Freight transportation and logistics provider Saia (NASDAQ:SAIA) announced better-than-expected revenue in Q4 CY2024, with sales up 5% year on year to $789 million. Its GAAP profit of $2.84 per share was 2.6% above analysts’ consensus estimates.

Is now the time to buy Saia? Find out by accessing our full research report, it’s free.

Saia (SAIA) Q4 CY2024 Highlights:

- Revenue: $789 million vs analyst estimates of $777.3 million (5% year-on-year growth, 1.5% beat)

- EPS (GAAP): $2.84 vs analyst estimates of $2.77 (2.6% beat)

- Operating Margin: 12.9%, down from 15% in the same quarter last year

- Free Cash Flow was -$3.52 million, down from $62.91 million in the same quarter last year

- Sales Volumes rose 10.1% year on year (8.2% in the same quarter last year)

- Market Capitalization: $12.73 billion

Saia President and CEO, Fritz Holzgrefe, commented on the year stating, “I am pleased with the progress we made this year, as we opened 21 new terminals and relocated 9 others, further enhancing our service offerings in both new and existing markets. We are proud to bring our 100th year in operation to a close with 214 terminals and our ability to provide direct service to all 48 contiguous states, positioning us as a leading national carrier. We remain focused on operational excellence and are pleased with customer acceptance thus far. We onboarded approximately 1,300 new team members during the year and closed 2024 with over 15,000 employees company-wide.”

Company Overview

Pivoting its business model after realizing there was more success in delivering produce than selling it, Saia (NASDAQ:SAIA) is a provider of freight transportation solutions.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

