Over the past six months, Park-Ohio has been a great trade, beating the S&P 500 by 5%. Its stock price has climbed to $30.32, representing a healthy 17.1% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Park-Ohio, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why you should be careful with PKOH and a stock we'd rather own.

Why Do We Think Park-Ohio Will Underperform?

Based in Cleveland, Park-Ohio (NASDAQ:PKOH) provides supply chain management services, capital equipment, and manufactured components.

1. Long-Term Revenue Growth Flatter Than a Pancake

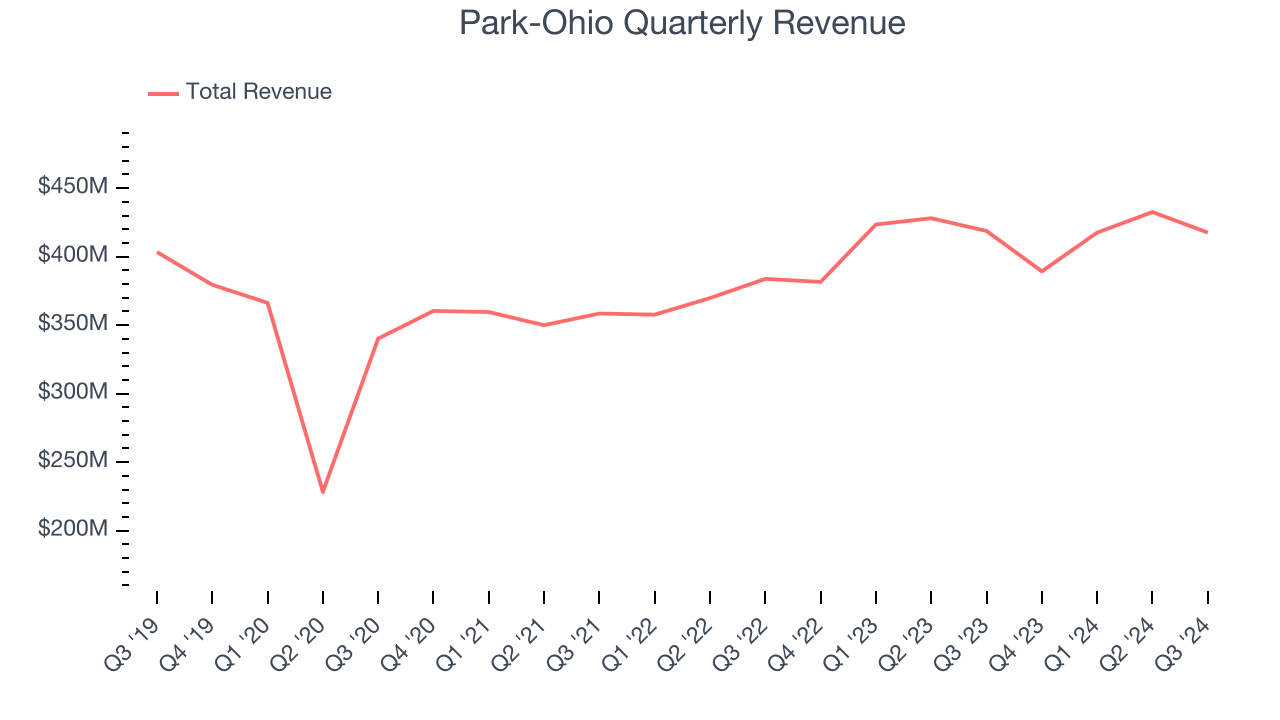

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Park-Ohio struggled to consistently increase demand as its $1.66 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business.

