Data search and analytics platform Elastic (NYSE: ESTC) stock has taken a (-31%) drop on the year but is staging a strong comeback. Elastic is the leading database search engine that also enables observability and cybersecurity. It’s infrastructure platform enables users and developers to perform precision searches within an application on the cloud through a subscription model. It allows companies to transform data into insights and action. Elastic is the leading provider of enterprise data search solutions and partnered with both Google (NASDAQ: GOOG), Amazon AWS (NASDAQ: AMZN),and Microsoft (NASDAQ: MSFT).

Data search and analytics platform Elastic (NYSE: ESTC) stock has taken a (-31%) drop on the year but is staging a strong comeback. Elastic is the leading database search engine that also enables observability and cybersecurity. It’s infrastructure platform enables users and developers to perform precision searches within an application on the cloud through a subscription model. It allows companies to transform data into insights and action. Elastic is the leading provider of enterprise data search solutions and partnered with both Google (NASDAQ: GOOG), Amazon AWS (NASDAQ: AMZN),and Microsoft (NASDAQ: MSFT). The demand environment continues to be strong as evidenced by the 35% top line growth and Elastic Cloud showing 80% growth. Customer acquisitions remain strong growing its base 130% to 18,600 subscription customers of which 960 had $100,000 or more in annual contract value (ACV). Annual commitments from customers almost doubled versus prior year. The business benefits from three major recession-proof tailwinds which are digital transformation, cloud migration and the need for enterprises to search and analyze through massively growing data volumes. Prudent investors seeking exposure in the enterprise data search and analytics segment can look for opportunistic pullbacks in shares of Elastic.

Fiscal Q4 2022 Earnings Release

On June 1, 2022, Elastic released its fiscal fourth-quarter 2022 results for the quarter ended April 2022. The Company reported an earnings-per-share (EPS) loss of (-$0.16) versus (-$0.21) consensus analyst estimates, an $0.05 beat. Revenues grew 34.8% year-over-year (YoY) to $239.36 million, beating analyst estimates for $232.38 million. Elastic Cloud revenue grew 71% to $87.7 million. The Company ended the quarter with cash and cash equivalents of $860.9 million. Elastic CEO Ash Kulkarni commented, “We had a strong fourth quarter and closed out an excellent year, driven by robust growth in Elastic Cloud, which grew 80% year-over-year in fiscal year 2022, and increased to 37% of total revenue in Q4. The strong momentum in Elastic Cloud puts us on the path to deliver over 50% of total revenue from Elastic Cloud exiting Q4 of fiscal year 2024, which is ahead of our prior outlook. The enormous market opportunity, the strategic relevance of our solutions to our customers and partners, and the momentum in Elastic Cloud make us confident that we can achieve $2 billion in total revenue in fiscal year 2025.”

Mixed Fiscal 2023 Guidance

Elastic provided fiscal Q1 fiscal 2023 EPS estimates to (-$0.20) to (-$0.16) versus (-$0.16) consensus analyst estimates on revenues between $244 million to $246 million compared to $243.43 million analyst estimates. The Company provided full-year fiscal 2023 EPS to come in between (-$0.36) to (-$0.28) versus analyst estimates for ($0.30) with revenues expected between $1.080 billion to $1.086 million versus $1.080 billion analyst expectations.

Conference Call Takeaways

CEO Kulkarni summed up the core business as its data analytics platform powered by search that enable customers to transform that data into ideas and actions. He noted they are in the early stages of a $78 billion total addressable market (TAM). Elastic cloud grew 140% in Q4. Cloud represented 37% of total revenues and expects it to exceed 50% by Q4 fiscal 2024 doubling down their efforts with cloud hyperscalers. He expects to hit $2 billion in revenues by fiscal 2025. Elastic Cloud makes it easy for customers to adopt its products through partner marketplaces. He stated Cloud is the cornerstone of investment. It drives easier customer acquisition, expansion and better retention. They are incentivizing its sales force with a new compensation schedule for fiscal 2023 with explicit bias towards cloud. Partnering with Amazon to include Elastic Cloud on AWS and Microsoft Azure and Google Cloud make it easier to onboard new customers.