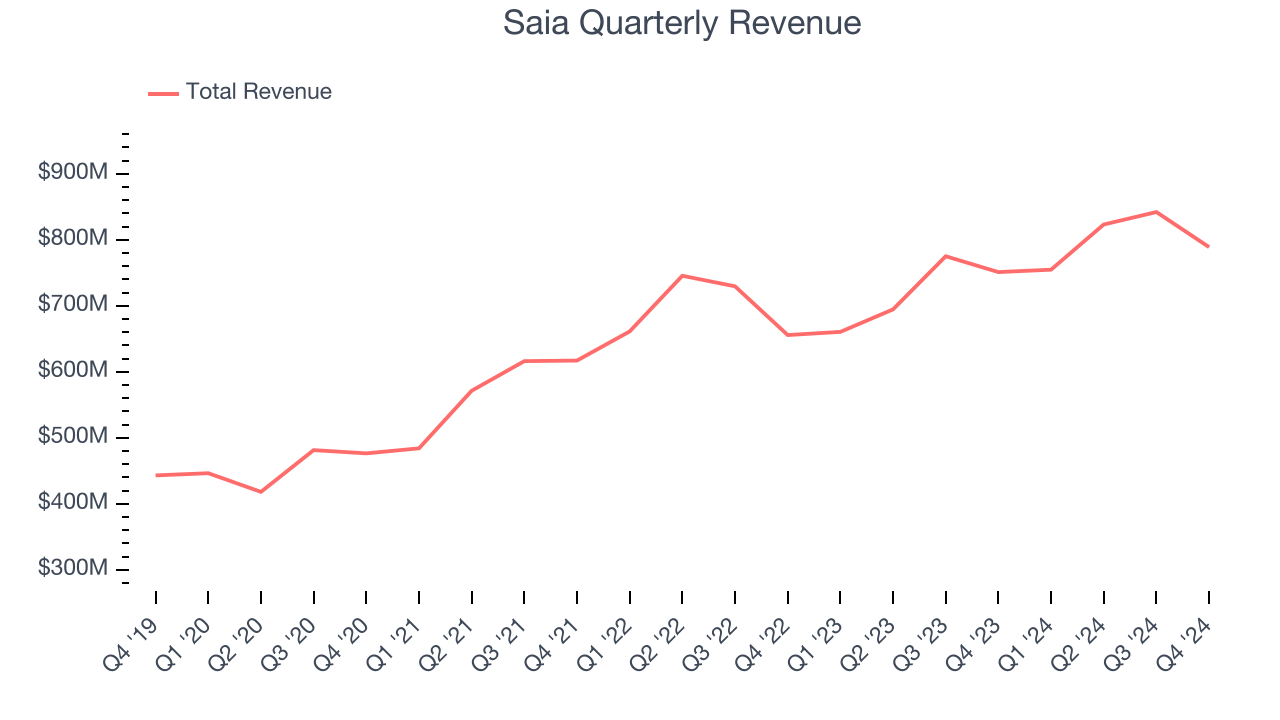

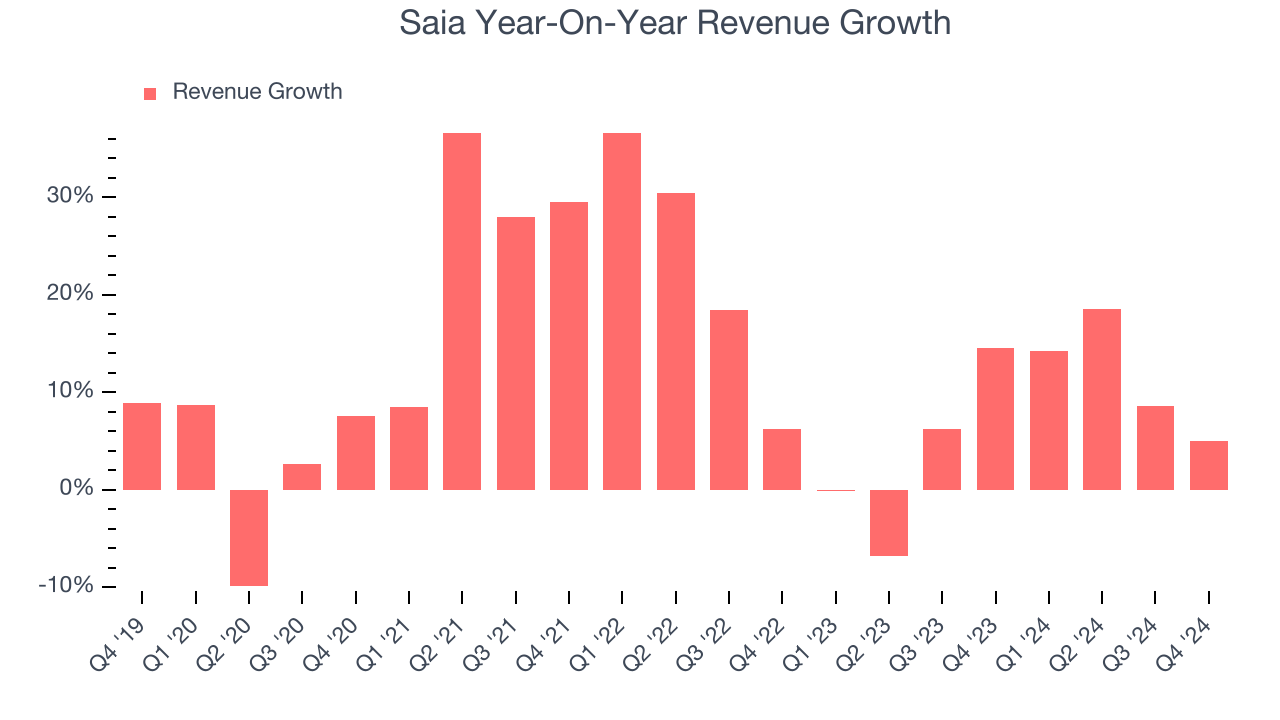

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Saia’s sales grew at an excellent 12.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Saia’s recent history shows its demand slowed significantly as its annualized revenue growth of 7.2% over the last two years is well below its five-year trend. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Saia grew slower than we’d like, it did perform better than its peers.

