After 14 years of development, blockchain has developed from a simple digital currency represented by BTC to a huge decentralized digital ecosystem. Public blockchains, DeFi, GameFi, NFT and DAO are working together to improve the blockchain ecosystem. According to the statistics of Huobi Global, there are currently more than 320 million crypto users worldwide, and the total investment in the primary crypto market exceeded 27.7 billion in 2022. The vigorous development of blockchain has brought rich return on investment to crypto users; meanwhile, the collapse of such projects as Luna and FTX has also reminded investors that the high return of crypto market is also accompanied by high risks. It is necessary to carefully analyze and select a right track if you want to obtain ideal return on investment.

The best projects to invest in

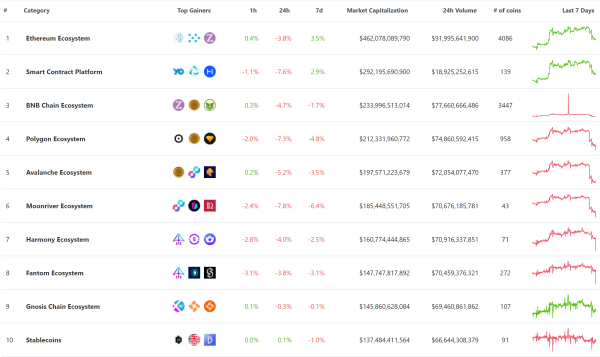

According to the CMC digital currency market cap ranking, the top 20 ones include BTC, ETH, USDT, BNB, USDC, XRP, BUSD, ADA, DOGE, MATIC, SOL, LTC, DAI, DOT, TRX, SHIB, UNI, AVAX, LEO and ATOM. Among them, ETH, ADA, MATIC, SOL, DOT, TRX, AVAX, ATOM are public chain tokens, with a highest percentage of 40%. If the four stablecoins are removed, the proportion of public chains will reach 50%. Statistics of CoinGecko show that public chain projects occupy the top nine places in terms of market cap, while NFT and GameFi, both of which have developed rapidly in the past two years, respectively rank 24th and 30th. Therefore, the data tells that the public chains outshines the other blockchain projects with its rapid development and highest market cap.

Public chains: digital assets with the highest return

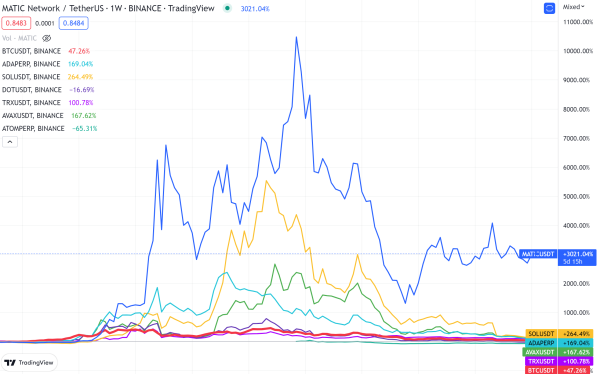

As displayed in the following historical K-line chart of TradingView, during the early stage of the bull market, the public chains had much larger increases in price changes than BTC (with bold red line), with Matic rising by 142 times at its highest price, SOL 117 times, and BTC 0.6 times. However, when you look at them in during a downward trend, prices of the public chain tokens had larger declines. Therefore, it is less risky to invest in projects in their early stages when their markets are still at their lows.

Characteristics of promising public chains

It is found that promising public chain projects have strong teams and investment backgrounds, and advanced technologies. Take Solana, Avalanche and Polkadot as examples.

1. Team

Solana: It has a mature and experienced technology team composed of former employees from Qualcomm, Google, Dropbox and Apple.

Avalanche: Ava Labs has more than 110 employees, most of whom have rich technical experience. Emin Gun Sirer, the founder and CEO of the company, is an associate professor of computer science at Cornell University, mainly focusing on distributed systems and algorithms.

Polkadot: Its founder Gavin Wood is the co-founder of Ethereum, the author of Ethereum Yellow Paper and one of the veteran crypto geeks.

2. Technology

Solana: The Proof of Work (POH) consensus mechanism allows each node to generate timestamps locally instead of on the chain, which provides high scalability and low transaction fees, making it different from other networks.

Avalanche: With a new Byzantine Fault Tolerance (BFT) consensus, the whole network has the characteristics of low latency and high scalability. A three-chain framework is used, and the subnet must be the validator of the mainnet, which make its network of high security.

Polkadot: A heterogeneous multi-chain framework is used, with the relay chain and parachains combined to enable cross-chain exchange of data and higher scalability.

3. Investment background

Solana: Alameda Research, CMS Holdings, CoinShares, Jump Trading, Multicoin Capital, Sino Global Capita, etc.

Avalanche:Polychain, a16z, ThreeArrows, Bitmain, Galaxy Digital, Dragonfly Capital, NGC Ventures, Initialized Capital, etc.

Polkadot:Bosst VC, Pantera Capital Polychain Capital, etc.

Public chains with great potential

The following public chain projects, in the author’s opinion, have great potential based on their technologies, teams and ecosystems and they are still in their early stages. This article shares only some observations, not investment suggestions.

BFMeta: BFMeta is a new and promising public chain that has emerged this year. It enables direct connection of mobile terminals to the blockchain network, based on the open-sourced underlying technology of BFChain, another public chain platform developed by the same team. BFMeta has an original energy-saving, secure and efficient consensus algorithm that combines Delegated Proof of Participation (DPOP), Transaction Proof of Work (TPOW) and Practical Byzantine Fault Tolerance (PBFT). It features native cross-chain exchange of cry, peer-to-peer encrypted communication, large blocks, automatic merging of forks, multi-dimensional sharding distributed storage, distributed computing and a high capacity in layer 1, keeping a good balance among decentralization, security and high performance (the impossible triangle theory of blockchain); and thus it can support billions of users worldwide to develop and experience Web3.0 and metaverse applications . The project, with a low-profile team, has attracted the attention of one of the world’s greatest investors and experts since its launch. At present, the parties involved are in close communication.

Linera: Like Aptos and Sui, Linera’s founder previously worked at Meta, and its team members were core members of Diem, formerly known as Libra. From the author’s point of view, Linera’s team is more devoted to technology development, while the other two, which are so highly valued that it’s not suitable for ordinary investors to be involved, are more enthusiastic about marketing. In terms of technology, Linera adopts linear scalability, allowing the expansion of system capacity by increasing the number of machines, and thus improving the throughput. To sum up, the public chain is characterized by anti-censorship attack, low latency, linear scalability, fast transaction speed, ability of solving the “impossible triangle” problem and hiding payment amount and relationships between senders and receivers. Therefore, Linera can be described as a promising public chain project.

Media Contact

Company Name: BFChainMeta

Contact Person: Jacky

Email: Send Email

Country: Singapore

Website: https://twitter.com/BFMeta