Kraft Heinz currently trades at $30.72 per share and has shown little upside over the past six months, posting a small loss of 4%. The stock also fell short of the S&P 500’s 7.3% gain during that period.

Is now the time to buy Kraft Heinz, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We're swiping left on Kraft Heinz for now. Here are three reasons why we avoid KHC and a stock we'd rather own.

Why Do We Think Kraft Heinz Will Underperform?

The result of a 2015 mega-merger between Kraft and Heinz, Kraft Heinz (NASDAQ:KHC) is a packaged foods giant whose products span coffee to cheese to packaged meat.

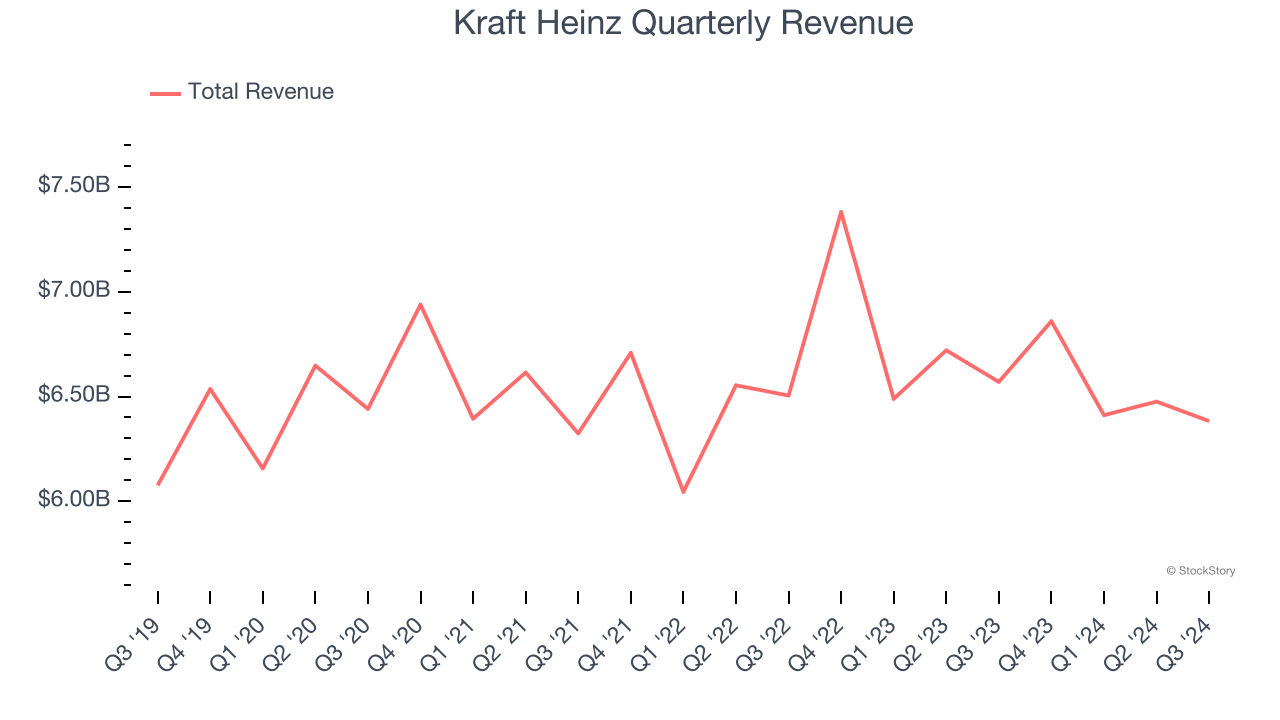

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Kraft Heinz struggled to consistently increase demand as its $26.13 billion of sales for the trailing 12 months was close to its revenue three years ago. This fell short of our benchmarks and is a sign of poor business quality.