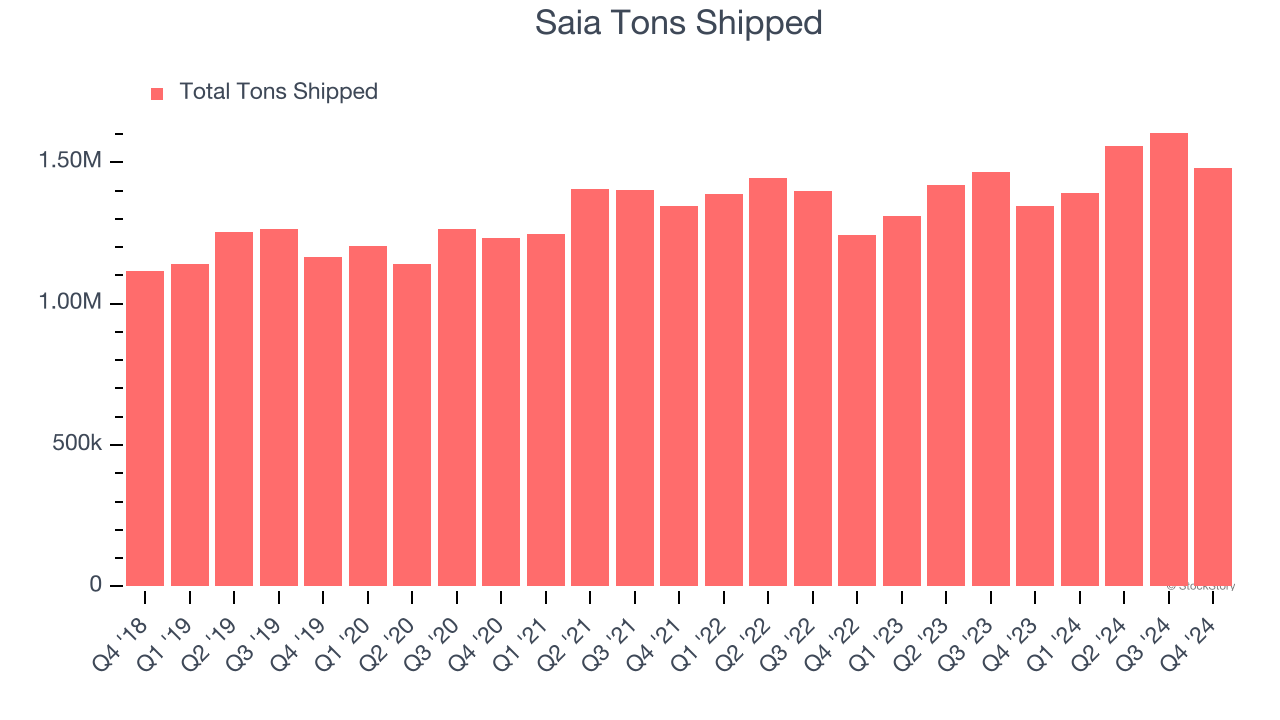

We can better understand the company’s revenue dynamics by analyzing its tons shipped, which reached 1.48 million in the latest quarter. Over the last two years, Saia’s tons shipped averaged 5.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Saia reported year-on-year revenue growth of 5%, and its $789 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and implies its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

