy GoPro? Find out by accessing our full research report, it’s free.

GoPro (GPRO) Q3 CY2024 Highlights:

- Revenue: $258.9 million vs analyst estimates of $255 million (1.5% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.04 ($0.04 beat)

- EBITDA: $5.45 million vs analyst estimates of -$3.97 million (237% beat)

- Gross Margin (GAAP): 35.5%, up from 32% in the same quarter last year

- Operating Margin: -3.1%, down from -1.3% in the same quarter last year

- EBITDA Margin: 2.1%, in line with the same quarter last year

- Free Cash Flow was -$4.19 million compared to -$1.66 million in the same quarter last year

- Market Capitalization: $219.9 million

"While 2024 has been a challenging year for GoPro, the consumer digital imaging market is growing, and we believe our product roadmap will enable us to grow with it. And we believe our reduced operating expenses in 2025 to approximately $250 million will position us to pursue this growth opportunity as a profitable company," said Nicholas Woodman, GoPro's founder and CEO.

Company Overview

Known for sponsoring extreme athletes, GoPro (NASDAQ:GPRO) is a camera company known for its POV videos and editing software.

Consumer Electronics

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

Sales Growth

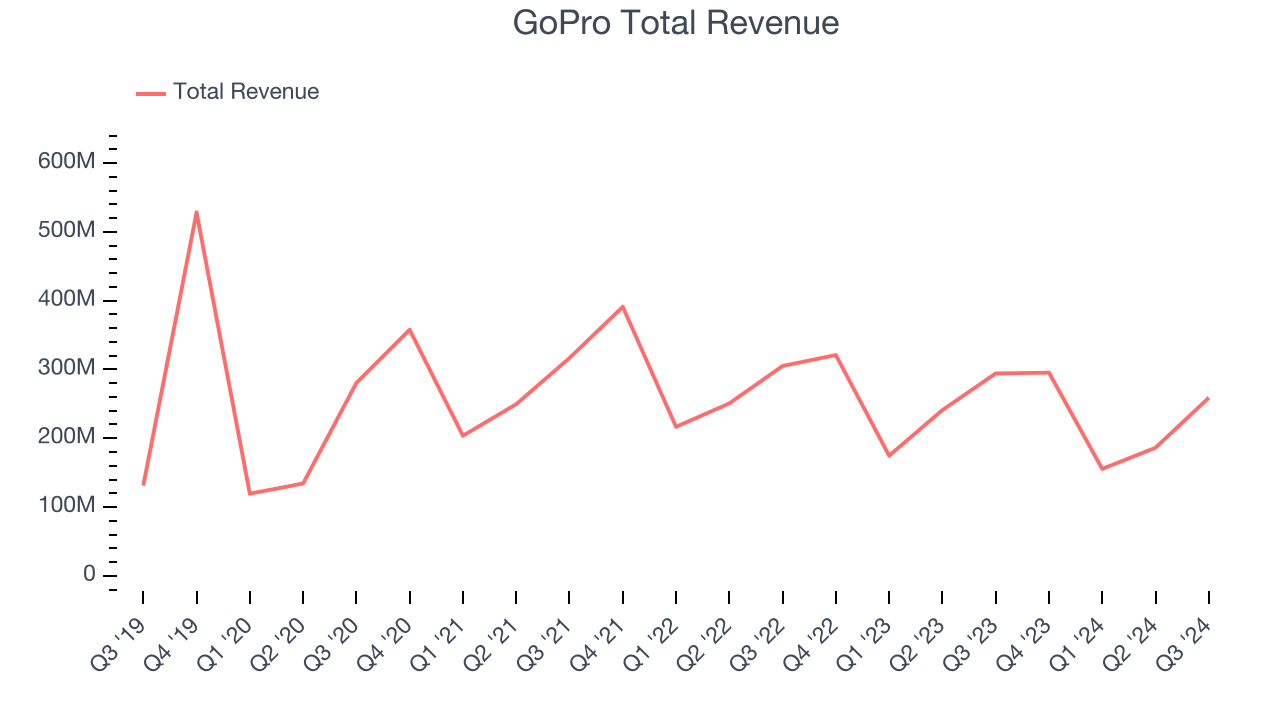

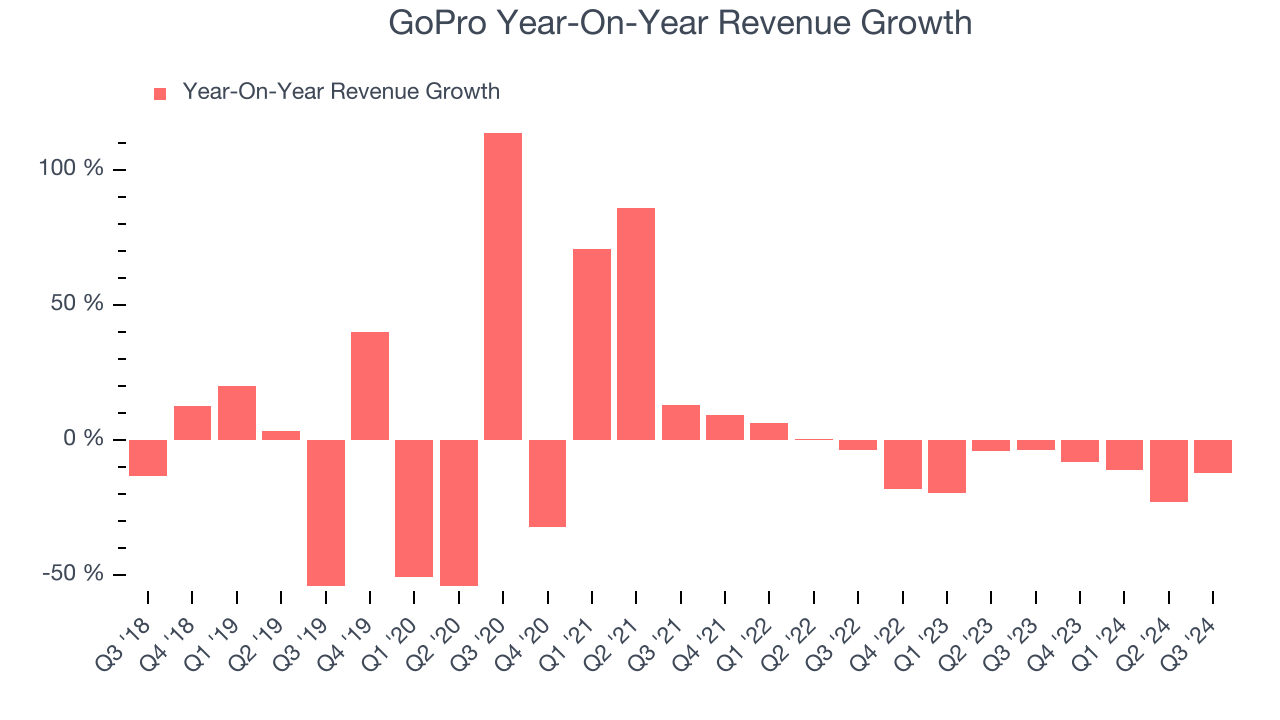

