Multinational media and entertainment corporation Paramount (NASDAQ:PARA) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 5.6% year on year to $6.73 billion. Its non-GAAP profit of $0.49 per share was 102% above analysts’ consensus estimates.

Is now the time to buy Paramount? Find out by accessing our full research report, it’s free.

Paramount (PARA) Q3 CY2024 Highlights:

- Revenue: $6.73 billion vs analyst estimates of $6.97 billion (3.4% miss)

- Operating profit: $337 million vs analyst estimates of $383 million (11.9% miss)

- Adjusted EPS: $0.49 vs analyst estimates of $0.24 ($0.25 beat)

- Paramount+ added 3.5 million new subscribers (#4 global streaming video service) (beat vs expectations of 1-2 million net adds)

- Progressing on non-content cost reductions that will result in $500 million in annual run rate savings

- Gross Margin (GAAP): 35.5%, up from 34.4% in the same quarter last year

- Operating Margin: 5%, down from 8.7% in the same quarter last year

- EBITDA Margin: 6.4%, down from 10% in the same quarter last year

- Free Cash Flow Margin: 3.2%, down from 5.3% in the same quarter last year

- Market Capitalization: $8.12 billion

Company Overview

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

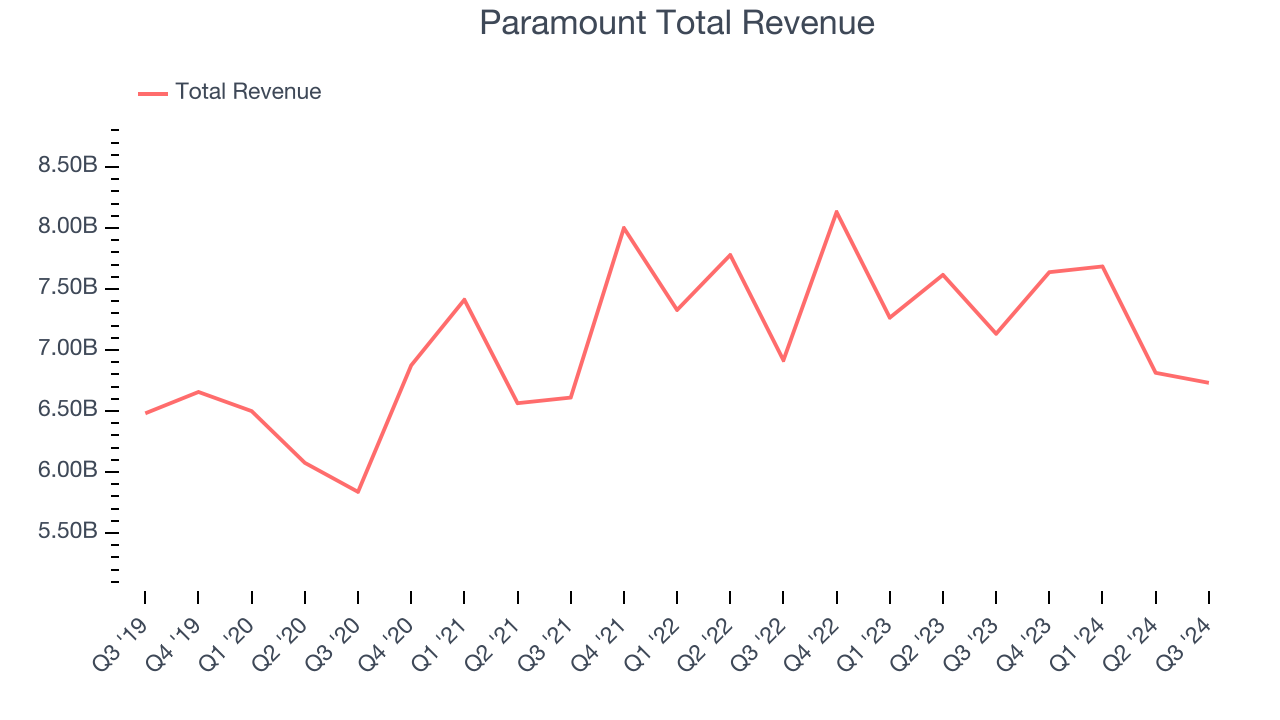

Sales Growth

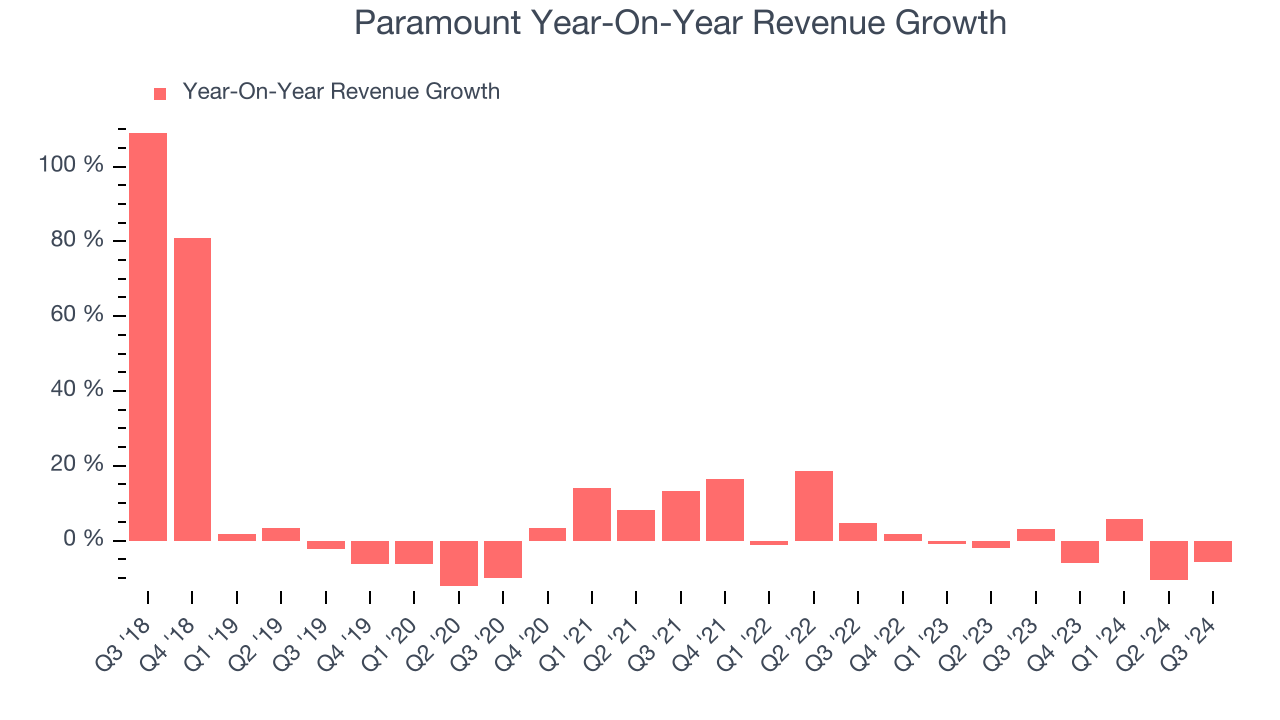

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Paramount’s sales grew at a weak 1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Paramount’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.9% annually.

Paramount also breaks out the revenue for its three most important segments: TV Media, Direct-to-Consumer, and Filmed Entertainment, which are 63.9%, 27.6%, and 8.8% of revenue. Over the last two years, Paramount’s Direct-to-Consumer revenue (streaming) averaged 28.5% year-on-year growth while its TV Media (broadcasting) and Filmed Entertainment (movies) revenues averaged 7.3% and 9.5% declines.