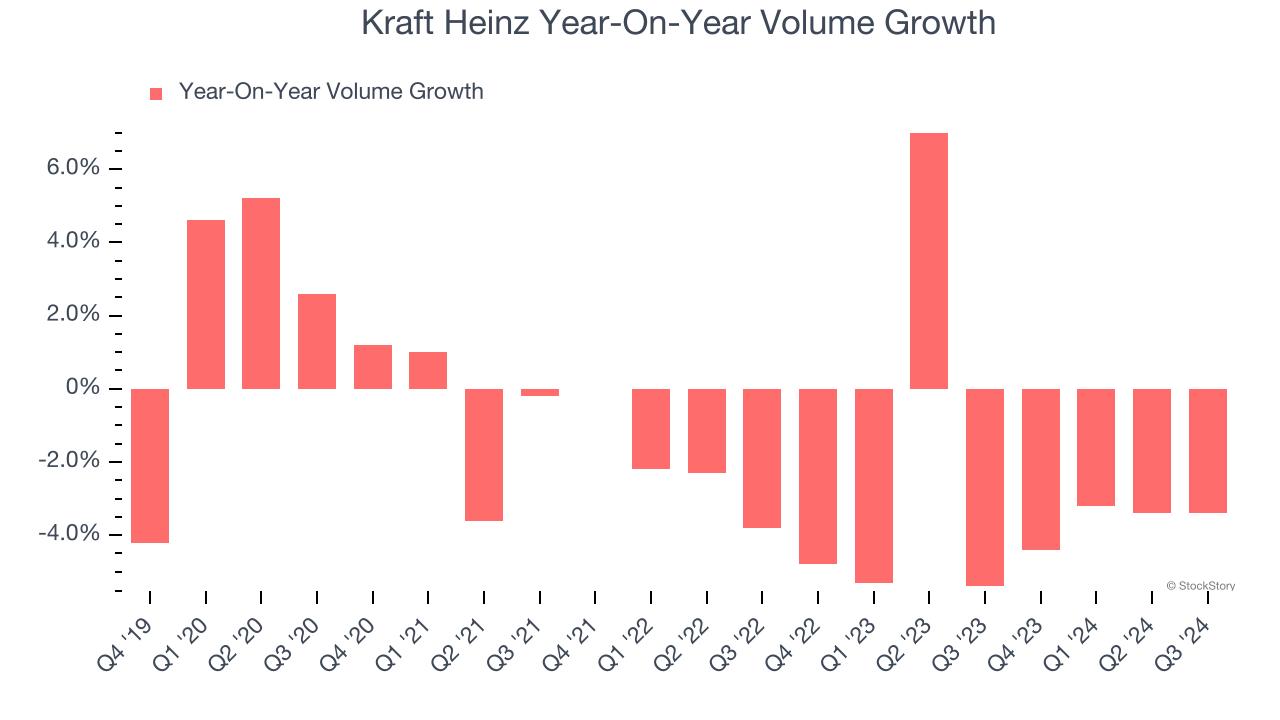

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Kraft Heinz’s average quarterly sales volumes have shrunk by 2.9% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

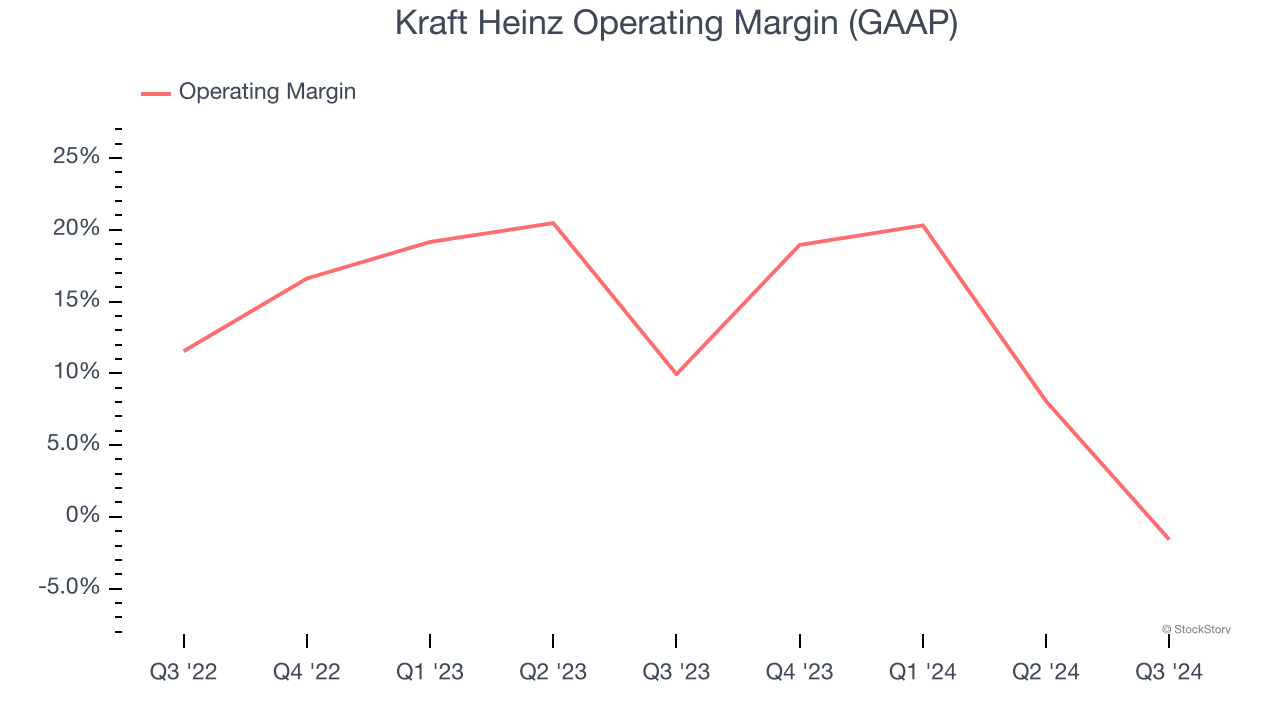

3. Operating Margin Falling

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Looking at the trend in its profitability, Kraft Heinz’s operating margin decreased by 5 percentage points over the last year. Even though its historical margin is high, shareholders will want to see Kraft Heinz become more profitable in the future. Its operating margin for the trailing 12 months was 11.6%.

Final Judgment

Kraft Heinz falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 9.8× forward price-to-earnings (or $30.72 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Like More Than Kraft Heinz

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.