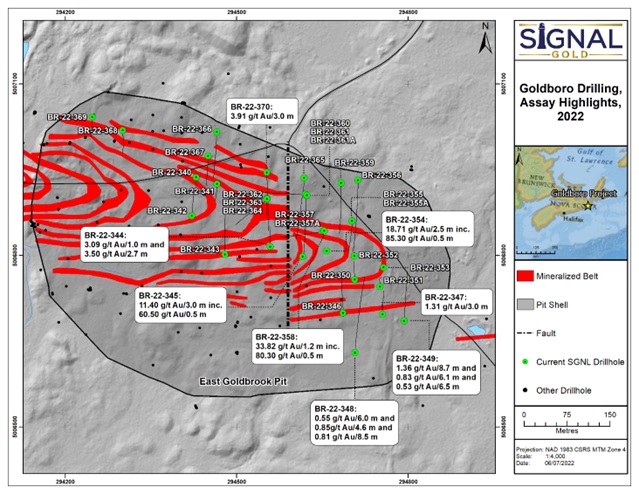

TORONTO, ON / ACCESSWIRE / July 6, 2022 / Signal Gold Inc. ("Signal Gold" or the "Company") (TSX:SGNL)(OTCQX:SGNLF) is pleased to announce results from a recent drill program at its 100%-owned Goldboro Gold Project in Nova Scotia ("Goldboro" or the "Project"). The infill drill program, consisting of 3,865 metres in 31 diamond drill holes, was conducted to aide in the conversion of Inferred Mineral Resources within the East Goldbrook Pit into Indicated Mineral Resources (the "Infill Drill Program"). The existing constrained open pits outlined in the Phase 1 Open Pit Feasibility Study1 were designed using only Measured and Indicated Resources, however they captured 975,000 tonnes of Inferred Mineral Resources at a grade of 2.11 grams per tonne ("g/t"), mainly in the East Goldboro Pit (Exhibit A). This represents an opportunity to positively impact Project economics by upgrading these Inferred Mineral Resources which are currently accounted for as waste tonnes.

Selected composited highlights from the Infill Drill Program include:

- 18.71 g/t gold over 2.5 metres (13.5 to 16.0 metres) including 85.30 g/t gold over 0.5 metres in diamond drill hole BR-22-354;

- 11.40 g/t gold over 3.0 metres (34.8 to 37.8 metres) including 60.50 g/t gold over 0.5 metres in diamond drill hole BR-22-345;

- 33.82 g/t gold over 1.2 metres (48.4 to 49.6 metres) in diamond drill hole BR-22-358;

- 1.36 g/t gold over 8.7 metres (20.3 to 29.0 metres) in diamond drill hole BR-22-349; and

- 3.91 g/t gold over 3.0 metres (169.0 to 172.0 metres) in diamond drill hole BR-22-370.

The results are important as they support the continuity of gold mineralization adjacent to existing Indicated Mineral Resources within the East Goldbrook Pit.

"As outlined in the Feasibility Study for the Goldboro Gold Project, we have identified significant opportunities to optimize the value of the Project and potentially increase the overall economics and longevity of the Project. This included the upgrading of Inferred Mineral Resources in the East Goldbrook Pit as well as exploring adjacent to, and along strike, of the existing Mineral Resource. We believe the results of the Infill Drill Program reported today may positively impact the Project's economics as the Inferred Mineral Resources being targeted are currently being accounted for as waste tonnes in the economics outlined in the Feasibility Study. Any Inferred Mineral Resources that we are able to convert would positively impact Project revenues and would reduce the strip ratio. The data gathered during the Infill Drill Program will be used in a future Mineral Resource Estimate anticipated to coincide with detailed engineering studies in 2023."

~ Kevin Bullock, President and CEO, Signal Gold Inc.

1 Please refer to the technical report and Feasibility Study dated January 11, 2022 and titled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia", which is available on SEDAR at www.sedar.com and on the Company's website at www.signalgold.com.

Drill holes BR-22-237 to BR-22-339 were drilled prior to holes BR-22-240 to BR-22-270, but were drilled for the purposes of testing mineralization, evaluating geotechnical properties as well as water testing. Assays for these holes have not been received and will be reported at a future date once data is available.