This quarter, Paramount missed Wall Street’s estimates and reported a rather uninspiring 5.6% year-on-year revenue decline, generating $6.73 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, an improvement versus the last two years. Although this projection indicates the market thinks its newer products and services will fuel better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

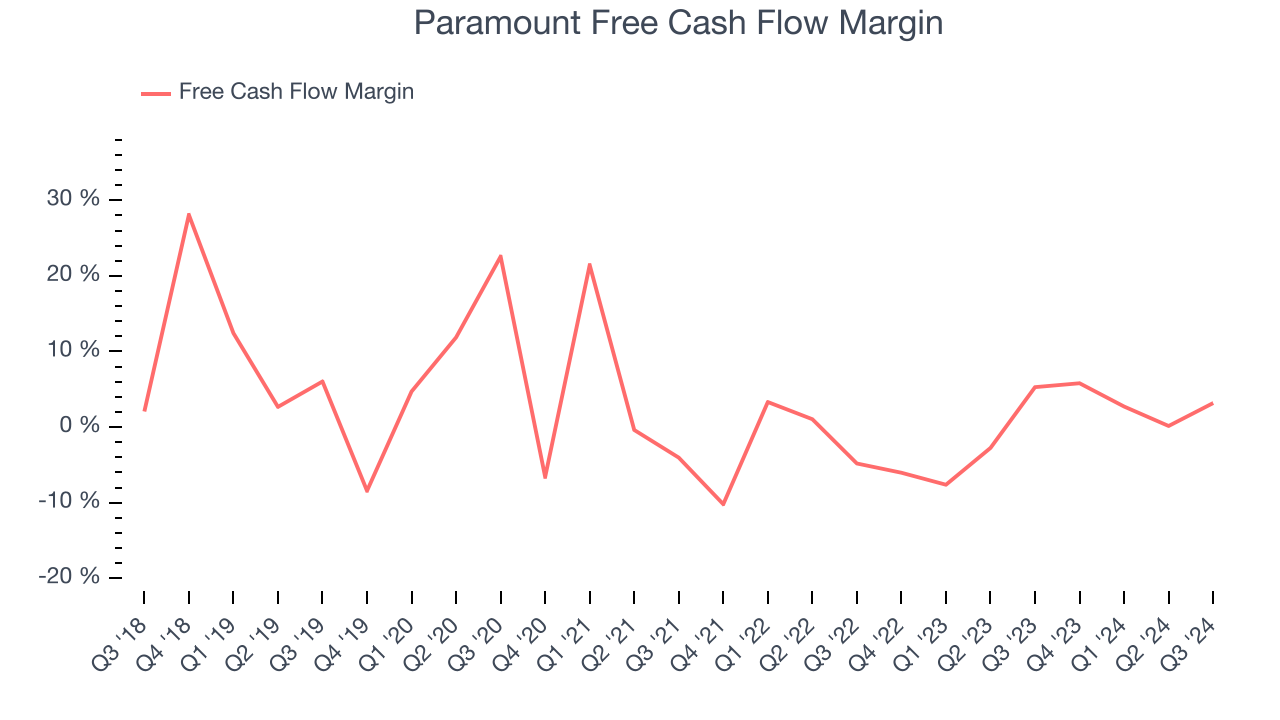

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Paramount broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Paramount’s free cash flow clocked in at $214 million in Q3, equivalent to a 3.2% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict Paramount’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 3% for the last 12 months will decrease to 1.9%.

Key Takeaways from Paramount’s Q3 Results

Although revenue and EBIT missed, Paramount+ added 3.5 million subscribers. For media companies such as Paramount that are trying to pivot from traditional cable TV to streaming, the market is paying extra attention to the success of the streaming platforms. Paramount is also making progress on non-content cost savings that will total $500 million run rate, important because the market is no longer rewarding streaming growth at any cost. The stock traded up 2.6% to $11.85 immediately after reporting.

So should you invest in Paramount right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.