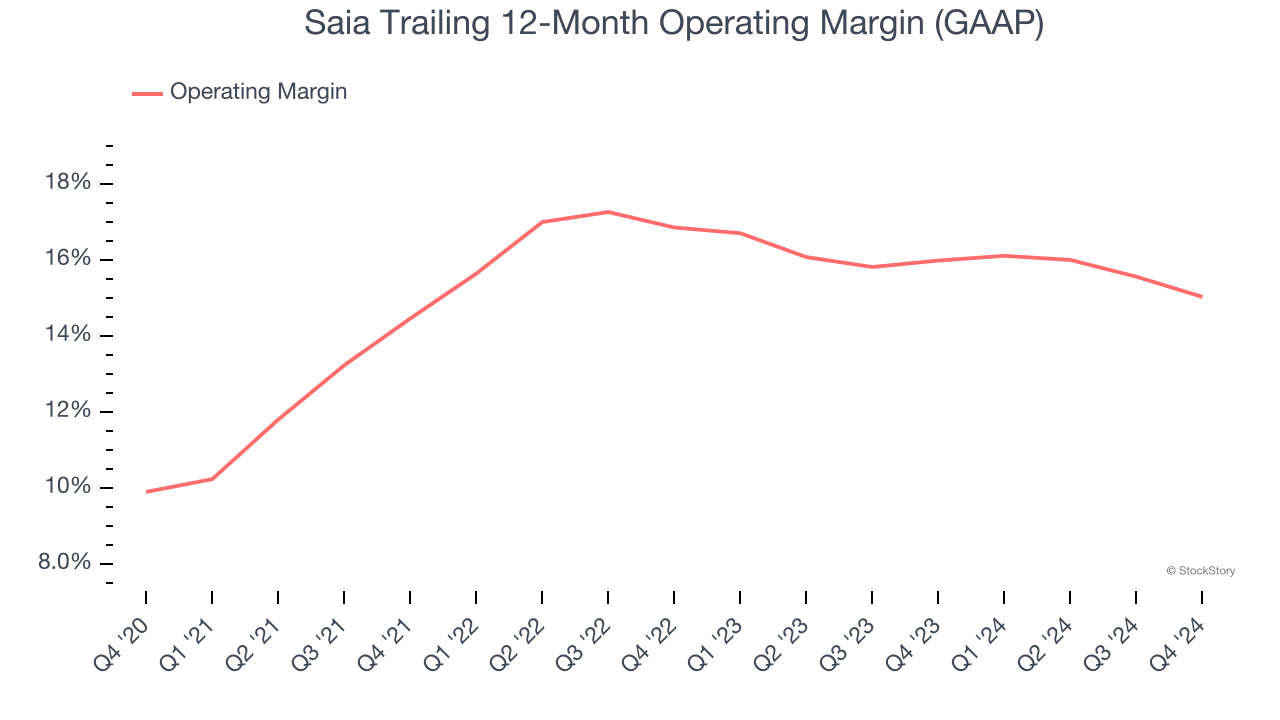

Saia has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Saia’s operating margin rose by 5.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Saia generated an operating profit margin of 12.9%, down 2.1 percentage points year on year. Since Saia’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

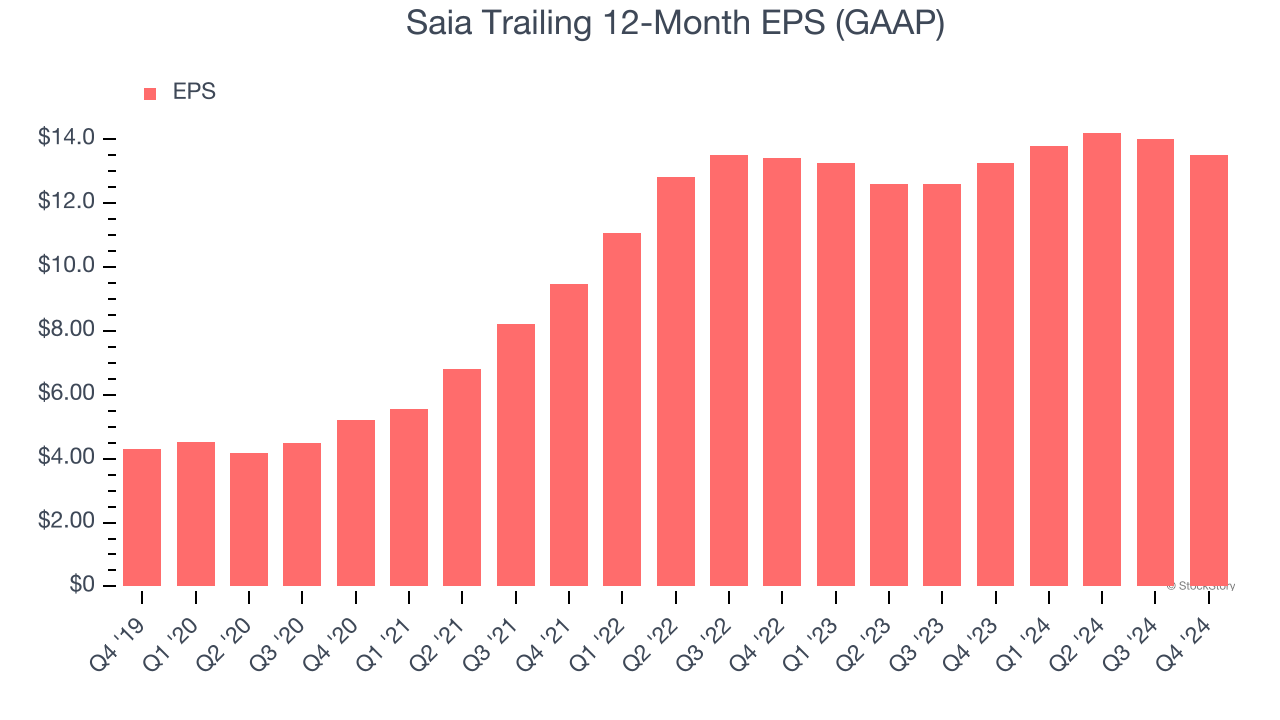

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Saia’s EPS grew at an astounding 25.7% compounded annual growth rate over the last five years, higher than its 12.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Saia’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Saia’s operating margin declined this quarter but expanded by 5.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Saia, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, Saia reported EPS at $2.84, down from $3.33 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects Saia’s full-year EPS of $13.51 to grow 14.2%.

Key Takeaways from Saia’s Q4 Results

We enjoyed seeing Saia exceed analysts’ sales volume expectations this quarter, which led to a revenue beat. In addition, EPS exceeded expectations. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 5.1% to $505.02 immediately after reporting.

Saia may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.