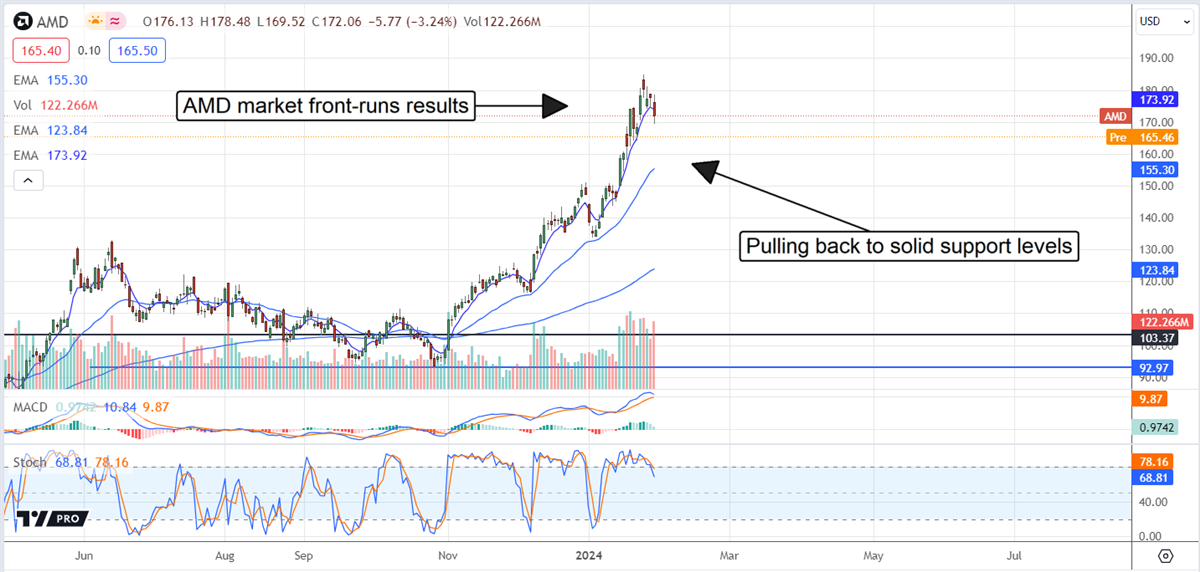

Advanced Micro Devices (NASDAQ: AMD) share price imploded following the Q4 release, but investors should not fear the move. The decline is a knee-jerk reaction to expected news, setting the market up for another run. The Q4 results did not catalyze a rally but highlighted a bifurcation in the semiconductor market. On the one hand, end-market normalization continues to impact some segments while the cloud and AI are driving growth in others.

This bifurcation is creating a headwind to growth, seen in the Q1 outlook, below the analysts' consensus forecast, but a turning point is at hand. End-market inventory normalization is expected by the end of the year, and data center/AI sales are ramping. At some point this year, these forces will align to supercharge revenue and drive margin expansion and earnings.

Advanced Micro Devices has an NVIDIA-like quarter?

Advanced Micro Devices share prices shot up in Q4 2023 and January 2024 on the expectation the company would have an NVIDIA-like (NASDAQ: NVDA) quarter driven by AI, and it did. The problem is that its NVIDIA-like results are limited to two segments and offset by weakness in others. The result is that revenue jumped 10.7% in Q4, in alignment with the analysts' consensus.

Segmentally, Data Center and Client grew by 38% and 62% on demand for Epyc GPUs, CPUs, and Ryzen CPUs. These GPUs and CPUs are central to AMD's AI program. Results are compounded by ramping expectations for sales in 2024. Both segments set records and are projected to accelerate this year. Gaming and Embedded fell by 17% and 24% on sluggish demand linked to high supply and end-market inventory.

The margin news is also favorable. Margin expanded sequentially on a GAAP and adjusted basis with adjusted gross margin flat compared to last year. Gross profits rose by 21% and adjusted gross profits by 6%, leaving Q4 adjusted EPS at $0.77, as expected.

Guidance is mixed and a primary cause for the post-release share plunge. The company issued Q1 guidance expecting a sequential decline larger than analysts expected. However, the guidance is likely cautious and offset by an expectation for margin expansion and accelerating business later in the year.

The forecast for MI300 sales alone has nearly doubled since the last report and is compounded by expectations for solid Ryzen and Epyc sales. The company did not give specific guidance for the year, but analysts forecast a 15% top-line gain, accelerating to over 20% in 2025, with margin expansion in both years. Earnings are expected to grow by 40% this year and almost 50% next year, bringing the stock valuation below 30X with the post-release drop.

Analysts are leading Advanced Micro Devices Higher

Analysts are supportive of Advanced Micro Devices and leading the market higher. The post-release pullback in the price action is sharp but aligns the market with the analysts' consensus, which is up nearly 100% compared to last year.

The Q4 results and Q1 guidance may not spark a round of upward revisions, but significant downward revisions are not expected either. As it is, no price targets below the $162 consensus have been set since 2023, and there have been 14 revisions in 2024. Those 14 include some mixed activity but come with an average target of $180 or 11% above the consensus, and many have this stock at a new high.

The price drop in AMD shares is concerning and may provide a hurdle to higher prices. However, the downturn is a healthy and needed correction after the stock’s solid rise and will likely lead to a buying opportunity soon. If support doesn’t hold at $162, the 30-day EMA is the next best target. A fall below would be concerning and may lead the stock to a deeper decline. The market should begin to consolidate and move sideways, assuming the market can find support above the 30-day EMA, with a chance of rallying to new highs by mid-year.