A table of selected composited assay results from the Infill Drill Program

Hole ID | From (m) | To (m) | Interval (m) | Gold (g/t) | Visible Gold |

| BR-22-340 | 40.0 | 41.0 | 1.0 | 1.09 |

|

| BR-22-343 | 21.0 | 24.0 | 3.0 | 0.50 |

|

| and | 34.6 | 35.6 | 1.0 | 1.03 |

|

| BR-22-344 | 21.0 | 22.0 | 1.0 | 3.09 |

|

| and | 45.5 | 48.2 | 2.7 | 3.50 |

|

| including | 45.5 | 46.2 | 0.7 | 12.40 |

|

| BR-22-345 | 14.0 | 20.0 | 6.0 | 0.66 |

|

| and | 34.8 | 37.8 | 3.0 | 11.40 |

|

| including | 36.1 | 36.6 | 0.5 | 60.50 | VG |

| and | 43.4 | 44.0 | 0.6 | 1.35 |

|

| and | 53.2 | 63.9 | 10.7 | 0.62 |

|

| BR-22-346 | 13.0 | 14.0 | 1.0 | 0.70 |

|

| and | 20.0 | 21.0 | 1.0 | 0.72 |

|

| and | 67.6 | 68.1 | 0.5 | 1.50 |

|

| and | 78.0 | 82.0 | 4.0 | 0.86 |

|

| BR-22-347 | 47.7 | 48.7 | 1.0 | 1.37 |

|

| and | 148.7 | 151.7 | 3.0 | 1.31 |

|

| and | 178.0 | 179.0 | 1.0 | 1.34 |

|

| BR-22-348 | 104.5 | 110.5 | 6.0 | 0.55 |

|

| and | 140.2 | 140.7 | 0.5 | 15.30 | VG |

| and | 160.0 | 160.5 | 0.5 | 0.58 | VG |

| and | 167.9 | 172.5 | 4.6 | 0.85 |

|

| including | 167.9 | 168.9 | 1.0 | 3.23 |

|

| and | 191.3 | 194.5 | 3.2 | 0.57 |

|

| and | 209.5 | 212.4 | 2.9 | 1.02 |

|

| and | 220.2 | 222.2 | 2.0 | 2.41 |

|

| and | 232.5 | 241.0 | 8.5 | 0.81 | |

| including | 232.5 | 233.0 | 0.5 | 7.69 | VG |

| BR-22-349 | 20.3 | 29.0 | 8.7 | 1.36 |

|

| including | 28.0 | 29.0 | 1.0 | 7.75 |

|

| and | 52.7 | 53.7 | 1.0 | 0.66 |

|

| and | 123.7 | 125.4 | 1.7 | 0.79 |

|

| and | 156.8 | 159.6 | 2.8 | 1.01 |

|

| BR-22-350 | 16.0 | 17.6 | 1.6 | 1.49 |

|

| and | 27.0 | 33.1 | 6.1 | 0.83 |

|

| and | 50.9 | 57.4 | 6.5 | 0.53 |

|

| BR-22-351 | 32.5 | 34.5 | 2.0 | 2.37 |

|

| and | 47.4 | 48.9 | 1.5 | 0.62 | VG |

| and | 54.6 | 55.4 | 0.8 | 6.18 |

|

| and | 63.0 | 65.6 | 2.6 | 0.63 |

|

| and | 114.3 | 117.7 | 3.4 | 0.96 |

|

| BR-22-352 | 32.0 | 33.0 | 1.0 | 0.85 |

|

| and | 44.4 | 44.9 | 0.5 | 2.89 |

|

| and | 151.4 | 152.0 | 0.6 | 2.16 |

|

| and | 169.6 | 170.1 | 0.5 | 72.70 | VG |

| BR-22-353 | 46.5 | 47.5 | 1.0 | 0.52 |

|

| and | 60.0 | 63.9 | 3.9 | 0.74 |

|

| and | 73.5 | 74.5 | 1.0 | 0.89 |

|

| and | 121.5 | 122.3 | 0.8 | 5.47 |

|

| BR-22-354 | 13.5 | 16.0 | 2.5 | 18.71 |

|

| including | 14.5 | 15.0 | 0.5 | 85.30 | VG |

| and | 38.0 | 38.5 | 0.5 | 2.87 | VG |

| and | 57.6 | 58.1 | 0.5 | 1.12 | VG |

| BR-22-356 | 40.0 | 41.0 | 1.0 | 8.59 |

|

| BR-22-357 | 10.9 | 11.4 | 0.5 | 6.88 | VG |

| and | 88.2 | 89.2 | 1.0 | 4.40 |

|

| and | 122.5 | 123.5 | 1.0 | 5.82 |

|

| BR-22-358 | 48.4 | 49.6 | 1.2 | 33.82 |

|

| including | 48.4 | 48.9 | 0.5 | 80.30 | VG |

| BR-22-360 | 108.5 | 109.5 | 1.0 | 0.85 |

|

| and | 138.5 | 139.0 | 0.5 | 0.69 | VG |

| BR-22-361 | 69.4 | 70.4 | 1.0 | 1.07 |

|

| BR-22-366 | 15.7 | 16.7 | 1.0 | 1.52 |

|

| and | 82.7 | 83.7 | 1.0 | 0.82 |

|

| and | 99.1 | 100.1 | 1.0 | 0.59 |

|

| BR-22-367 | 63.5 | 64.0 | 0.5 | 4.75 |

|

| BR-22-368 | 55.8 | 57.3 | 1.5 | 2.70 |

|

| and | 84.5 | 85.5 | 1.0 | 1.29 |

|

| BR-22-370 | 29.0 | 29.5 | 0.5 | 9.00 |

|

| and | 40.5 | 41.5 | 1.0 | 8.70 |

|

| and | 105.0 | 106.0 | 1.0 | 0.54 |

|

| and | 136.0 | 137.0 | 1.0 | 1.01 |

|

| and | 169.0 | 172.0 | 3.0 | 3.91 |

|

- Intervals are reported as core length only. True widths are estimated to be between 70% and 100% of the core length.

