KINGSTON, NY / ACCESSWIRE / July 22, 2024 / Kingstone Companies, Inc. (Nasdaq:KINS) (the "Company" or "Kingstone"), a Northeast regional property and casualty insurance holding company, today issued the following open letter to stockholders regarding changes in its market opportunity:

Dear Shareholders,

As we enter the second half of the year, I want to update you on our progress and alert you to material changes in the competitive landscape of the New York property market which represents a previously unforeseen and highly significant opportunity for our company to grow and prosper.

Our strategy to focus on our Core state of New York is well understood. To again deliver Kingstone's historic level of profitability required us to:

Price right;

Properly match rate to risk;

Insure all properties at their current replacement cost;

Follow effective risk management protocols; and

Operate at a highly efficient expense structure.

These strategies are all in place and are being reflected in our financial results. We will soon be reporting our third consecutive quarter of profitability in our incredible turn-around journey.

The phenomenal improvement in our profit margin is only half the story. Today, I want to share our prospects for significant growth within our Core Business.

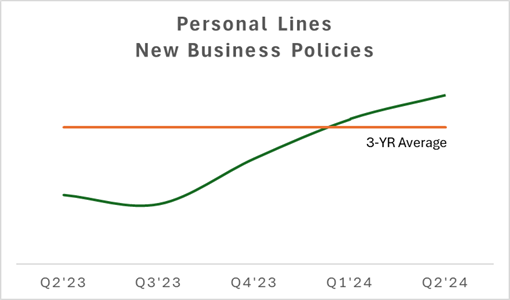

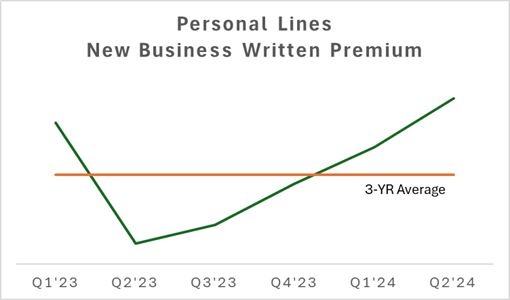

Kingstone acted with swift decisive measures to address the difficult macroeconomic environment and other industry specific issues to return the Company to profitability. Other carriers have succumbed to these problems and have either stopped or restricted writing policies. As such, our personal lines (PL) new business has been growing quite significantly since last year, as indicated in the charts below.

|

|

For the second quarter of 2024, estimated direct written premium growth across all lines of business within our Core NY business was +21.5% (+12.5% in Q1'24) compared to the prior year periods; estimated Core PL direct written premium growth in Q2 2024 was +24.3% (+13.2% in Q1'24). We expect to see this trend escalating and continuing through 2025.

Market dynamics have changed profoundly in the last few weeks. Competing carriers, representing >$200 million in annual premium, made the decision to exit New York State (or to exit the personal property market countrywide). All of the policies issued by these carriers must be moved to alternative carriers.

This situation is reminiscent of the surge in growth we experienced almost twenty years ago, following the three major Gulf Coast hurricanes where carriers responded by greatly restricting or stopping their coastal writings. This is when our prior long-term growth path began.

I believe the current market changes present us with the greatest profitable growth opportunity that Kingstone has ever experienced!

We have the strongest management team in our history. We have built long-term relationships with our extensive group of producers. We have a highly segmented and proven product that effectively matches rate to risk. With confidence in our operations, this incredible growth opportunity could not have come at a better time. I will continue to keep you appraised of this development as accelerating new business comes our way.

While it is impossible to gauge the size of this opportunity for Kingstone right now, I can share that every incremental $10 million in new PL premium written translates into approximately $0.10 of additional earnings per share as we earn the premium, and even higher earnings as the business renews.

Core direct written premium growth in the first half of the year was 17.1%. Clearly, our growth rate for the rest of this year will far exceed what we had previously shared. It's possible that we could grow at more than two times that pace in the second half of the year. Typically, our new business represents only 20% of total premium. However, we have already seen a surge in PL new business quoting (up 2X) new business policies (up 3X) and new business premium (up 9X) this month versus the prior year month, and it will likely increase. As such, we are increasing our guidance for 2024 Core business direct written premium growth to a range of 21% to 30%, up from 16% to 20% that was previously communicated.

Best regards,

Meryl

Meryl Golden

President & Chief Executive Officer

About Kingstone Companies, Inc.

Kingstone is a northeast regional property and casualty insurance holding company whose principal operating subsidiary is Kingstone Insurance Company ("KICO"). KICO is a New York domiciled carrier writing business through retail and wholesale agents and brokers. KICO is actively writing personal lines and commercial auto insurance in New York, and in 2023 was the 15th largest writer of homeowners insurance in New York. KICO is also licensed in New Jersey, Rhode Island, Massachusetts, Connecticut, Pennsylvania, New Hampshire, and Maine.

Disclaimer and Forward-Looking Statements

The estimated, unaudited financial results indicated above are based on information available as of July 22, 2024, remain subject to change based on management's ongoing review of the Company's second quarter results and are forward-looking statements (see below). The actual results may be materially different and are affected by the risk factors and uncertainties identified in Kingstone's annual and quarterly filings with the Securities and Exchange Commission.

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements involve risks and uncertainties that could cause actual results to differ materially from those included in forward-looking statements due to a variety of factors. For more details on factors that could affect expectations, see Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023.

The risks and uncertainties include, without limitation, the following:

the risk of significant losses from catastrophes and severe weather events;

risks related to the lack of a financial strength rating from A.M. Best;

risks related to our indebtedness due on December 30, 2024, including due to the need to comply with certain financial covenants and limitations on the ability of our insurance subsidiary to pay dividends to us;

adverse capital, credit and financial market conditions;

the unavailability of reinsurance at current levels and prices;

the exposure to greater net insurance losses in the event of reduced reliance on reinsurance;

the credit risk of our reinsurers;

the inability to maintain the requisite amount of risk-based capital needed to grow our business;

the effects of climate change on the frequency or severity of weather events and wildfires;

risks related to the limited market area of our business;

risks related to a concentration of business in a limited number of producers;

legislative and regulatory changes, including changes in insurance laws and regulations and their application by our regulators;

limitations with regard to our ability to pay dividends;

the effects of competition in our market areas;

our reliance on certain key personnel;

risks related to security breaches or other attacks involving our computer systems or those of our vendors; and

our reliance on information technology and information systems.

Kingstone undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

Karin Daly

Vice President

The Equity Group Inc.

kdaly@equityny.com

SOURCE: Kingstone Companies, Inc

View the original press release on accesswire.com