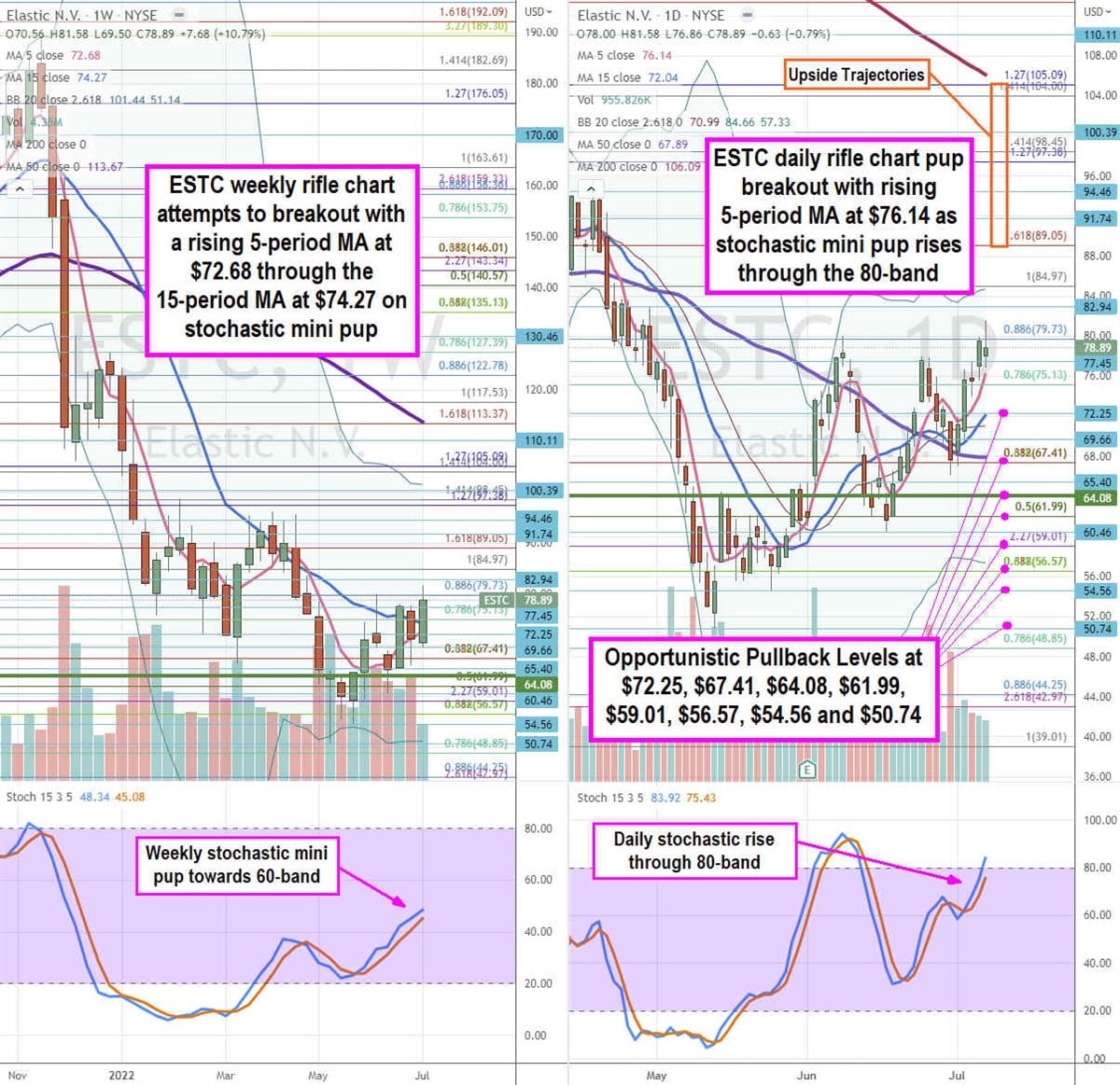

ESTC Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for ESTC stock. The weekly rifle chart bottomed out at the $48.85 Fibonacci (fib) level before staging a rally towards a breakout. The weekly 5-period moving average (MA) is rising at $72.68 towards the 15-period MA at $74.27/ The weekly stochastic formed a mini pup through the 40-band. The weekly upper Bollinger Bands (BBs) sit at $101.44 and weekly 50-period MA sits at $113.67. The weekly market structure low (MSL) buy triggers on the breakout through $64.08. The daily rifle chart has a pup breakout with a rising 5-period MA at $76.14 and 15-period MA at $72.04. The daily 50-period MA at $67.89 and daily upper BB sit at $84.66. The daily stochastic is rising through the 80-band. Prudent investors can watch for opportunistic pullback levels at the $72.25, $67.41 fib, $64.08 weekly MSL trigger, $61.99 fib, $59.01 fib, $56.57 fib, $54.56, and $50.74. Upside trajectories range from the $89.05 fib up towards the $105.09 fib level. Keep an eye on competitors like Datadog (NASDAQ: DDOG) and Splunk (NASDAQ: SPLK).