- All drill hole results are reported using fire assay only. See notes on QAQC procedures at the bottom of this press release.

- All drill holes not reported in the table above did not encounter significant mineralization.

- Drill holes were oriented along a north-south trend with holes on the north limb of the hosting anticlinal structure drilled southward and holes located south of the anticlinal structure drilled northward. The dip of holes is dependant upon the location relative to the anticline with the goal of intersecting mineralized zones orthogonally.

Goldboro Gold Project - Mineral Resource Estimate

The Mineral Resource Estimate presented was prepared by Independent Qualified Person Glen Kuntz, P. Geo., of Nordmin Engineering Ltd. The Mineral Resource Estimate is based on validated results of 681 surface and underground drill holes for a total of 121,540 metres of diamond drilling completed between 1984 and the effective date of November 15, 2021, including 55,803 metres conducted by Signal Gold.

Mineral Resource Estimate for the Goldboro Gold Project - Effective Date November 15, 2021

Resource Type | Gold Cut-off (g/t gold) | Category | Tonnes | Grade (g/t gold) | Gold Troy Ounces |

| Open Pit | 0.45 | Measured | 7,680,000 | 2.76 | 681,000 |

Indicated | 7,988,000 | 2.89 | 741,000 | ||

Measured + Indicated | 15,668,000 | 2.82 | 1,422,000 | ||

Inferred | 975,000 | 2.11 | 66,000 | ||

| Underground | 2.40 | Measured | 1,576,000 | 7.45 | 377,000 |

Indicated | 4,350,000 | 5.59 | 782,000 | ||

Measured + Indicated | 5,925,000 | 6.09 | 1,159,000 | ||

Inferred | 2,206,000 | 5.89 | 418,000 | ||

| Combined Open Pit and Underground* | 0.45 and 2.40

| Measured | 9,255,000 | 3.56 | 1,058,000 |

Indicated | 12,338,000 | 3.84 | 1,523,000 | ||

Measured + Indicated | 21,593,000 | 3.72 | 2,581,000 | ||

Inferred | 3,181,000 | 4.73 | 484,000 |

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.45 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.40 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are inclusive of Mineral Reserves.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.45 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a metallurgical recovery factor of 89% around cut-off as calculated from ((GRADE-(0.0262*LN(GRADE)+0.0712))/GRADE*100)-0.083.

- Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a gold processing recovery factor of 97%.

- Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Effective date of the Mineral Resource Estimate is November 15, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

Qualified Person and Technical Report Notes

A Technical Report titled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia", prepared in accordance with NI 43-101 for the Goldboro Gold Project Feasibility Study can be found on SEDAR (www.sedar.com) under the company's profile. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource and Mineral Reserve and Feasibility Study. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The Qualified Person responsible for the preparation of the Goldboro Gold Project Mineral Resource Estimate contained in this press release is Glen Kuntz, P. Geo. (Ontario, Nova Scotia) of Nordmin Engineering Ltd. Mr. Kuntz, is considered to be "Independent" of Signal Gold Inc. and a "Qualified Person" under NI 43-101.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

All assays in this press release are reported as fire assays only. For samples analyzing greater than 0.5 g/t Au via 30 g fire assay, these samples will be re-analyzed at Eastern Analytical Ltd. via total pulp metallics. For the total pulp metallics analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Total pulp metallics assays for drillholes sited within this press release may be updated in a future news release.

Paul McNeill, P. Geo., VP Exploration of Signal Gold, is a "Qualified Person" as such term is defined under NI 43-101 Standards for Disclosure for Mineral Projects and has reviewed and approved the scientific and technical information and data included in this press release.

A version of this press release will be available in French on Signal Gold's website (www.signalgold.com) in two to three business days.

ABOUT SIGNAL GOLD

Signal Gold is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Nova Scotia and Newfoundland. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study (Please see the ‘NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia' on January 11, 2022 for further details). Signal Gold also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

FOR ADDITIONAL INFORMATION CONTACT:

| Signal Gold Inc. Kevin Bullock President and CEO (647) 388-1842 kbullock@signalgold.com | Reseau ProMarket Inc. Dany Cenac Robert Investor Relations (514) 722-2276 x456 Dany.Cenac-Robert@ReseauProMarket.com |

Exhibit A: A map showing the East Goldbrook Pit and the location and highlights of the Infill Drill Program which targeted Inferred Resources coincident with the open pit constrained to Measured and Indicated Resources only.

SOURCE: Signal Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/707611/Signal-Gold-Intersects-1871-gt-Gold-over-25-metres-and-1140-gt-Gold-over-30-metres-at-the-Goldboro-Gold-Project