What a time it’s been for Shake Shack. In the past six months alone, the company’s stock price has increased by a massive 49.9%, reaching $129.80 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Shake Shack, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we're cautious about Shake Shack. Here are three reasons why we avoid SHAK and a stock we'd rather own.

Why Is Shake Shack Not Exciting?

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

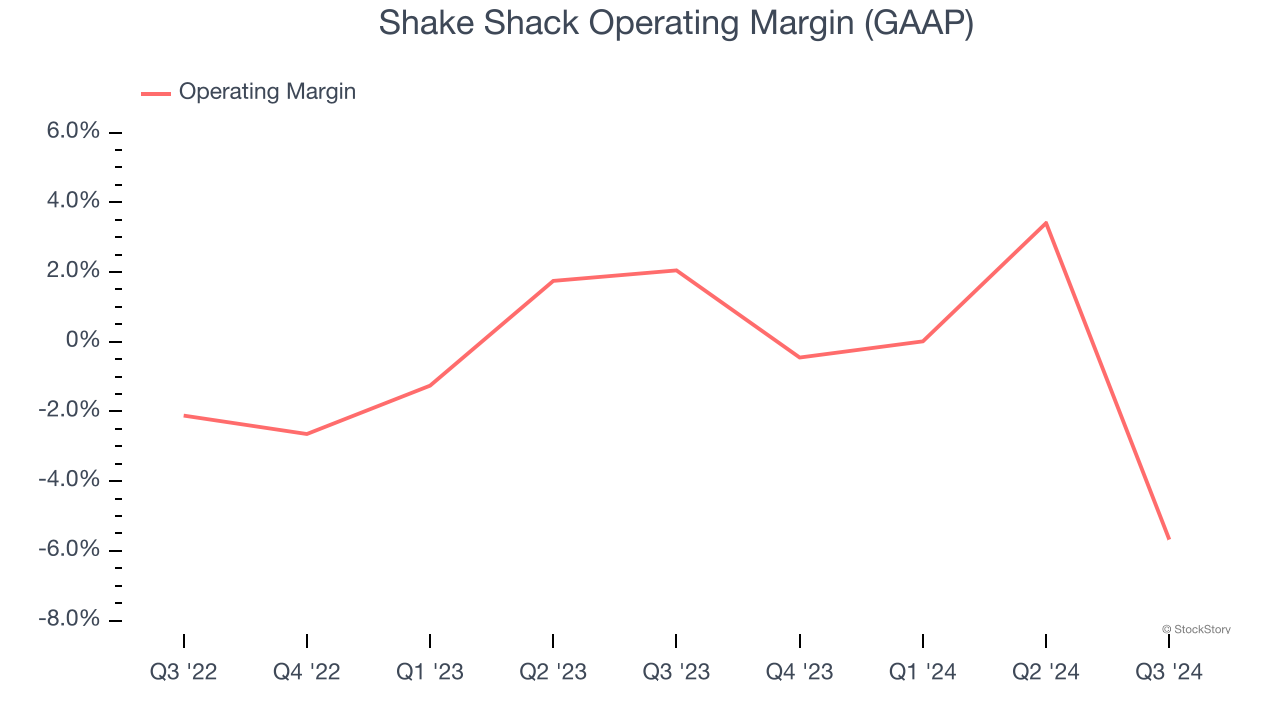

1. Breakeven Operating Raises Questions

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Shake Shack was roughly breakeven when averaging the last two years of quarterly operating profits, one of the worst outcomes in the restaurant sector. This result is surprising given its high gross margin as a starting point.

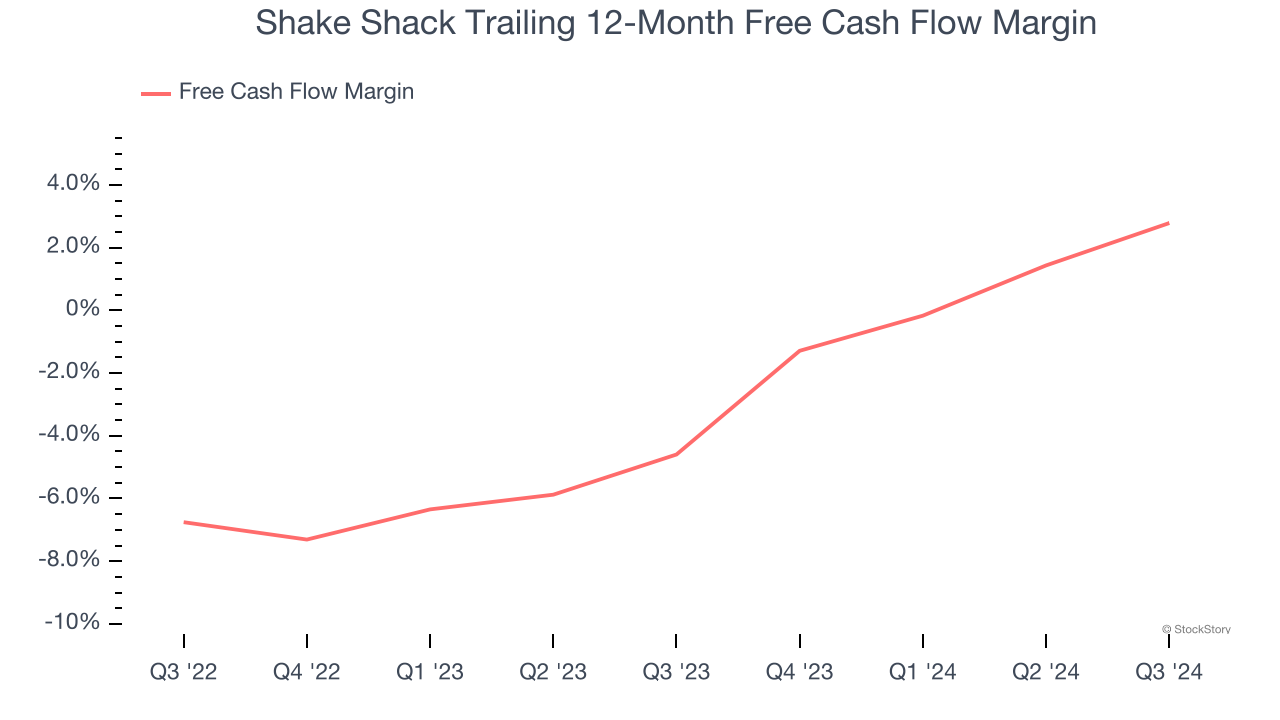

2. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Shake Shack broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Shake Shack’s five-year average ROIC was negative 2.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

Shake Shack isn’t a terrible business, but it doesn’t pass our quality test. Following the recent surge, the stock trades at 140.1× forward price-to-earnings (or $129.80 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Would Buy Instead of Shake Shack

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.