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. GoPro’s demand was weak over the last five years as its sales fell by 3% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. GoPro’s recent history shows its demand has stayed suppressed as its revenue has declined by 12.3% annually over the last two years.

This quarter, GoPro’s revenue fell 12% year on year to $258.9 million but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, an improvement versus the last two years. While this projection illustrates the market believes its newer products and services will spur better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

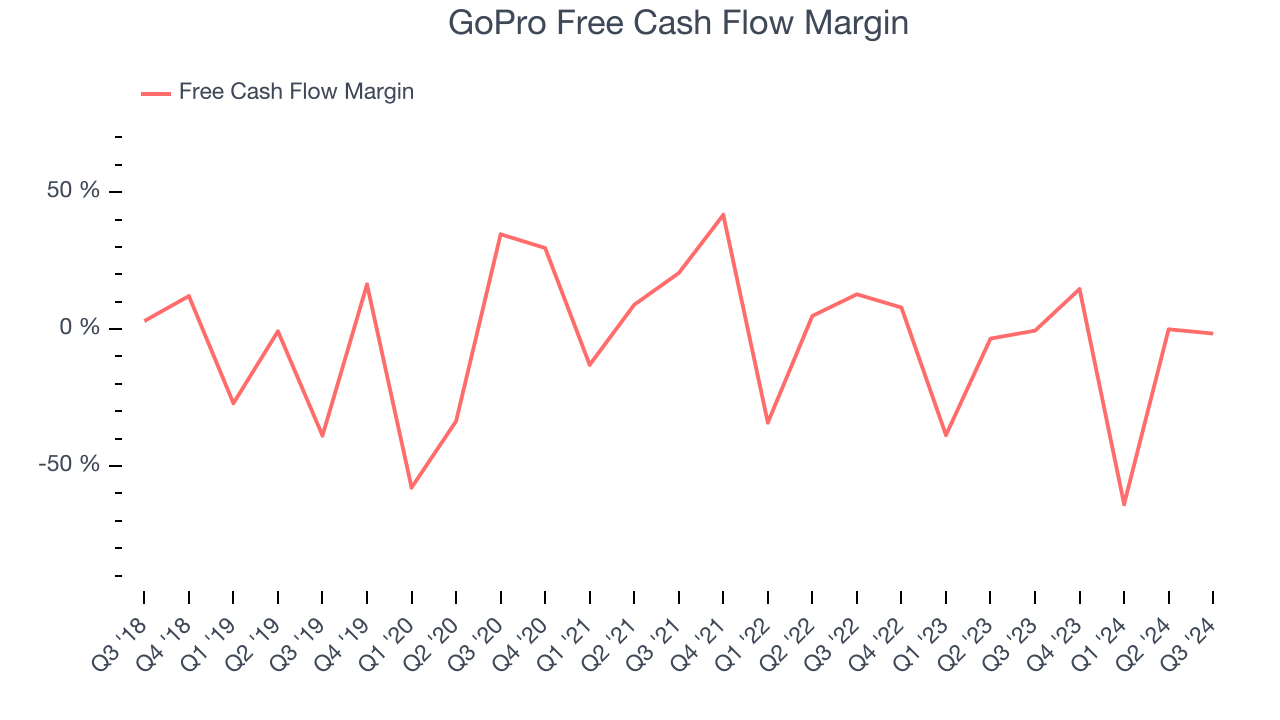

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, GoPro’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 5.8%, meaning it lit $5.85 of cash on fire for every $100 in revenue.

GoPro burned through $4.19 million of cash in Q3, equivalent to a negative 1.6% margin. The company’s cash burn was similar to its $1.66 million of lost cash in the same quarter last year.

Over the next year, analysts predict GoPro’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 6.7% for the last 12 months will increase by 6.6 percentage points.

Key Takeaways from GoPro’s Q3 Results

We were impressed by how significantly GoPro blew past analysts’ EPS expectations this quarter. We were also excited its revenue and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $1.46 immediately after reporting.

GoPro put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.