In an invaluable session for entrepreneurs and business owners, Matt Cohen, the renowned strategist from Synesis Advisors, has distilled years of experience into essential advice on preparing for a business sale. Recognizing the complexities and emotional weight of selling a business, the guidance covers the full spectrum—from initial preparation to post-sale considerations—empowering owners with the knowledge to maximize their outcomes.

Listen to the podcast interview here: https://streamyard.com/watch/qYJFS48QViPY

Preparation is Key:

It emphasizes the importance of meticulous preparation well ahead of a sale. It’s not just about having financials in order, it’s about ensuring the business runs like a well-oiled machine without them. This preparation includes streamlining operations, bolstering a management team, and solidifying the customer base to make a business as attractive as possible to potential buyers.

Assembling a Stellar Team:

Highlighting the importance of a strong support system during the sale process, it is advised to assemble a team that can include a business broker, an accountant, a lawyer, and financial advisors. The right team will not only help secure the best deal but also navigate the complexities of the sales process. He stresses the importance of choosing advisors with a proven track record in business sales.

Knowing When to Walk Away:

One of the most critical pieces of advice Cohen offers is recognizing when to walk away from a deal. Not all offers are equal, and some may undervalue a person’s life’s work. It’s essential to have a clear understanding of the business’s worth and the patience to wait for an offer that meets the criteria.

Post-Sale Considerations:

It also touches on the often-overlooked aspect of what comes after a sale. He suggests planning for the emotional and financial implications of no longer owning the business. This includes considering how to manage the proceeds from the sale, exploring new opportunities or passions, and adjusting to life without the day-to-day responsibilities of running the business.

All this is especially appropriate for those anticipating a sale in the next few years as well as those who have sold their business and looking for another opportunity.

A highly anticipated guidance session for current and aspiring business owners demystifies the complexities of the business sale and acquisition process. With a keen focus on understanding potential buyers and the factors influencing their decision-making and what entrepreneurs should consider before purchasing a business, his insights offer invaluable direction for navigating these significant transactions successfully.

Mike Ross shares: “This topic is important because the odds of success when choosing to sell or buy a business are so low. After putting all that time into building a business, find a way to sell it to the right person.”

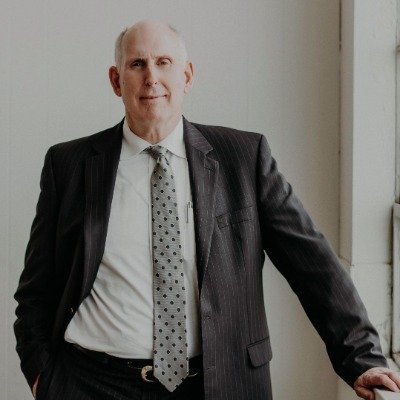

About Michael Ross

Michael Ross, is 30+ year veteran as a financial advisor. After 30 years with Morgan Stanley, he is now an independent financial advisor who excels in helping business owners exit their businesses and move to the next phase of their lives.

Learn more: www.mylatticewealth.com

Advisory services are offered through Integrated Advisors Network LLC, a registered investment advisor.