(Please enjoy this updated version of my weekly commentary published January 31, 2022 from the POWR Growth newsletter).

First, let’s do our normal review of the past week:

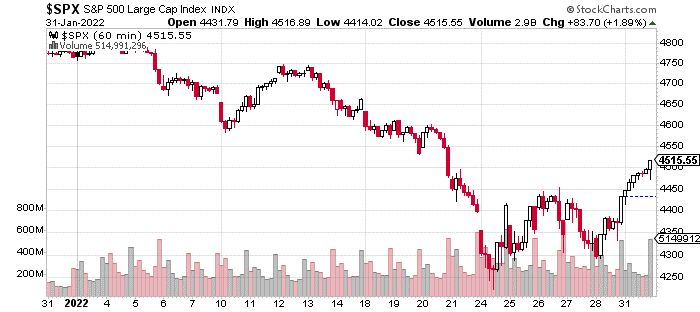

As noted in the Intro, the past week saw us whip around in a wide range between 4,250 and 4,450. Due to the selling, the market did reach extremes in bearish sentiment and oversold technical readings that have reliably predicted good buying opportunities throughout this bull market.

While, I had my doubts that it would be just as simple this time, the market has clearly broken higher from last week’s range on strong volume.

I do believe there are some positive developments under the surface. We saw gains across the board rather than gains that were concentrated in a handful of stocks and sectors which was the case last week.

We also saw the type of “relentless buying” that marks important inflection points in the market and can be powerful enough to cause a change in trend.

However, I don’t think this means that we should throw caution out of the window. At times over the past few months, we’ve switched from an aggressive posture to a more defensive one.

Given these developments, it’s appropriate to switch to a more neutral stance, loosen our risk controls, and reduce our focus on risk and the downside of our holdings.

Bull or Bear?

To be clear, this question cannot be definitively answered. And only a charlatan will pretend like they can. The best we can do is look at it in terms of probabilities.

And my neutral stance is kind of a spoiler to where I stand. But, let’s recap some of the arguments on each side.

The bearish argument centers around the economy slowing at the same time that the Fed is embarking upon a hiking cycle. Just like the combination of an accelerating economy and a dovish Fed was like jet fuel for equities, the inverse will create a similar dynamic.

In fact, we kind of had this circumstance in late 2018 when the Fed was hiking just as the economy was rolling over.

It caused more than a 20% drop in stock prices, and the Fed was forced to terminate its hiking cycle after a couple of hikes. Another component of this argument is that the Fed won’t be able to easily pivot like it did in 2018 due to inflation that is running above 7%.

And, now let’s look at the bullish argument. The main feature is that economic growth and earnings are strong enough to withstand the headwind from marginally higher rates.

Second, inflation is bound to come lower especially as it had more to do with supply chain issues rather than inflation that is entrenched into the system.

Third, the market drop has resulted in valuations getting much more attractive and has wrung out many of the excesses. Fourth, the market has priced in a lot of hawkishness with the consensus now being between 4 and 5 rate hikes in 2022.

I think both sides make good arguments. The bears have a point that the Fed turning hawkish does change things, and it already has led to a more challenging market environment.

The bulls make a good point that a lot of bad news is priced into the market which means a positive surprise like inflation declining or the Fed going slower than expected could cause stocks to rally.

Change in Character

This discussion while interesting is mostly academic. What’s more certain is that we are seeing a subtle change in character for the market. For much of the past year, cyclicals have led the market higher but now they are faltering.

I think we could be due for a rotation, type trade out of cyclicals and back into tech and long-term growth stocks. Some of the stocks in this category that I’m watching are VEEV, RMD, and ZTS. All of these stocks are down between 25 and 40% from their recent highs which means they are due for big bounces simply for technical reasons.

However, these companies have shown no slowing in their earnings and revenue growth unlike many of the tech and growth stocks which are also down by similar amounts.

So, I think the bull vs bear argument is merely a sideshow. The real opportunity right now is in identifying the growth stocks that have been unfairly punished during the market correction.

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +48.22% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $450.11 per share on Tuesday afternoon, up $0.20 (+0.04%). Year-to-date, SPY has declined -5.23%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Is the Bull Market Ready to Run Again? appeared first on StockNews.com