2. Breakeven Free Cash Flow Limits Reinvestment Potential

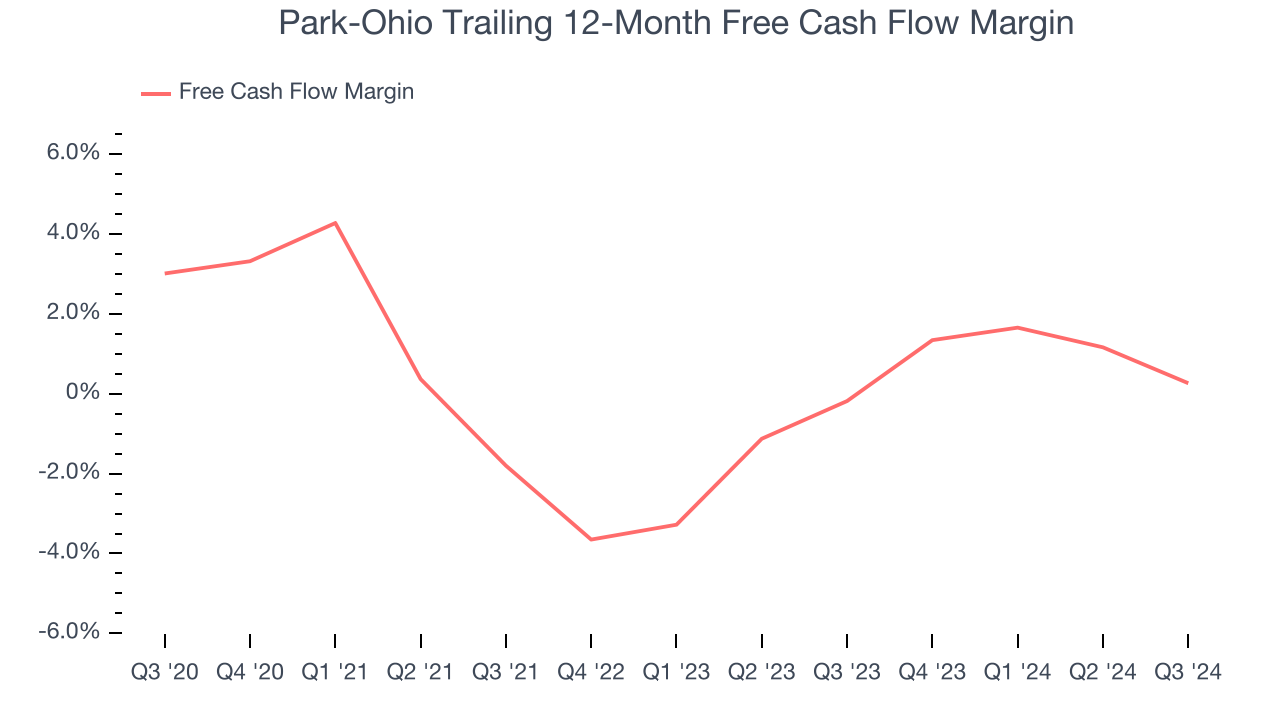

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Park-Ohio broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

3. High Debt Levels Increase Risk

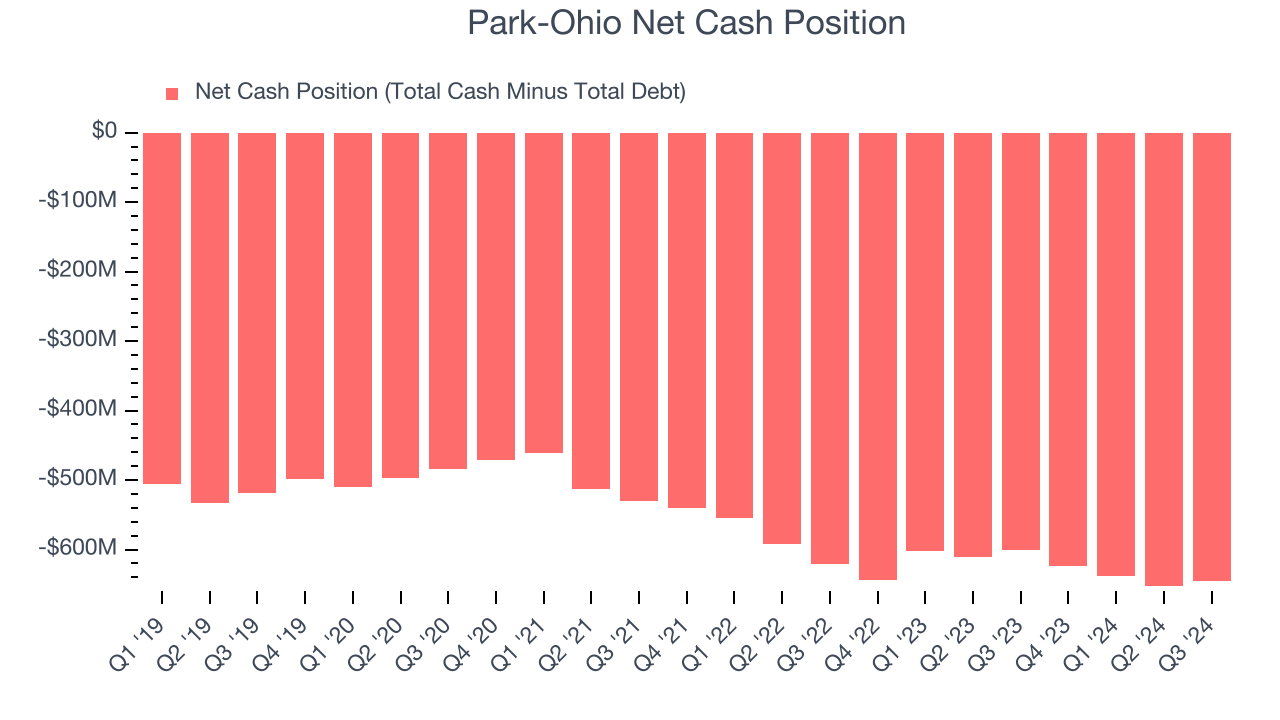

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Park-Ohio’s $705 million of debt exceeds the $59.5 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $112.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Park-Ohio could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Park-Ohio can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Park-Ohio doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 8.6× forward price-to-earnings (or $30.32 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than Park-Ohio

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.